The June 2024 Short-Term Energy Outlook by the U.S. Energy Information Administration (EIA) presents several forecasts for energy prices and production through 2025. Notably, Brent crude oil prices are predicted to increase slightly reflecting adjustments due to OPEC+ production cuts extending through the third quarter of 2024. U.S. crude oil production is expected to rise.

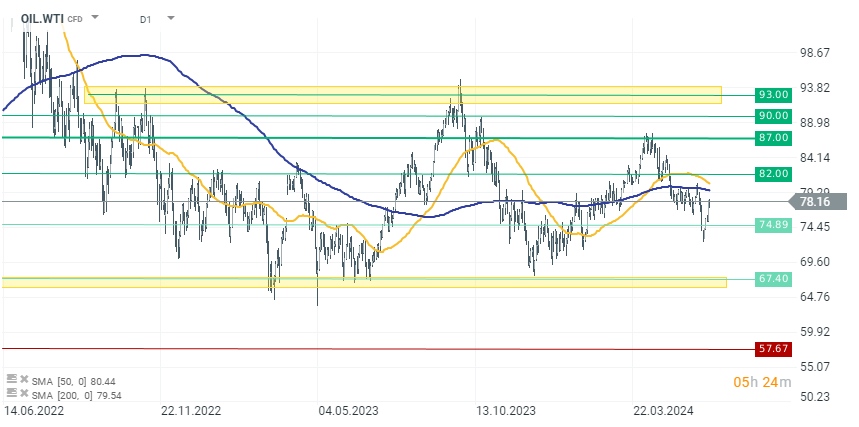

OPEC+ is expected to start relaxing its voluntary production cuts in the fourth quarter of 2024, which is later than previously anticipated. This adjustment is expected to sustain a decline in global oil inventories through the first quarter of 2025. Despite these cuts and an anticipated rise in oil prices, the EIA has revised its Brent crude price forecast downward by 4% to $84 per barrel for 2024, based on lower-than-expected prices in May.

-

EIA now expects Brent Crude prices to average $84.15 a barrel this year, 4% lower than the previous forecast of $87.79.

-

US crude oil output to rise by 310,000 bpd in 2024, vs the previous forecast for 270,000 bpd increase, and is to grow by 470,000 bpd in 2025, vs the previous forecast of 530,000 bpd

-

EIA raises forecast for 2024 world oil demand growth by 180,000 bpd, now sees 1.10 mln bpd year-on-year increase

-

Current year crude oil production forecast 13.24 mln bpd vs. 13.2 mln bpd previously. Year-ahead crude oil production forecast 13.71 mln bpd vs. 13.73 mln bpd previously

-

EIA forecasts US retail gasoline prices to average $3.42 a gallon this year, 3% lower than previous forecast

US natural gas production is forecast to decrease by 1% in 2024 due to lower prices, with significant declines expected in the Haynesville and Appalachia regions. Conversely, production in the Permian region is projected to grow, associated with oil production increases. Additionally, US electricity consumption is set to increase slightly, influenced by warmer temperatures and growing power demand from data centers, particularly in the South Atlantic and West South Central regions.

📅 ปฏิทินเศรษฐกิจ: ตัวเลข NFP และ รายงานปริมาณน้ำมันคงคลังสหรัฐฯ 💡

Silver พุ่ง 3% ในวันนี้ 📈

สรุปตลาดเช้า: ดอลลาร์ติดกับดัก ตลาดจับตา NFP คืนนี้ 🏛️

ข่าวเด่นวันนี้