The final pre-Christmas session on the global financial markets has been calm so far. Trading ranges are narrow as investors are looking forward to a long, holiday weekend. However, traders will be offered an important US data reading today at 1:30 pm GMT - a monthly data pack for November, including PCE inflation, which is Fed's preferred inflation measure.

What is the market expecting from today's data?

- Headline PCE inflation (annual). Expected: 2.8% YoY. Previous: 3.0% YoY

- Headline PCE inflation (monthly). Expected: 0.0% MoM. Previous: 0.0% MoM

- Core PCE inflation (annual). Expected: 3.3% YoY. Previous: 3.5% YoY

- Core PCE inflation (monthly). Expected: 0.2% MoM. Previous: 0.2% MoM

- Personal income. Expected: 0.4% MoM. Previous: 0.2% MoM

- Personal spending. Expected: 0.3% MoM. Previous: 0.2% MoM

PCE inflation and CPI inflation. Source: Macrobond, XTB Research

PCE inflation and CPI inflation. Source: Macrobond, XTB Research

How will data impact markets and Fed?

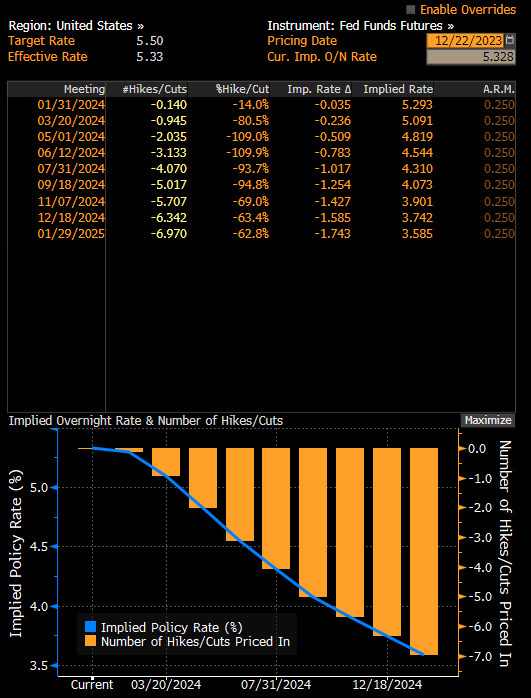

Money markets are pricing in 150 basis points of rate cuts during 2024. Fed is projecting three 25 basis point rate cuts for 2024. Market expectations seem to be high but inflation readings that are in-line or below expectations may encourage investors to continue selling USD and buying stocks. It should be noted that S&P 500 index has been climbing for the 8 weeks in a row now, and today's PCE reading may be determine whether the index will hold onto record levels.

Money markets are pricing in an around-80% chance of Fed delivering the first rate cut as soon as at March 2024 meeting. However, should inflation data came in lower-than-expected, those dovish bets may increase further and may allow indices to continue to trade at record levels, and allow EURUSD to finish the year above 1.10.

Money markets are expecting an extremely dovish Fed next year, given the number and timing of rate cuts priced in. Source: Bloomberg

EURUSD

EURUSD is trading at the highest level since August 2023. Should bulls hold above this level until the end of the year, a technical setup would hint at possibility of a test of the 78.6% retracement. Nevertheless, should PCE data came in above expectations, EURUSD may take a hit with 1.0970 area being the first support to watch.

Source: xStation5

US100

US100 continues to trade at near-record levels, but sell-off in Chinese gaming stocks is causing sentiment to deteriorate today. Should PCE inflation came in below expectations, US100 may attempt to climb above 17,000 pts mark. On the other hand, a PCE reading above expectations (3.4% YoY and 0.3% MoM for core PCE) would increase risk of downward correction, with 16,780 pts being a potential target.

Source: xStation5

BREAKING: US100 พุ่งแรง หลังรายงาน NFP สหรัฐแข็งแกร่งกว่าคาด

📅 ปฏิทินเศรษฐกิจ: ตัวเลข NFP และ รายงานปริมาณน้ำมันคงคลังสหรัฐฯ 💡

สรุปตลาดเช้า: ดอลลาร์ติดกับดัก ตลาดจับตา NFP คืนนี้ 🏛️

ข่าวเด่นวันนี้