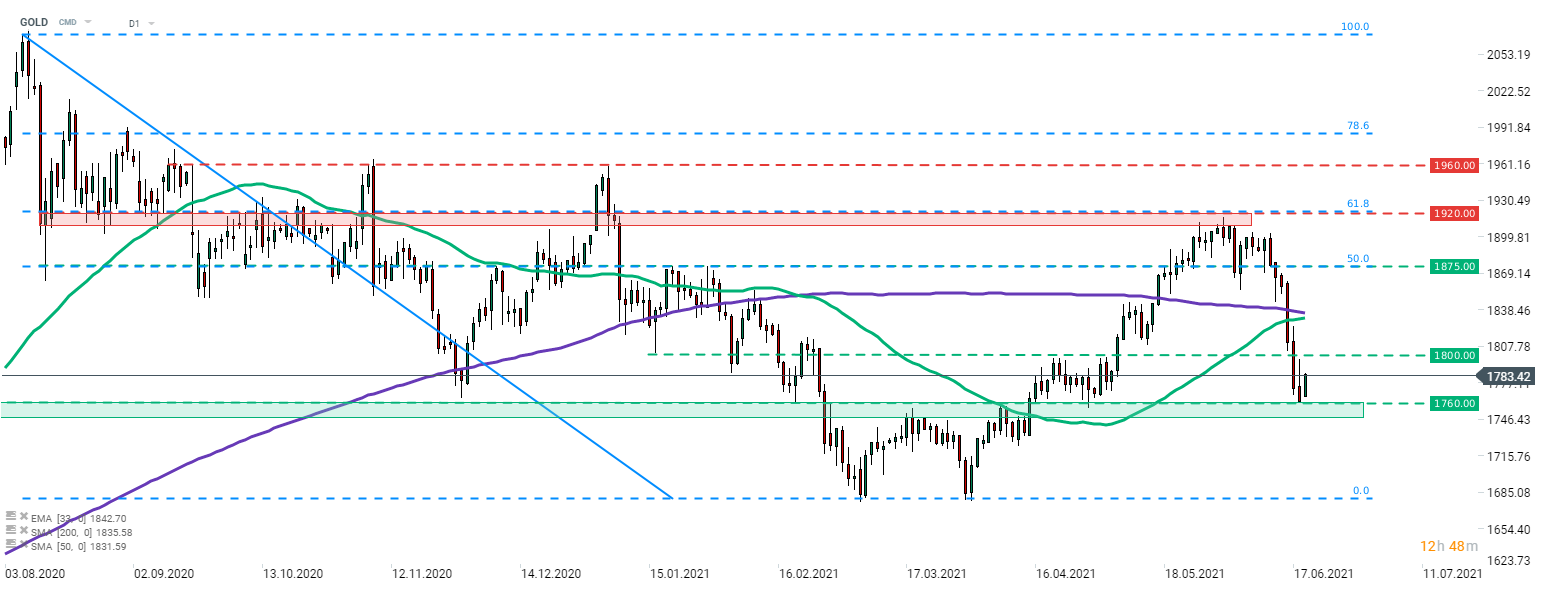

Gold has been underperforming as of late with downward move accelerating last week amid Fed's hawkish tilt. Precious metal slumped on Friday when Fed's Bullard confirmed that taper discussions have already begun. Gold dropped around 8% from its recent peak near $1,900. However, gold bulls are trying to regain ground today. Price bounced off the support zone at $1,760 and the precious metal trades over 1% higher today. Psychological $1,800 area is a key near-term support to watch. However, traders should keep in mind that there are a number of speeches from Fed members scheduled for today, including another speech from Bullard at 2:30 pm BST.

Source: xStation5

Source: xStation5

ข่าวเด่นวันนี้

3 ตลาดสำคัญที่ต้องจับตาในสัปดาห์นี้

ก๊าซธรรมชาติลด 6% ตามพยากรณ์อากาศใหม่

Geopolitical Briefing : Iran ยังเป็นปัจจัยเสี่ยงอยู่หรือไม่?