We are after a very strong report from the US labour market. NFP falls above 300k and the previous report is revised above this level as well. While it must be acknowledged that NFP is a seasonally adjusted report, there is no denying that it is still a powerful surprise for the market.

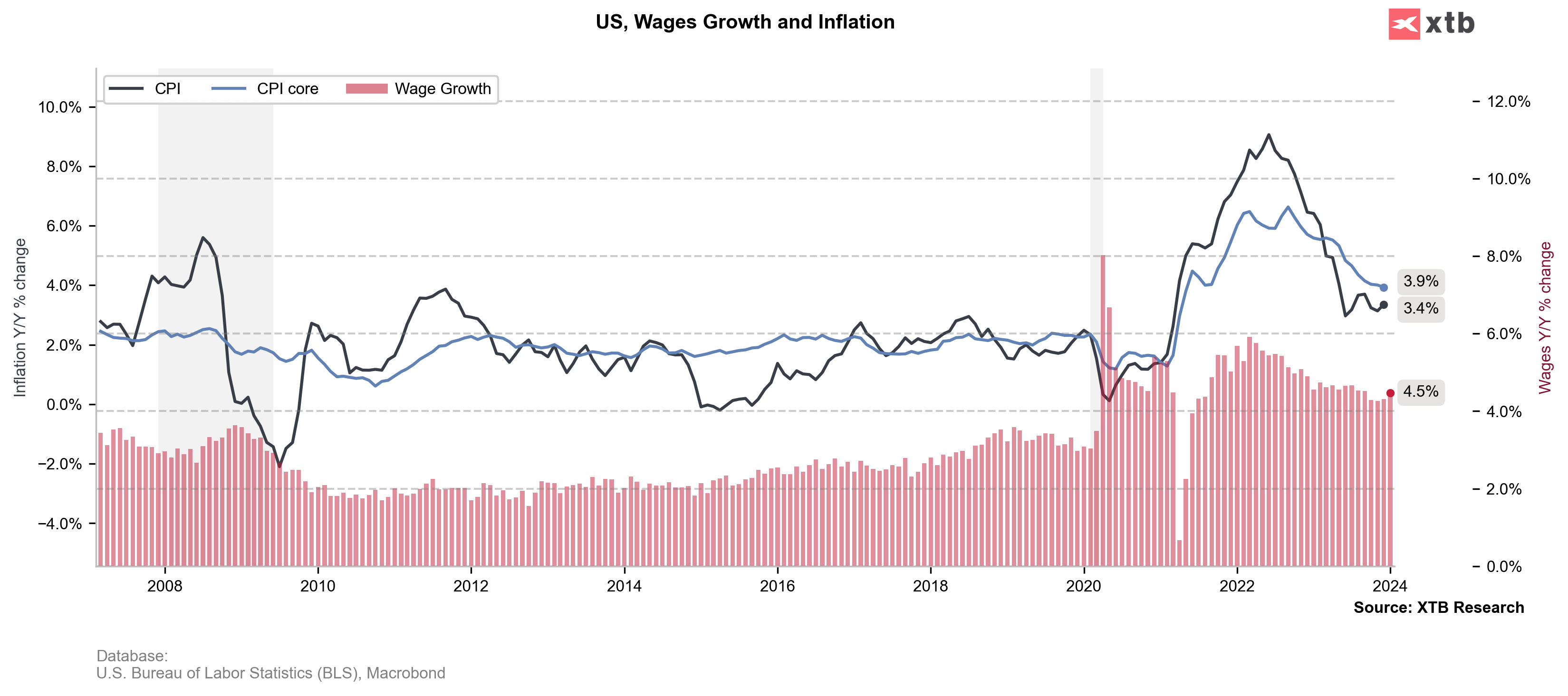

The hawkish tone of the data is also evidenced by an unchanged unemployment rate and strong wage growth, at 0.6% MoM and 4.5% YoY. This in turn could theoretically suggest a potential rebound in inflation in the coming months.

Source: Bloomberg Finance LP, XTB

As March after such NFP data is basically ruled out as a possible interest rate cut, we are seeing a clear rebound in the dollar and yields, which translates into massive falls in the precious metals market. Gold is losing 1% and retreating from around $2055 to $2030 per ounce. Key supports for gold are $2015 and then $2000 per ounce.

Source: xStation5

ข่าวเด่นวันนี้

3 ตลาดสำคัญที่ต้องจับตาในสัปดาห์นี้

ก๊าซธรรมชาติลด 6% ตามพยากรณ์อากาศใหม่

Geopolitical Briefing : Iran ยังเป็นปัจจัยเสี่ยงอยู่หรือไม่?