In spite of continued assurances from Russia that it is withdrawing troops from the Ukrainian border, the situation remains tense. US and EU officials say that there is no evidence of actual withdrawal taking place. Moreover, the US envoy to the United Nations said that there is evidence that Russia is moving towards an imminent invasion. Those accusations were rejected by Russia, which said that there will be no Ukraine invasion and none is planned. Nevertheless, according to the most recent media reports, Russia has decided to expel Deputy US Ambassador.

Claims that Ukraine invasion is imminent and news of Ambassador expulsion have triggered some risk-off moods in the markets. DE30 dropped around 150 points while US500 dipped around 35 points. Gold reached the highest level since mid-June 2021 - just slightly below $1,900 per ounce. As tensions pick-up once again, some upward pressure on oil prices could be spotted. However, crude has erased almost all of those gains already.

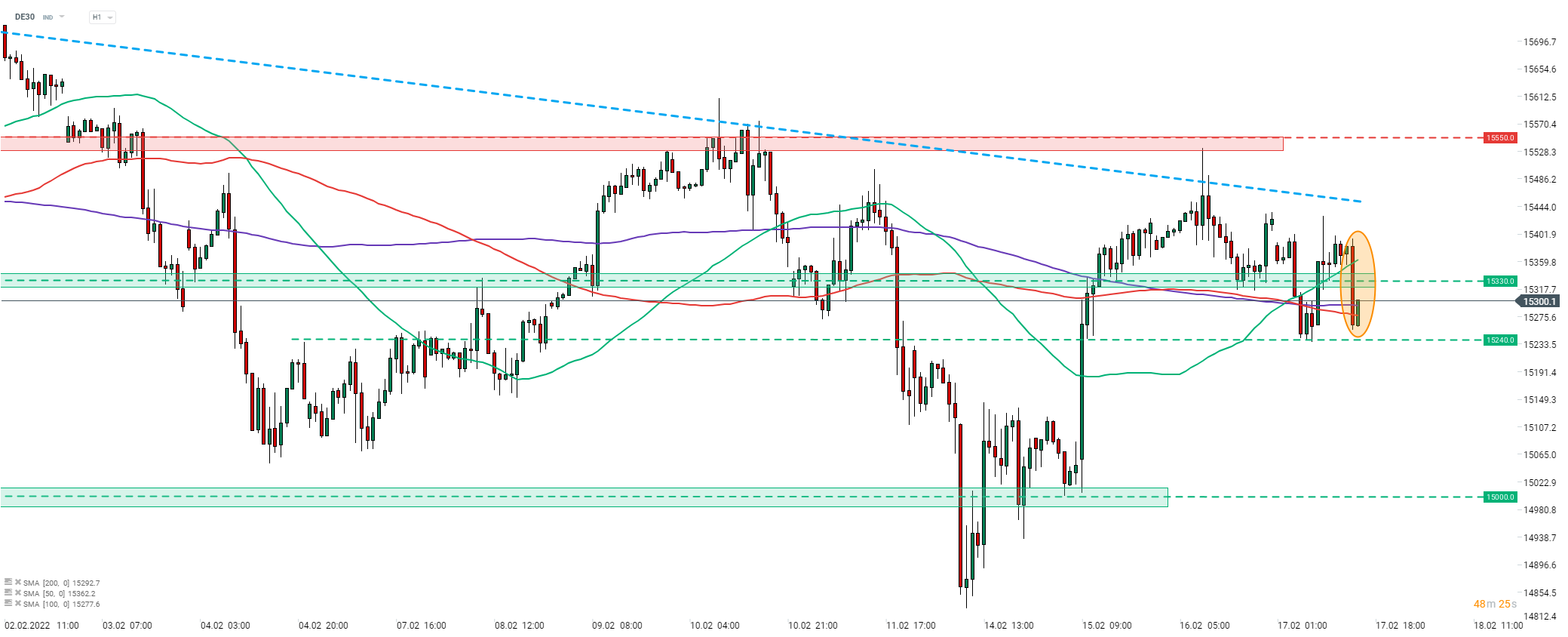

DE30 took a hit on negative Ukraine headlines (orange circle). Index dropped around 150 points and move back below the 15,330 pts support. Drop was halted slightly above a short-term swing level at 15,240 pts and a recovery attempt can be observed at press time. Source: xStation5

DE30 took a hit on negative Ukraine headlines (orange circle). Index dropped around 150 points and move back below the 15,330 pts support. Drop was halted slightly above a short-term swing level at 15,240 pts and a recovery attempt can be observed at press time. Source: xStation5

ข่าวเด่นวันนี้

US2000 ใกล้ระดับสูงสุดเป็นประวัติการณ์ 🗽 ข้อมูล NFIB แสดงอะไรบ้าง?

กราฟวันนี้ 🗽 US100 ฟื้นตัวต่อเนื่อง หลังฤดูกาลประกาศผลกำไรสหรัฐฯ

Wall Street ปรับตัวขึ้นต่อเนื่อง; ดัชนี US100 รีบาวด์มากกว่า 1% 📈