-

In spite of a pick-up in yield, US indices finished yesterday's trading higher. S&P 500 gained 0.84%, Dow Jones moved 1.06% higher, Nasdaq added 1.28% and Russell 2000 jumped 1.63%

-

10-year US yield climbed to 1.95%

-

Upbeat moods extended into Asian trading with major indices from the region gaining as well. Nikkei and S&P/ASX 200 moved 1.1% higher, Kospi gained 0.8% and indices from China traded 0.8-1.9% higher

-

DAX futures point to a higher opening of the European cash session today

-

Fed's Daly said she favors rate hike in March but central bank cannot be too aggressive

-

BoJ's Nakamura said that conditions for rate higher were not met yet and that hiking before wages begin to grow steadily would be a mistake

-

According to Kommersant report, Russia may soon recognize digital assets as currencies

-

According to JPMorgan, Bitcoin fair value is around $38,000

-

API report pointed to a 2.0 million barrel drop in US oil inventories (exp. +0.7 mb)

-

Precious metals trade mixed - gold and silver gain while palladium and platinum drop

-

Oil continues pullback with Brent and WTI dropping 0.7% each

-

AUD and GBP are the best performing major currencies while CHF and JPY lag the most

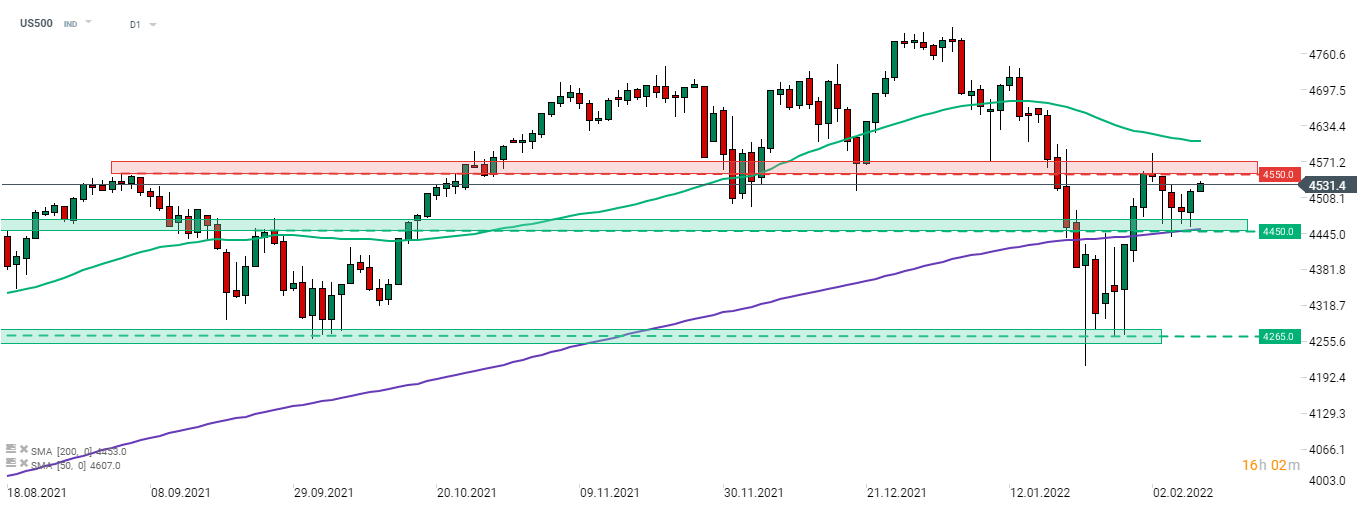

US500 bounced off the support zone in the 4,450 pts area, marked with 200-session moving average and previous price reactions. US index is now eyeing a test of the resistance zone ranging above 4,550 pts handle. Source: xStation5

US500 bounced off the support zone in the 4,450 pts area, marked with 200-session moving average and previous price reactions. US index is now eyeing a test of the resistance zone ranging above 4,550 pts handle. Source: xStation5

ข่าวเด่นวันนี้

US2000 ใกล้ระดับสูงสุดเป็นประวัติการณ์ 🗽 ข้อมูล NFIB แสดงอะไรบ้าง?

กราฟวันนี้ 🗽 US100 ฟื้นตัวต่อเนื่อง หลังฤดูกาลประกาศผลกำไรสหรัฐฯ

Wall Street ปรับตัวขึ้นต่อเนื่อง; ดัชนี US100 รีบาวด์มากกว่า 1% 📈