US natural gas prices (NATGAS) drops around 4% today and tests $1.70 per MMBTu area, marked with 61.8% retracement of the latest upward impulse. NATGAS also drops below 14-day moving average, which seems to be a key to maintaining the uptrend. A drop below these levels may pave the way for a deeper drop, with 78.6% retracement being the next potential targets for sellers. This would mean dropping to the levels not seen in over a month.

NATGAS drops below 14-day moving average. Should NATGAS finish today's trading below this hurdle, it could pave the way for a drop towards 78.6% retracement. Source: xStation5

NATGAS drops below 14-day moving average. Should NATGAS finish today's trading below this hurdle, it could pave the way for a drop towards 78.6% retracement. Source: xStation5

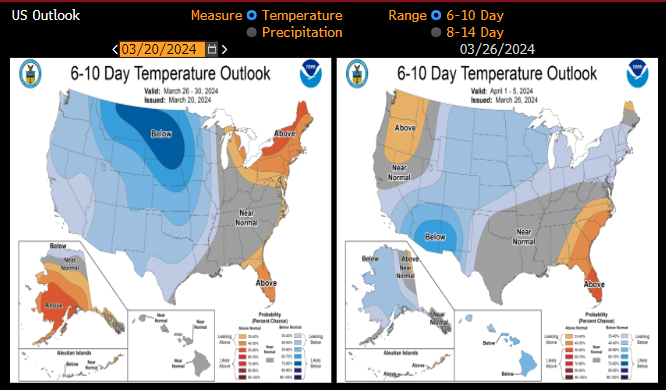

Weather forecasts for the United States start to stabilize after a recent period of colder weather. Current temperatures in the US suggest that heating season in the country is practically over already. Source: Bloomberg, NOAA

Stockpiles should not drop significantly from current levels, what leads to one of the biggest surpluses in history. On the other hand, a drop in production may suggest a slower refilling of inventories in the coming months. Source: Bloomberg Finance LP, XTB

น้ำมันถูกกดดัน ตลาดรอการตัดสินใจจาก G7

🔴LIVE: เทรดท่ามกลางสงคราม

3 ตลาดที่น่าจับตาสัปดาห์นี้

น้ำมันทะลุ $100 วิกฤตอุปทานพลังงานกดดันตลาด