Nvidia's (NVDA.US) Q2 report is one of the main events, not only in the context of this week but perhaps the entire second half of the year on the indices. The company's stock is the 'litmus test' of the AI trend, given its nearly 80% market share in the highest-performing GPUs, used to scale the power of artificial intelligence.

- The AI boom contributed mightily to the gains of the Nasdaq 100 and S&P500 in the first half of the year

- The Philadelphia Stock Exchange Semiconductor Index is up about 40% year-to-date against a nearly 220% gain in Nvidia shares

- The development of generative AI requires significant computing power, mainly provided by Nvidia chips

- The company has built a 'wide moat' against its competitors, thanks to its GPUs (including A100, H100) and CUDA software

- Company aims to triple H100 production to 1.5 million in 2024 vs. 500,000 thousand now - demand outstrips supply

- Taiwan Semiconductors, a major chip manufacturing subcontractor, estimates 50% y/y growth in demand for AI chips, over the next 5 years

- Server shipments for AI training are estimated to triple in 2024, and their share of the overall server market will increase from 7% last year to about 20% in 2027

- Deutsche Bank expects 86% q/q growth in Data Center revenues to $7.99 billion amid rising A100/H100 chip orders from major technology companies

- Company raised earnings forecast by 50% for Q2 - Wall Street believes company will deliver on promise, analysts will pay attention to Data Center (AI) segment

Nvidia's strong report and, above all, higher forecasts may give strength to Wall Street as a whole, indicating that artificial intelligence promises not only a technological but also a financial revolution for businesses and companies. Here are the expectations:

- Projected revenues: $11,06 billion, up 54% q/q according to Refinitiv (Citigroup expects $12.5 billion)

- Projected earnings per share (EPS): $2.09 vs. $1.09 in Q1 and $0.51 in Q2 2022

- Data Center revenue: $7,99 billion vs 4,28 billion in Q1 (86% q/q)

- Operating costs: USD 1.9 billion (9% increase q/q)

- Projected revenue for Q3 2023: $12.3 billion (105% y/y and 11% q/q)

- Projected earnings per share (EPS) for Q3 2023: $2.30 (up 10% q/q)

- Data center revenues for Q3 2023: $9,03 billion (135% y/y)

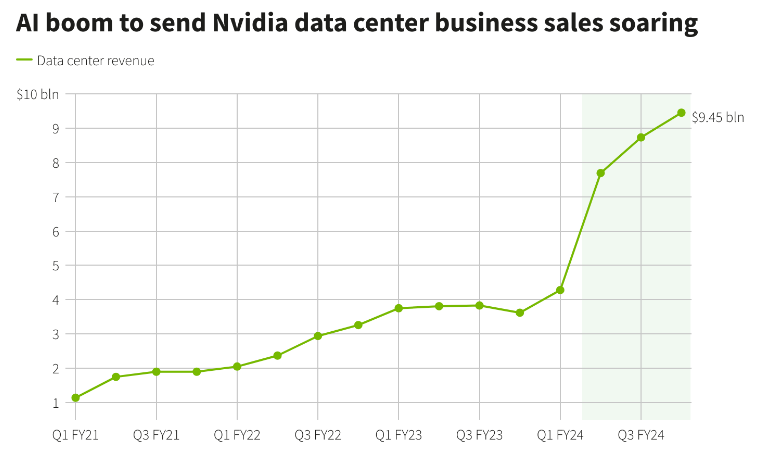

Strong Data Center, strong Nvidia?

The rapid rise in share prices in Q1 and Q2 indicates that Nvidia will not have much room for disappointment. In the face of high expectations, lower-than-forecast estimates may favor profit realization. The company delivered a mixed report in Q1, but the markets took note of high forecasts, better-than-expected earnings from Gaming (now Wall Street expects 5% y/y and 10% q/q growth, and the same quarterly dynamic in Q3) and, most importantly, soaring results in Data Center (AI), which account for a growing % of revenue and net income

For Nvidia shares, therefore, the stronger the results from Data Center, the better. If they will be strong enough, they can 'mask' any weakness in other segments. Industry technology portals point out that demand for AI A100 and H100 chips is powerful, and the company is only able to meet half of it. As a result, the price of the H100 has risen 100% from its initial $20,000. The trend could theoretically last for many quarters (until the market is saturated) although the question mark for its momentum remains a possible recession.

The market expects a jump in sales in the database segment. Source: Reuteres

Risks and competition in the longer term

The main risks for the company are the recession (the associated decline in corporate investment, lower R&D spending), geopolitical tensions in Taiwan (dependence of the manufacturing process on Taiwan's TSMC, Foxconn and Wistron), further tightening of U.S. sanctions on Chinese technology companies, and competition with AMD (AMD.US).

- Analysts estimate that chips from AMD could be up to half the price, and the company expects to start chip production in Q4 and could have about 10% of the AI chip market in 2024;

- AMD's challenge is of course Nvidia's CUDA software, which has become the industry standard for AI and has an advantage over similar products from any other company.

- Historically looking at the semiconductor market, the dominant manufacturer typically holds between 70 and 80% market share - at this stage, Nvidia's position as the chip leader for AI is unthreatened and obvious, as reflected in expectations and share price.

Nvidia shares (NVDA.US), D1 interval. In the event of a negative earnings disappointment, the stock could test levels near $400 where we see the 23.6 Fibonacci retracement, the primary support level after the May upward gap. The options market is pricing a move around 10% after the report. Looking at the stock price since late May/early June, we see a bearish divergence with the MACD and RSI - both indicators have cooled significantly, at a time when the stock 'on fumes' has risen nearly 15%. Source: xStation5

Palo Alto เข้าซื้อกิจการ CyberArk! ก้าวสู่การเป็นผู้นำใหม่ในวงการไซเบอร์ซีเคียวริตี้

เหลือเวลาไม่กี่วัน รับหุ้น GRAB ฟรี ⏳

📅 ปฏิทินเศรษฐกิจ: ตัวเลข NFP และ รายงานปริมาณน้ำมันคงคลังสหรัฐฯ 💡

ข่าวเด่นวันนี้