It was definitely a nervous Saturday morning in the Middle East when Izrael forced responded to the recent Iranian rocket attack with air raid of their own. However, Izrael stopped short of targeting Iranian oil infrastructure, choosing military targets instead and the Iranian side described impact as modest. Indeed an attach on the oil infrastructure was feared the most with the Iranian response possibly including an export blockade from the Middle East and potentially sending crude prices well in excess of $100.

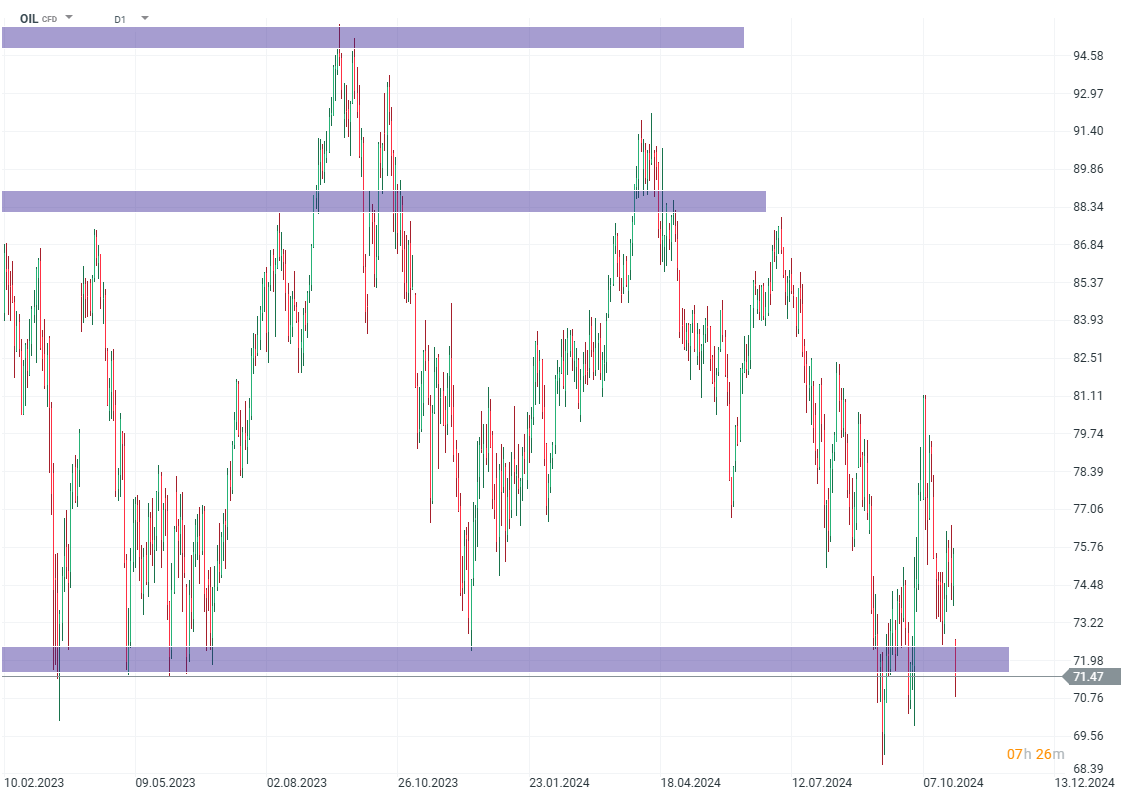

With this out of the picture – at least for the time being – the oil market returns to demand worries and the priced are under a firm downward pressure. On the chart of OIL one can see bulls once again struggling around the key support area and potentially paving the way for more downside.

Silver พุ่ง 3% ในวันนี้ 📈

ข่าวเด่นวันนี้

3 ตลาดสำคัญที่ต้องจับตาในสัปดาห์นี้

ก๊าซธรรมชาติลด 6% ตามพยากรณ์อากาศใหม่