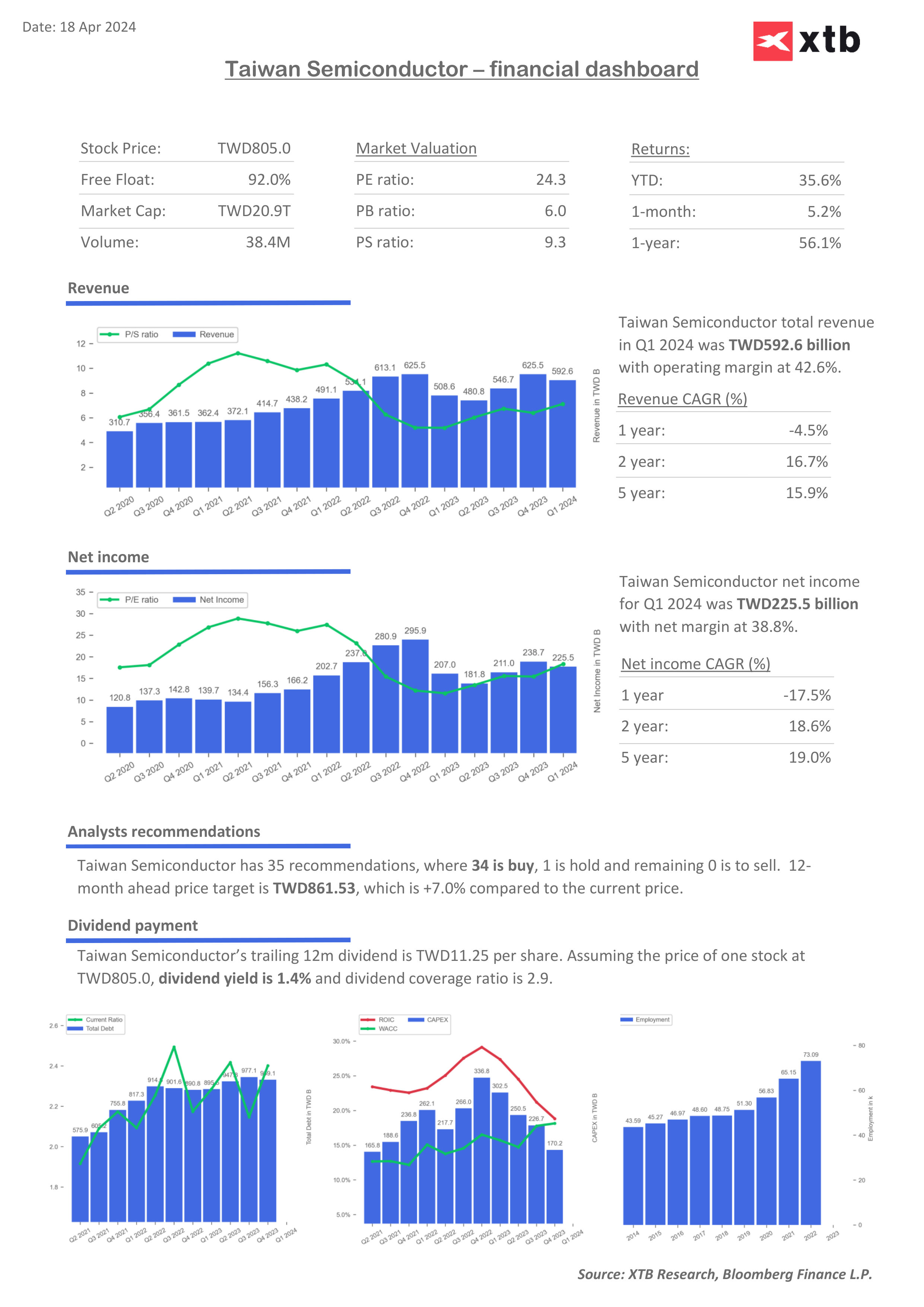

Taiwan Semiconductor Manufacturing Co. (TSM.US) announced strong financial results for the first quarter of 2024, with consolidated revenue reaching NT$592.64 billion, an increase of 16.5% year-over-year, although there was a 5.3% decrease from the fourth quarter of 2023. Net income for the quarter rose by 8.9% year-over-year to NT$225.49 billion, beating average analyst estimates. The company experienced growth primarily due to robust demand for AI chips, spurred by applications such as large language models and ongoing needs in the high-performance computing (HPC) sector.

- Net income NT$225.5 billion, +9% y/y, estimate NT$214.91 billion

- Gross margin 53.1% vs. 53% q/q, estimate 53%

- Operating profit NT$249.02 billion, +7.7% y/y, estimate NT$240.87 billion

- Total Revenue NT$592.64 billion, +17% y/y, estimate NT$583.46 billion

Revenue Stream

- Quarterly Comparison: Despite the annual growth, there was a 5.3% decrease in revenue compared to Q4 2023.

- Geographic Revenue Distribution: North America was the largest contributor, accounting for 69% of total net revenue; China, Asia Pacific, Japan, and EMEA contributed 9%, 12%, 6%, and 4% respectively.

Revenue by Technology Segment

- Advanced Technologies: Technologies defined as 7-nanometer and below accounted for 65% of total wafer revenue.

- Specific Technologies: 3-nanometer technology contributed 9%, 5-nanometer 37%, and 7-nanometer 19% of total wafer revenue.

Revenue by Platform Segment:

- High-Performance Computing (HPC) and Smartphones: These segments represented 46% and 38% of net revenue, respectively.

- Other Segments: IoT, Automotive, DCE, and Others each represented 6%, 6%, 2%, and 2% of revenue respectively.

TSMC's management highlighted that the company is recognized as the world’s largest producer of advanced processors. The company services major tech giants, including Nvidia and Apple, reflecting its pivotal role in the global semiconductor industry. TSMC is at the forefront of semiconductor technology, producing 3-nanometer chips and planning to start mass production of even smaller 2-nanometer chips by 2025. This shift towards more advanced, smaller nanometer technologies is expected to drive TSMC's long-term growth, enhancing the power and efficiency of the chips they produce.

TSMC dominates the global foundry market, accounting for 61% of the total revenue in the fourth quarter, with its closest competitor, Samsung Foundry, holding 14%. The demand for AI chips, especially for applications in large language models like ChatGPT, has significantly contributed to a 56% surge in TSMC’s shares over the past year.

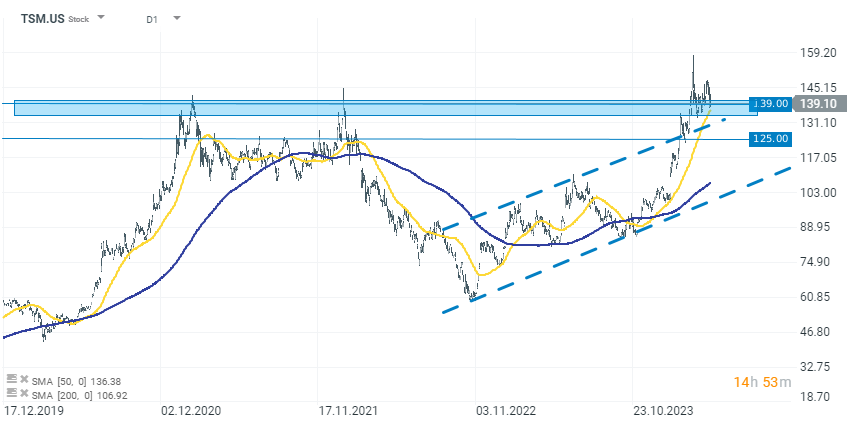

TSM (D1 interval)

At the last session, the company's stock closed around the resistance level of 139-140 dollars per share. Good results and promising forecasts for Q2 of this year may support the stock price and help bulls break through this zone.

Source: xStation 5

เหลือเวลาไม่กี่วัน รับหุ้น GRAB ฟรี ⏳

📅 ปฏิทินเศรษฐกิจ: ตัวเลข NFP และ รายงานปริมาณน้ำมันคงคลังสหรัฐฯ 💡

ข่าวเด่นวันนี้

Datadog ฟอร์มร้อนแรง: ทำสถิติสูงสุดในไตรมาส 4 พร้อมแนวโน้มแข็งแกร่งสำหรับปี 2026