Shares of major U.S. meat producer Tyson Foods (TSN.US) are losing 15% following the release of a surprise Q1 loss and lower full-year revenue forecasts. The company cited falling beef and pork prices. The reason? Falling consumption and higher costs, of course. As a result, the stock hit 3-year lows.

The company reported a $0.28 loss per share (EPS) or $97 million in net income, compared to $829 million in net income in Q1 2022. Analysts had expected $0.80 earnings per share (!). Revenue rose slightly y/y to $13.1 billion vs $13.6 billion estimated by Wall Street.

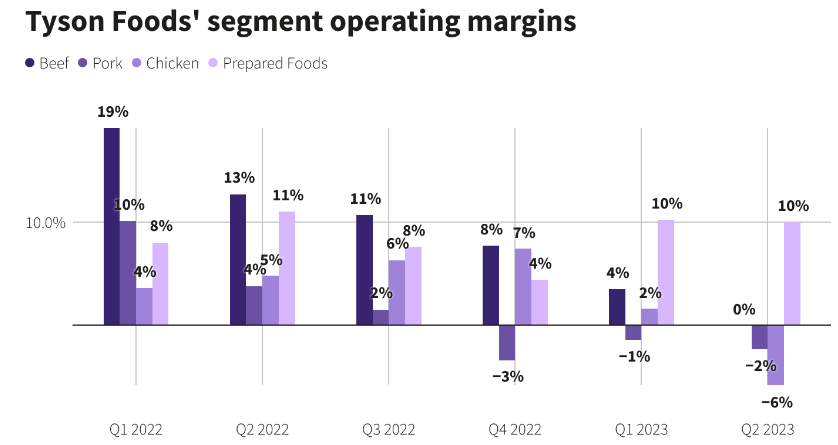

- Beef margins were 0.2%, the worst for the company since 2015

- Pork margins were negative (-2.2%) and the weakest in more than 20 years

- Poultry margins were also negative (-3.7%), with feed costs up $145 million

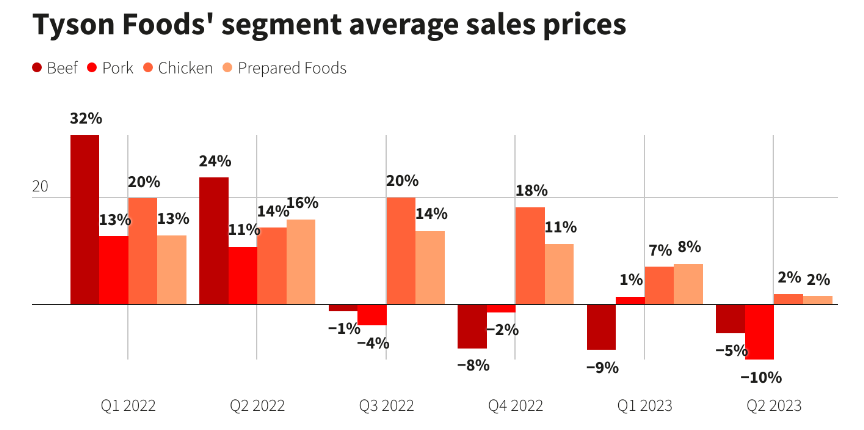

Tyson Foods' average selling prices. Source: Reuters

Average operating margins by Tyson Foods business segment. The producer estimated full-year beef margins at negative 1% to positive 1%, having previously estimated 2% to 4%. Source: Reuters

- The weaker results 'add to the disinflationary landscape in the U.S. and show that constrained consumer spending is slowly shifting to basic products. The disappointing net loss, in an environment of a still relatively strong U.S. consumer, could mean that if demand weakens further - the company's problems could worsen.

- The results disappointed JP Morgan analysts, among others, who were particularly surprised by the dismal performance in the poultry segment. Also, average selling prices for beef and pork fell 5.4% and 10.3%, respectively, in Q1, which ultimately affected profits.

- The price increases could not continue indefinitely. Beef sales at Tyson Foods fell 3% in Q1, which projected an 8.3% drop in overall sales.

- The company's CFO conveyed that consumer weakness is likely to continue for the rest of the year. The company will lay off about 10% of its workforce. At the same time, management remains confident that business remains healthy As a result of the weak quarter, the company lowered its sales forecast for fiscal 2023 to $53-54 billion from $55-57 billion previously.

- Higher feed costs and a drought in the United States have prompted cattle producers to send animals to slaughterhouses instead of keeping them for breeding. As a result, Tyson Foods' cattle purchase costs rose by $305 million. The company reported extremely low operating margins of 0.2% for its beef business - a near-total decline from 12.7% in Q1 2022.

Tyson Foods (TSN.US) shares. Demand for the company's shares is weakening at a time when markets expect a 'recessionary' landscape for the U.S. economy, which would mean even weaker consumers and a possible further decline in the company's stock price. Source: xStation5

Tyson Foods (TSN.US) shares. Demand for the company's shares is weakening at a time when markets expect a 'recessionary' landscape for the U.S. economy, which would mean even weaker consumers and a possible further decline in the company's stock price. Source: xStation5

ข่าวเด่นวันนี้

การขายทำกำไรในปัจจุบันหมายถึงจุดจบของบริษัทควอนตัมหรือไม่?

Howmet Aerospace พุ่ง 10% หลังประกาศผลกำไร ทำมูลค่าบริษัททะลุ 100 พันล้านดอลลาร์ 📈

📊 หุ้นเด่นรายสัปดาห์: Datadog – การมอนิเตอร์ที่คุ้มค่า