- Wall Street records gains at the opening

- Yields on U.S. bonds are rising

- The dollar is weakening

- Revision of U.S. inflation data

The end of the week brings further increases in the markets. Wall Street is hitting new records. In addition to good company results, fuel for further growth today comes from downward revisions of the U.S. CPI data. Bulls are also aided by a weaker dollar, with the dollar index losing 0.07%, falling below 104 points. Despite historically high levels for the US500 and US100, yields on U.S. bonds are rising to 4.19%, reflecting a decreasing probability of interest rate cuts in March.

CPI Data Revision

The U.S. monthly consumer prices for December were revised to show a smaller increase than initially estimated. The consumer price index (CPI) rose by 0.2% in December, revised from the previously reported 0.3%, while November's data was adjusted to a 0.2% increase from the initial 0.1%. These revisions are a result of recalculating seasonal adjustment factors, a routine annual procedure covering data from January 2019 to December 2023. The year-on-year data, not subject to seasonal adjustments, remained unchanged. Excluding volatile food and energy components, the CPI for December was consistently reported as a 0.3% increase.

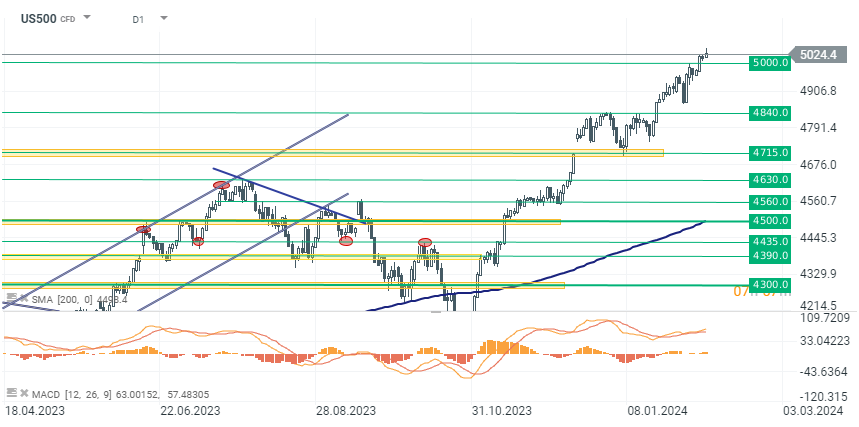

US500

The US500 index (D1) records a 0.15% increase at the opening to 5020 points. The RSI indicator remains around 70 points, indicating a high state of overbuying, and a slight divergence can be observed on the MACD. These indicators confirm market euphoria, but it's important to remember that this does not unequivocally mean a turning point in the current upward trend.

Source: xStation 5

Company News

Ericsson (ERIC.US) shares gain 1.4% after Reuters reported that the Swedish telecommunications firm is in talks to co-design a chip with semiconductor giant Nvidia.

Expedia (EXPE.US) shares tumble over 18% after the company reported fourth-quarter

gross bookings that slightly missed estimates. The company also announced that Ariane Gorin would succeed

Peter Kern as CEO. Jefferies said the reduced guidance for FY24 bookings and announcement of a CEO transition

had lowered their confidence in the company’s turnaround.

Humacyte (HUMA.US) announced that the U.S. FDA has accepted and granted priority review to the company’s marketing application for its Human Acellular Vessel (HAV), a bioengineered blood vessel. The FDA has set August 10, 2024, as the target action date for completing its review. HUMA seeks approval for HAV to be used in urgent arterial repair after extremity injuries.

Cloudflare (NET.US) has garnered positive attention benefiting from the increasing number of cyberattacks. The company saw a year-over-year customer increase of over 34%, including a significant three-year, $33M contract with the U.S. Department of Commerce. Morgan Stanley analyst Hamza Fodderwala noted a significant rise in distributed denial of service attacks in the second half of 2023, boosting demand for Cloudflare's core web security services.

Nvidia (NVDA.US) has reportedly held discussions with Amazon (AMZN), Meta, Microsoft, Google, and OpenAI about manufacturing custom chips for them including advanced AI processors, for cloud computing companies and others.

เตลาดเด่นวันนี้: US500 เคลื่อนไหวตามข้อมูล PCE และแรงส่งจากกระแส AI

Adobe เผชิญทั้งยุค AI และการเปลี่ยนแปลงผู้นำ พร้อมผลประกอบการที่ทำสถิติ แต่ยังมีความท้าทายจริงรออยู่ 📊🚀

สรุปข่าวเช้า: ไฟเขียวซื้อน้ำมันรัสเซียได้ 30 วัน

Market wrap: หุ้นยุโรปพยายามทรงตัว แม้ราคาน้ำมันพุ่งแรง 🔍