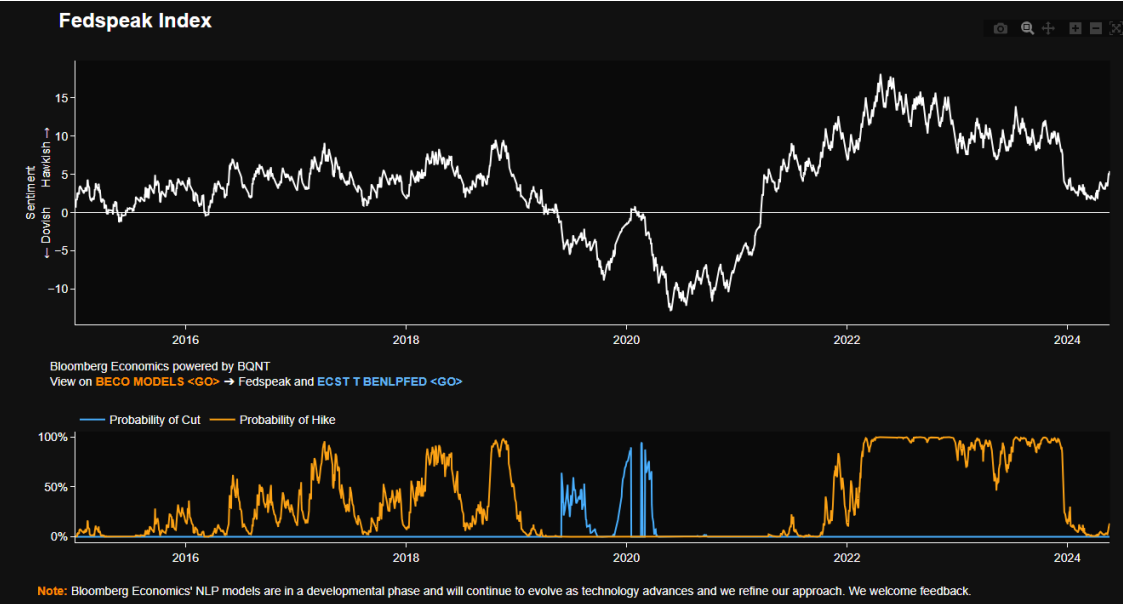

The publication of the FOMC Minutes did not cause undue volatility in the markets. The benchmark US100 retreated slightly, and the dollar appreciated after comments suggesting that Federal Reserve bankers favor maintaining a hawkish stance in the medium term. Moreover, some bankers perceive uncertainty about the degree of tightness in current financial conditions and the associated risks. This mention notably influenced a more hawkish market reaction after the publication.

The first movements have already been largely erased, which has to do with the market's expectation of hawkish comments during this publication. This was suggested, among other things, by recent comments from bankers.

The lack of surprise against the Minutes negates the declines observed in the first minutes after the publication. Source: Bloomberg Financial LP

All in all, the report presented indicates that it will take longer than previously anticipated before Fed bankers become more confident that inflation is permanently moving toward the 2% target. The market has been estimating all along that the first rate cut of 25 points will come with a 71% probability in September this year.

In response to the hawkish tone of the FOMC Minutes, we see the dollar strengthening against the euro. However it is hard to talk about a complete change in the narrative, and the decline in the area of 1.0829 brings us closer to the local minima set first by resistance near 1.0824 and then at 1.0820. Source: xStation.

BREAKING: US100 พุ่งแรง หลังรายงาน NFP สหรัฐแข็งแกร่งกว่าคาด

📅 ปฏิทินเศรษฐกิจ: ตัวเลข NFP และ รายงานปริมาณน้ำมันคงคลังสหรัฐฯ 💡

สรุปตลาดเช้า: ดอลลาร์ติดกับดัก ตลาดจับตา NFP คืนนี้ 🏛️

BREAKING: ยอดขายปลีกสหรัฐฯ ต่ำกว่าคาดการณ์