Oil, as well as other energy commodities, are pulling back today. Brent and WTI trade almost 4% lower while gasoline and US natural gas prices drop over 4%. Move looks to be driven by overall concerns over the condition of the global economy, with re-emergence of US banking problems being one of prime fear drivers. Apart from that, OPEC+ currently seems unwilling to intervene to support prices, what also adds to pressure.

- US banking sector issues have been reignited with collapse of First Republic Bank, boosting recession risk for the United States

- Back in March when US banking issues first arose, oil took a significant hit

- Chinese post-Covid demand recovery continues at a slower than expected pace

- Russia's Novak said that OPEC+ monitors oil price drop but it may turn out to be temporary

- No changes have been made to meeting schedule - oil producers are still set to meet no sooner than June

- WTI drops below $69 and trades at the lowest level since March 24, 2023

- Brent tests mid-March lows in $72.50 area

- US natural gas prices drop below $2.20 to the lowest level since mid-April

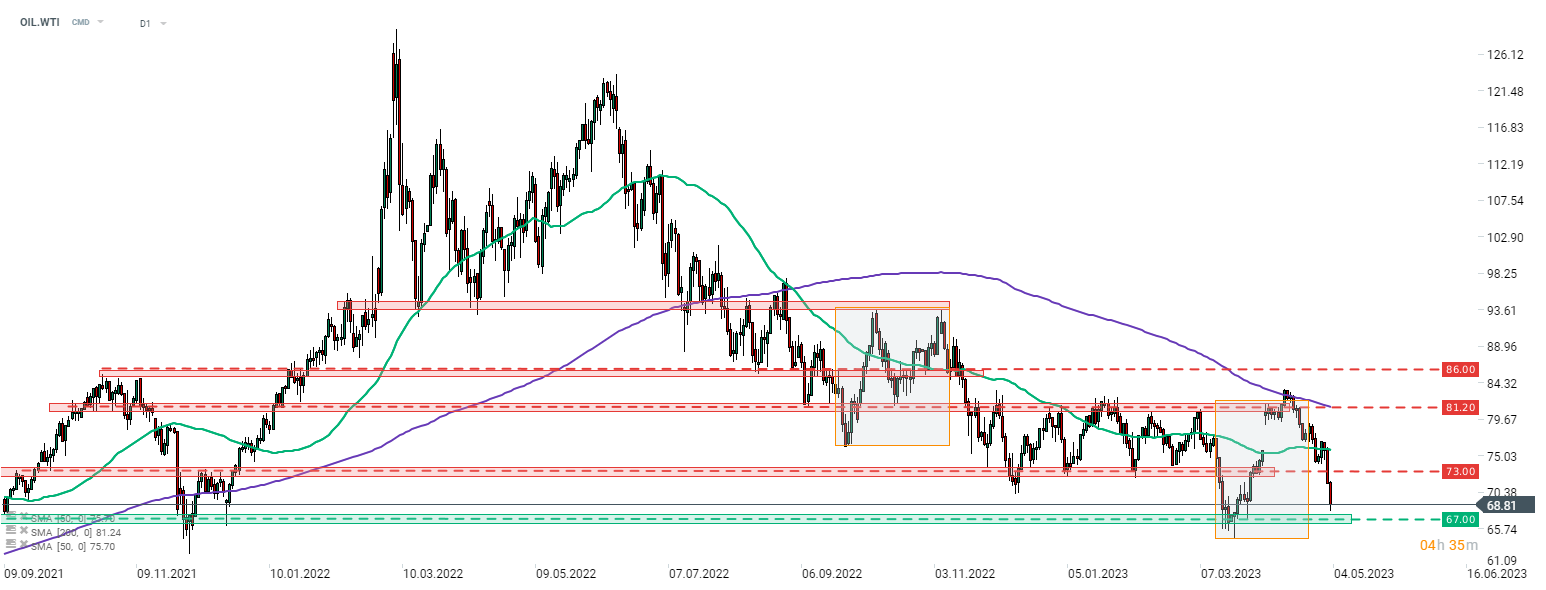

WTI (OIL.WTI) continues pullback after failed attempt to break above the upper limit of the Overbalance structure and 200-session moving average (purple line). WTI plunged below $73 price zone yesterday and continues to drop hard today. A test of $67 support zone looks probable, especially if Fed warns of rising recession risk today. Source: xStation5

WTI (OIL.WTI) continues pullback after failed attempt to break above the upper limit of the Overbalance structure and 200-session moving average (purple line). WTI plunged below $73 price zone yesterday and continues to drop hard today. A test of $67 support zone looks probable, especially if Fed warns of rising recession risk today. Source: xStation5

Significant declines can be spotted all across the energy commodity market today. Source: xStation5

น้ำมันถูกกดดัน ตลาดรอการตัดสินใจจาก G7

🔴LIVE: เทรดท่ามกลางสงคราม

3 ตลาดที่น่าจับตาสัปดาห์นี้

น้ำมันทะลุ $100 วิกฤตอุปทานพลังงานกดดันตลาด