Despite rising Wall Street indices and significant drop in both treasury bond yields and US dollar, we can see Bitcoin weakening by almost 3% today. Weaker than expected ISM data from the US economy didn't support the largest cryptocurrency. Also, so-called altcoins are losing today, with Ethereum and Solana dropping almost 4% and 8% respectively.

- We can assume that investors on the crypto market remain cautious amid unfavourable summer seasonality for Bitcoin (which is surprisingly losing correlation with the stock market, for which first 2 weeks of July are historically very strong) and risk of selling reserves from Mt.Gox crypto stock exchange, which can start repayments of investors since the 1 July, with more than 140k BTC held.

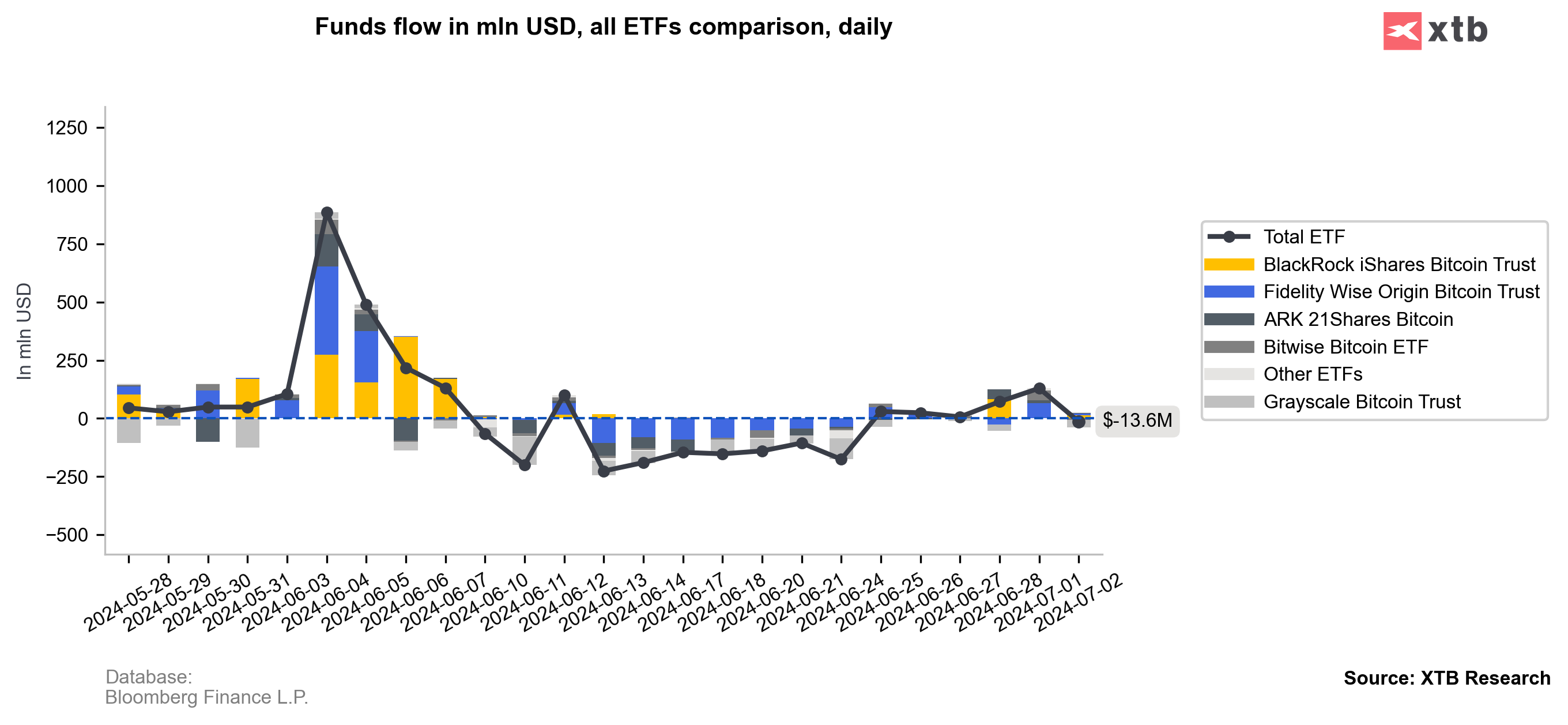

- A very important factor for Bitcoin is weakening activity and demand for Bitcoin ETFs. Investors demand for Bitcoin was very high during the H1 2024 - and it's still unknown will the 2024 H2 will be at least as good as H1 (or even better). Investors may see that lack of Bitcoin reaction to significantly dropping yields is a signal, that any positive BTC reaction to 'dovish Fed' or even rate cuts in the fall of 2024 are not guaranteed.

Inflows to US Bitcoin ETFs cooled off yesterday again, with $13.6 net outflows. Source: XTB Research, Bloomberg L.P.

Inflows to US Bitcoin ETFs cooled off yesterday again, with $13.6 net outflows. Source: XTB Research, Bloomberg L.P.

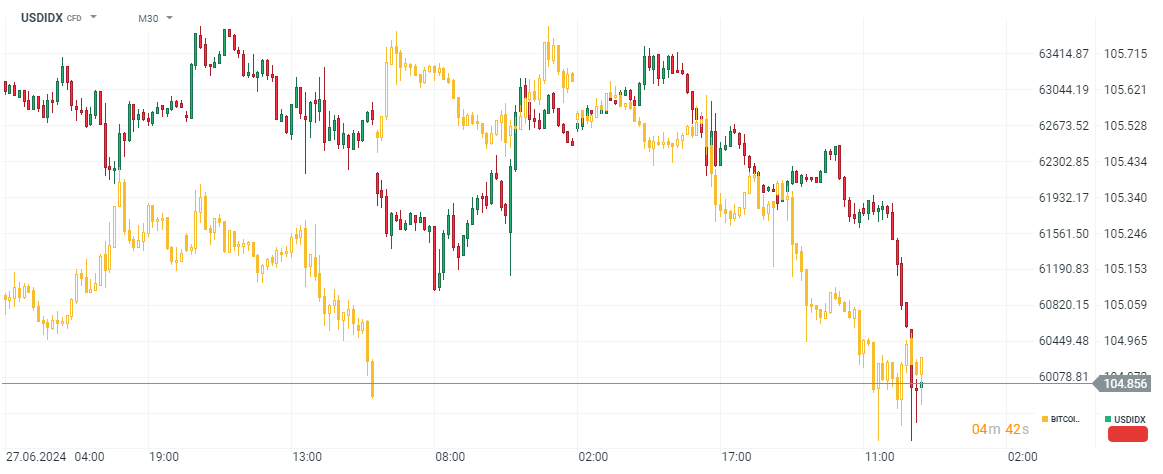

Bitcoin charts (M30, USDIDX VS BITCOIN)

Source: xStation5

Source: xStation5

What's interesting, while historically Bitcoin (orange chart) was mostly negatively correlated with US dollar, but now it drops in line with USDIDX.

Source: xStation5

Source: xStation5

ملخص اليوم: بيانات أمريكية ضعيفة تُؤدي إلى انخفاض الأسواق، والمعادن الثمينة تتعرض لضغوط مجدداً!

🚨 انخفاض سعر البيتكوين إلى 69,000 دولار 📉 هل هذا سيناريو تصحيح بنسبة 1:1؟

ملخص السوق: نوفو نورديسك تقفز بأكثر من 7% 🚀

أخبار العملات الرقمية: انخفاض سعر البيتكوين إلى ما دون 70 ألف دولار 📉 هل ستنخفض العملات الرقمية مرة أخرى؟