Bank of Japan deputy governor, Uchida spoke publicly in Hakonde:

- BoJ will not raise rates unless the market is stable

- Market is buoyed by US data, US economy should experience soft landing, however

- Path for interest rates may depend on market situation

- Policy will remain defensive, even with several hikes

- Real interest rates still strongly negative

- Financial conditions remain strongly accommodative

- Personally thinks markets will calm down and think carefully about further moves due to the situation

- Economically than has not changed, only market conditions show that one must be prudent

- Consumer spending remains strong, but one should be careful about it

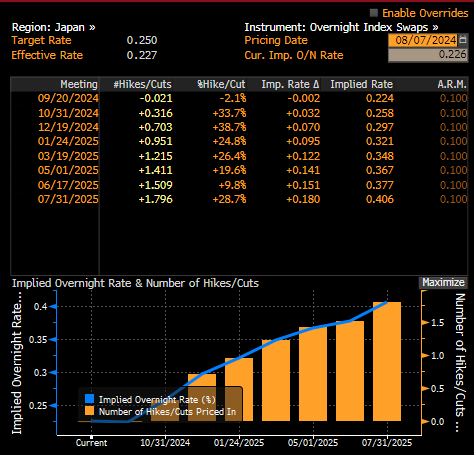

The market expects less than a 10bp hike this year. On the other hand, expectations for a hike have risen marginally since yesterday. A nearly full hike is priced in by January. Source: Bloomberg Finance LP, XTB

USDJPY is clearly weakening after Uchida's statement. The JPY is already losing 1.7% against the dollar. On the other hand, the yen's weakening has diminished as of 06:45 a.m. USDJPY is reacting to support at 146.5.

ملخص اليوم: انخفاض المؤشرات والعملات الرقمية وسط ارتفاع أسعار النفط 🚩 ارتفاع الذهب والدولار الأمريكي

ثلاثة أسواق تستحق المتابعة الأسبوع المقبل (06.03.2026)

ملخص السوق: رأس مال يغادر أوروبا📉

عاجل: بيانات الوظائف غير الزراعية من الولايات المتحدة