Bank of Canada announced its latest monetary policy decision today at 2:45 pm BST. Bank was expected to keep rates unchanged, with the main interest rate expected to remain at 5.00% for the sixth meeting in a row. Money markets saw just a 15% chance of Canadian central bankers delivering a 25 basis point rate cut at today's meeting. The chance of a cut by the June meeting was seen at around 65%.

Bank of Canada did not surprise the markets. Rates were left unchanged, in-line with expectations. Statement showed Bank as being confident that inflation will ease despite stronger growth. GDP forecast for 2024 was boosted to from 0.8 to 1.5% on exports and consumption strength, while CPI forecast was lowered from 2.8 to 2.6%. However, GDP forecast for 2025 was lowered from 2.4 to 2.2%, while growth is expected at 1.9% in 2026. CPI forecast for 2025 was left unchanged to 2.2%. Importantly, Bank of Canada increased neutral rate range forecast by 25 basis points, to 2.25-3.25%. BoC expects inflation to return to 2% target near the end of 2025. Market pricing of a June rate cut dropped to around 40% following the decision.

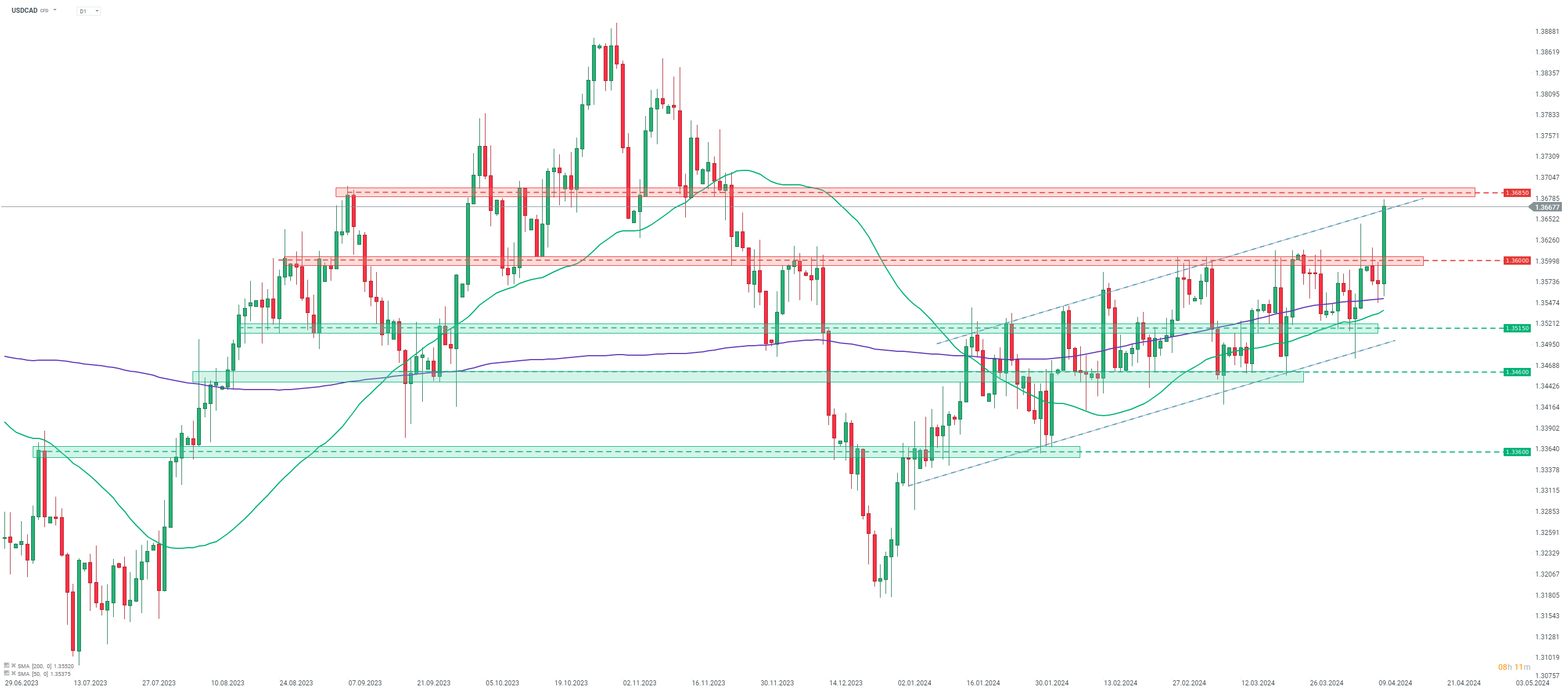

Canadian dollar gained following the decision. However, USDCAD remains significantly higher on the day, following a surge triggered by hotter-than-expected US CPI inflation reading earlier today.

CAD gained slightly after BoC decison but USDCAD remains higher on the day, following earlier US CPI report. The pair continues to trade near the upper limit of the bullish channel. Source: xStation5

CAD gained slightly after BoC decison but USDCAD remains higher on the day, following earlier US CPI report. The pair continues to trade near the upper limit of the bullish channel. Source: xStation5

التقويم الاقتصادي: التضخم في مؤشر أسعار المستهلك الأمريكي هو الإصدار الرئيسي 🔎

حصاد الأسواق (11.03.2026)

انتعاش قوي في سوق أبوظبي يعيد الثقة ويضيف 47 مليار درهم للقيمة السوقية

تؤكد S&P قوة الاقتصاد الإماراتي وتثبّت تصنيفه الائتماني مع نظرة مستقرة