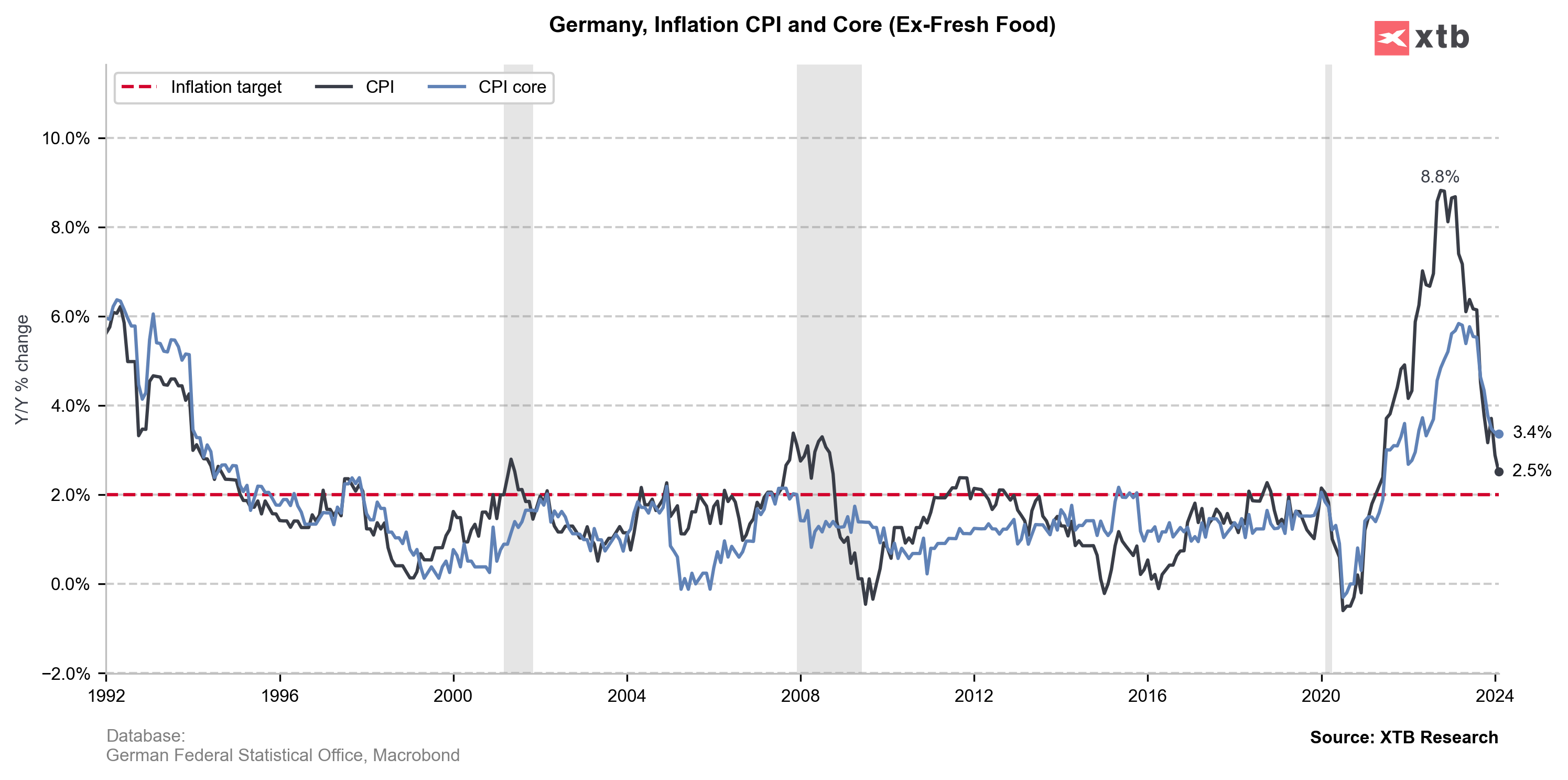

German flash CPI inflation data for February was released today at 1:00 pm GMT. Market was expecting slowdown in headline CPI from 2.9% to 2.6% YoY. However, data from France and Spain released earlier today showed smaller-than-expected slowdown in price growth, raising fears that German reading will also surprise to the upside. State-level data released throughout the day strongly hinted that overall German reading will show a slowdown.

Actual German reading stood in contrast to French and Spanish data as headline CPI inflation in Germany slowed more than expected in February. On a monthly basis, price growth was slower than expected. EUR dipped following the release as data can be seen as dovish. Interestingly, a small drop could also be spotted on DE40 market.

Germany, flash CPI inflation for February

- Annual: 2.5% YoY vs 2.6% YoY expected (2.9% YoY previously)

- Monthly: +0.4% MoM vs +0.5% MoM expected (+0.2% MoM previously

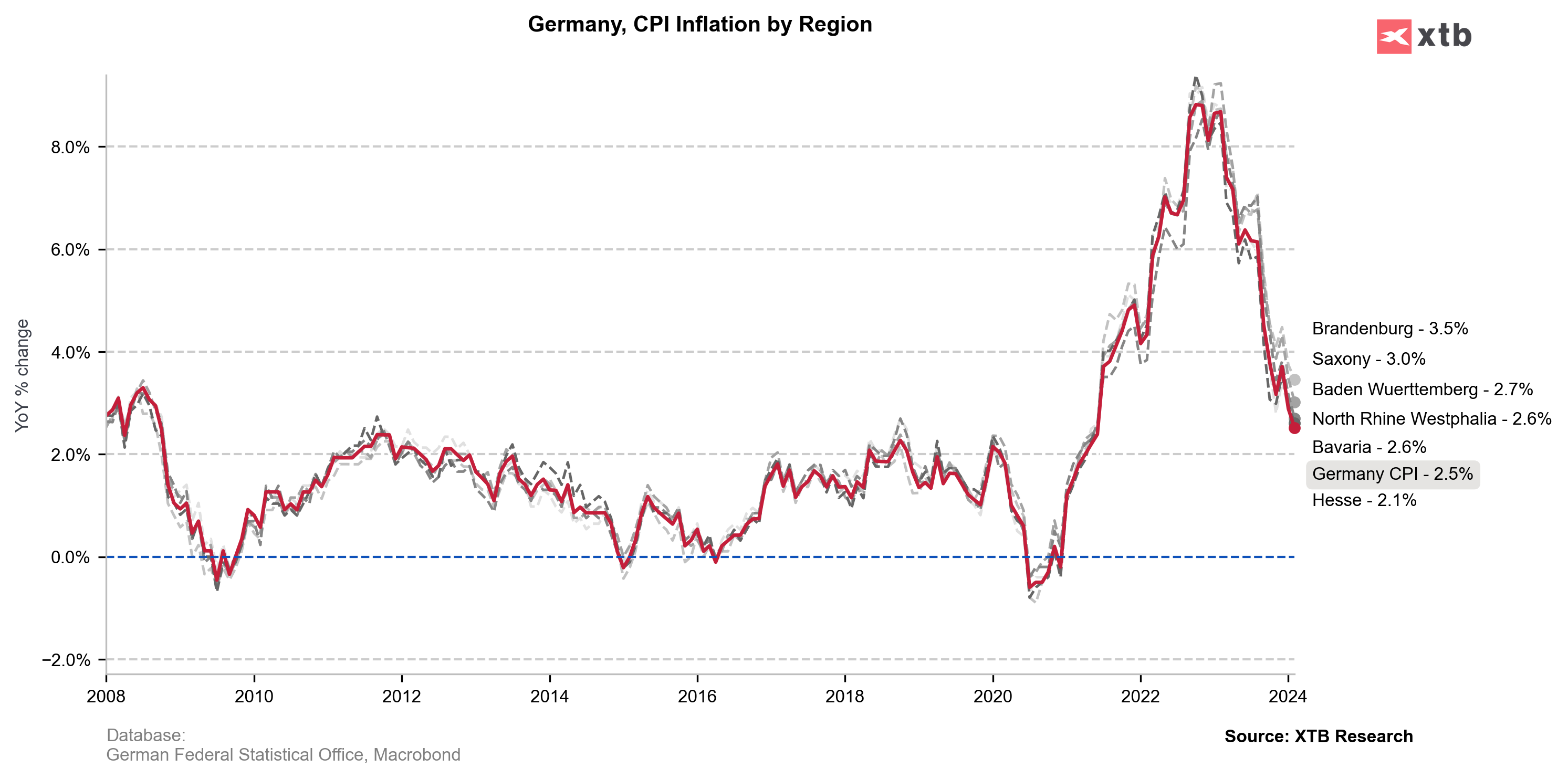

German state-level CPI readings for February

- Hesse: 2.1% YoY vs 2.2% YoY previously

- Bavaria: 2.6% YoY vs 2.9% YoY previously

- Brandenburg: 3.5% YoY vs 3.7% YoY previously

- Saxony: 3.0% YoY vs 3.5% YoY previously

- Baden Wuerttemberg: 2.7% YoY vs 3.2% YoY previously

- North Rhine Westphalia: 2.6% YoY vs 3.0% YoY previously

EURUSD broke below 1.0830 support zone following release of German CPI data for February and is now looking towards a test of the 200-hour moving average (purple line). Source: xStation5

محضر اجتماع البنك المركزي الأوروبي: لم يبلغ تأثير قوة اليورو على التضخم ذروته بعد

بنك «كانتور» يتوقع متوسط ارتفاع 30% لأسهم شركات «أدنوك»

أسهم إماراتية تمحو خسائرها الصباحية وتحقق مكاسب

توقعات ببلوغ 1.1 تريليون درهم لحجم سوق الشحن البحري الإماراتي في 2033