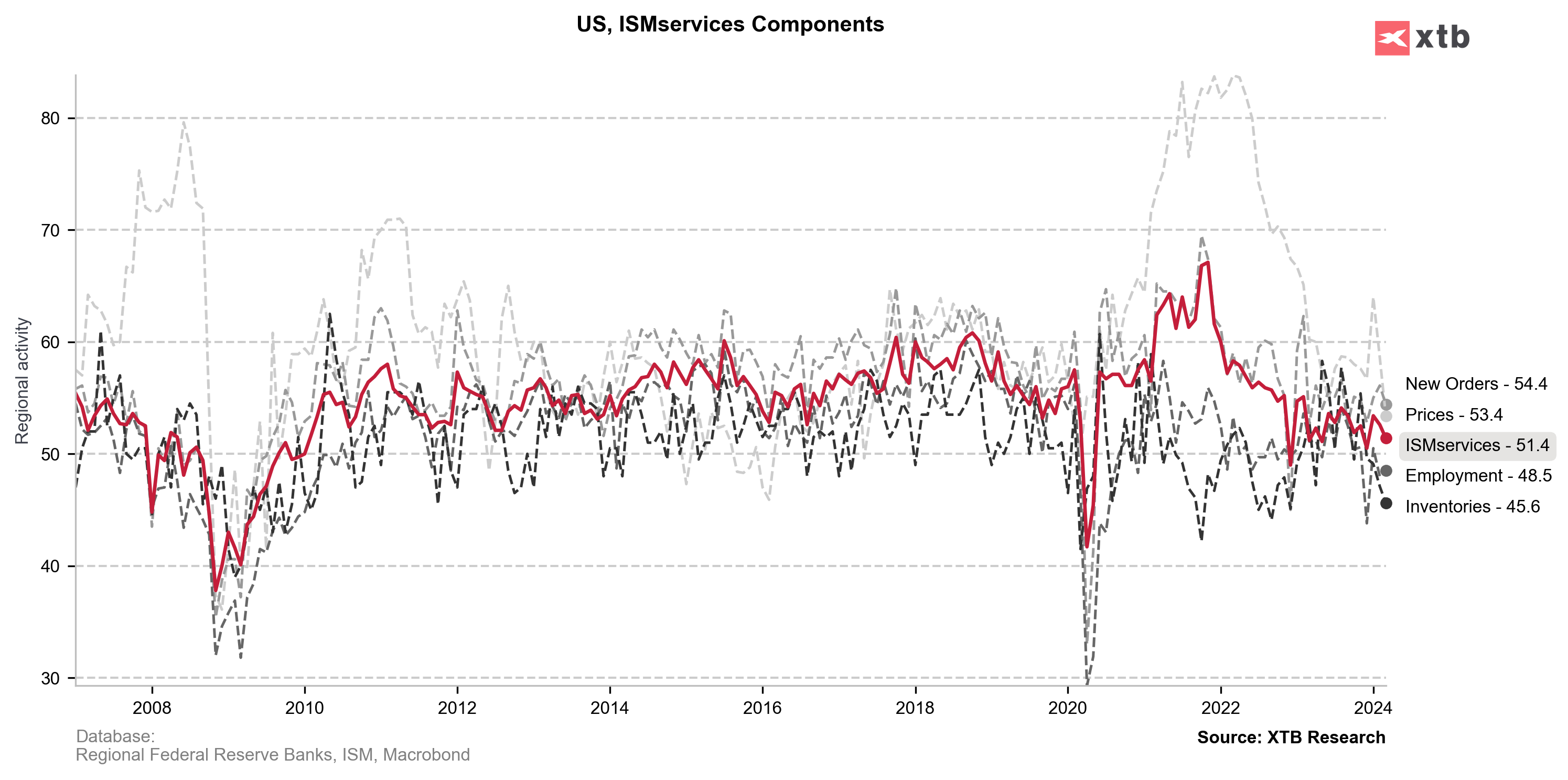

US services ISM data for March was released today at 3:00 pm BST. Report was expected to show the headline index staying virtually unchanged compared to February's data. However, an improvement was expected in New Orders subindex, as well as deterioration in Employment subindex.

The actual report turned out to be a negative surprise, with headline index and subindices all coming in below expectations. The biggest plunge was recorded in Prices Paid subindex. Employment subindex climbed compared to a month ago reading, but less than expected by analysts.

This is a dovish reading as it hints at weakening outlook for the US services sector as well as at easing price pressures. Having said that, it should not come as a surprise that we have seen a dovish response in the markets - USD dropped while US equity indices jumped.

US services ISM index for March: 51.4 vs 52.7 expected (52.6 previously)

- Prices Paid: 53.4 vs 58.4 expected (58.6 previously)

- New Orders: 54.4 vs 55.5 expected (56.1 previously)

- Employment: 48.5 vs 49.0 expected (48.0 previously)

EURUSD spiked after services ISM data, breaking above the 1.08 mark and approaching 38.2% retracement of the last major downward impulse. Source: xStation5

EURUSD spiked after services ISM data, breaking above the 1.08 mark and approaching 38.2% retracement of the last major downward impulse. Source: xStation5

مؤشر قوة خدمة العملاء (ISM) في ريدينغ يشهد أكبر توسع في النشاط منذ عام 2022

عاجل: أداء ADP الأقوى من المتوقع يفشل في دعم الدولار الأمريكي

تغييرات قيادية في «سابك»: تقاعد الفقيه وتكليف الفقير بقيادة المرحلة المقبلة

سابك تواجه خسائر قياسية بقيمة 25.78 مليار ريال في 2025