Fed's Federal Open Market Committee (FOMC) announced its monetary policy decision today at 7:00 pm BST. In-line with market expectations, interest rate were left unchanged, with Fed Funds rate staying in the 5.25-5.50% range. There were some changes to economic projections, however. Statement repeated that Fed does not expect it will be appropriate to reduce policy target range until gaining greater confidence inflation is moving sustainably towards 2% target.

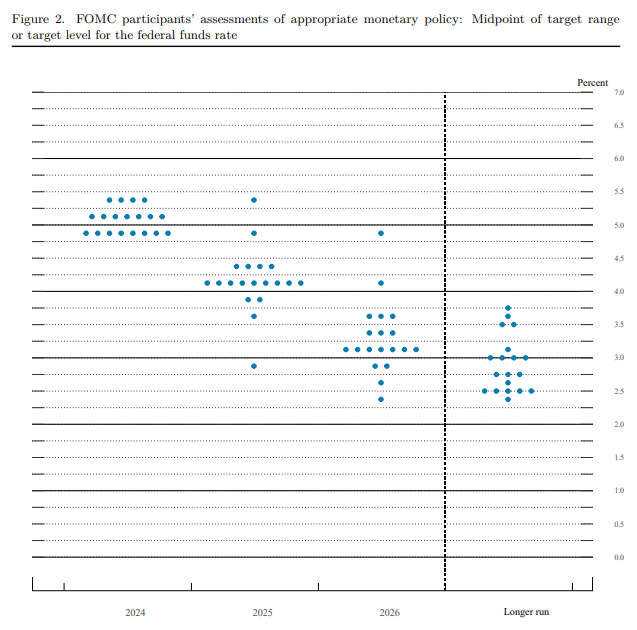

Most importantly, new dot-plot shows a median rate forecast of 5.1% for 2024, meaning just a single rate cut from current levels. However, split between those who saw 1 and those who saw 2 was almost equal. Core PCE inflation forecast for this and next year was boosted as well.

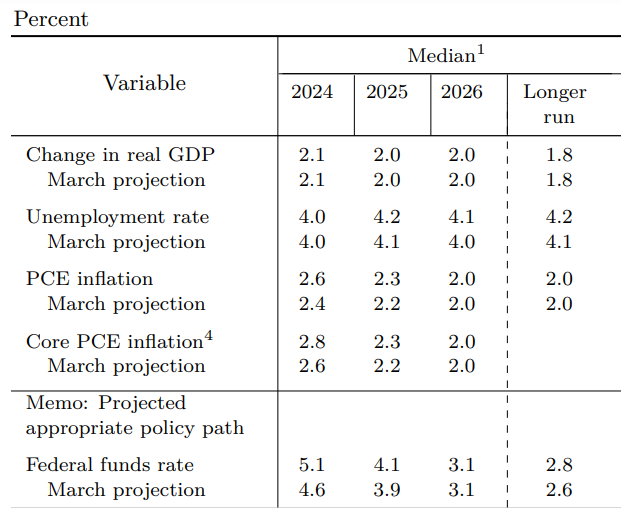

Fed Funds rate forecast

- 2024: 5.1% vs 4.6% in March projection

- 2025: 4.1%vs 3.9% in March projection

- 2026: 3.1% vs 3.1% in March projection

Core PCE inflation forecast

- 2024: 2.8% vs 2.6% in March projection

- 2025: 2.3% vs 2.2% in March projection

- 2026: 2.0% vs 2.0% in March projection

Real GDP forecast

- 2024: 2.1% vs 2.1% in March projection

- 2025: 2.0% vs 2.0% in March Projection

- 2026: 2.0% vs 2.0% in March projection

Unemployment rate forecast

- 2024: 4.0% vs 4.0% in March projection

- 2025: 4.2% vs 4.1% in March projection

- 2026: 4.1% vs 4.0% in March projection

PCE inflation forecast

- 2024: 2.6% vs 2.4% in March projection

- 2025: 2.3% vs 2.2% in March projection

- 2026: 2.0% vs 2.0% in March projection

Source: Federal Reserve

Source: Federal Reserve

عاجل: مبيعات التجزئة الأمريكية أقل من التوقعات

المركزي: التحويلات المالية المصرفية تجاوزت 24.4 تريليون درهم في 2025

«مبادلة» و«الدار»: 60 ملياراً لتوسعة المنطقة المالية في «المارية»

تأسيس شركة “طيران ناس سوريا” بملكية مشتركة مع السعودية