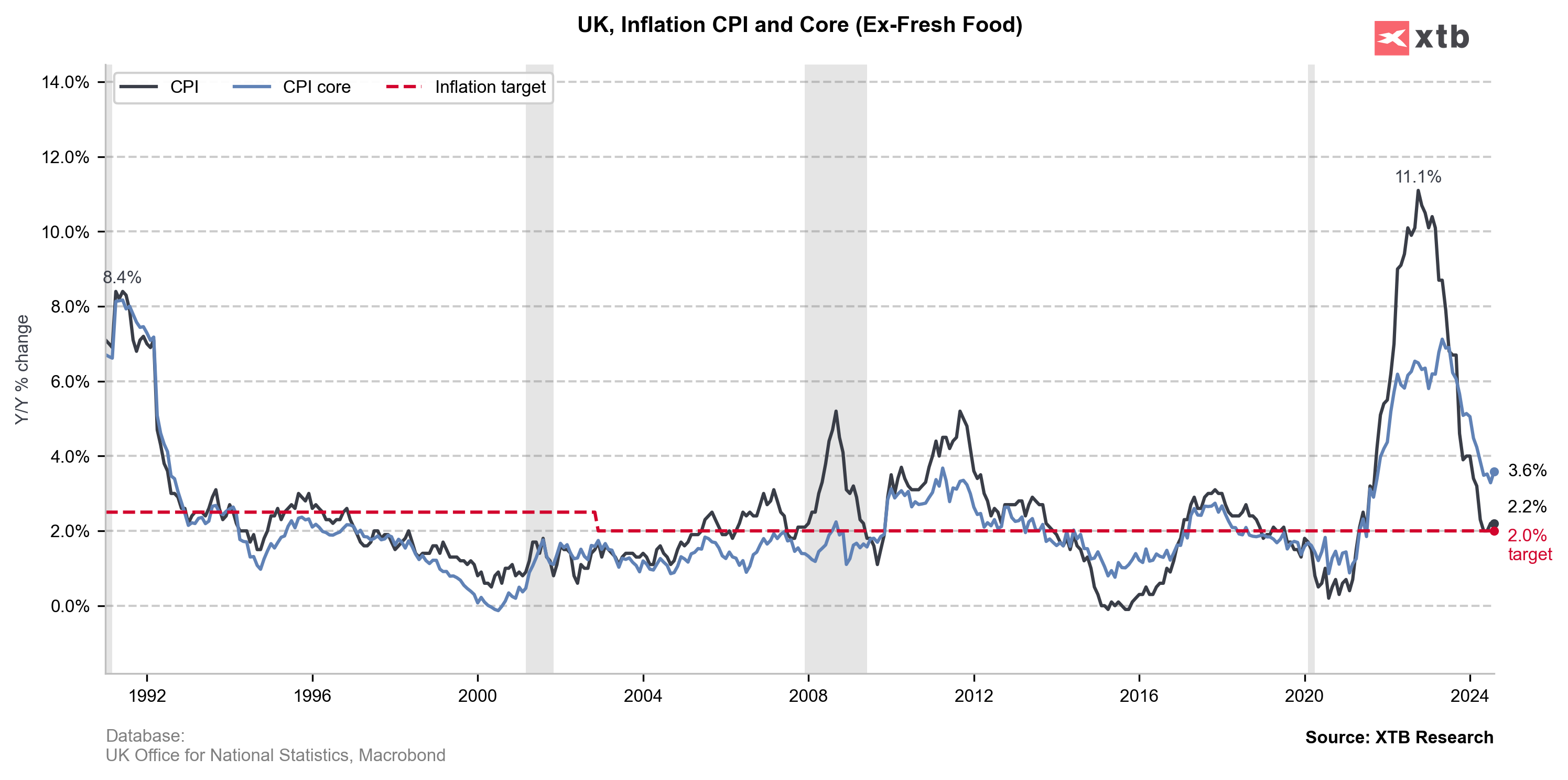

UK CPI in August came in 2.2% YoY vs 2.2% exp. and 2.2% previously (0.3% MoM vs 0.3% exp. and -0.2% previously)

UK Core CPI came in 3.6% YoY vs 3.6% exp. and 3.3% previously (0.4% MoM vs 0.1% previously)

UK PPI output prices came in lower than expected with 0.2% YoY vs 0.5% exp. and 0.8% previously (-0.3% MoM vs 0% exp. and 0% previously)

UK PPI input prices dropped -1.2% YoY vs -0.8% exp. and 0.4% previously (-0.5% MoM vs -0.3% exp. and -0.1% previously)

Source: xStation

Source: xStation

The lower than expected PPI data come one day ahead of the Bank of England meeting. Currently market is pricing 25% chance of rate cut and two cuts in this year. First meeting with implied softening of the monetary policy might come in November. This might partly explain strenght of British currency against US, where more than four cuts are expected by the market.

أرامكو السعودية تدرس طرقاً بديلة لتصدير النفط لتجنب مضيق هرمز

الإمارات.. أسواق المال المحلية تستأنف نشاطها غدا

التقويم الاقتصادي: منطقة اليورو

حصاد الأسواق (03.03.2026)