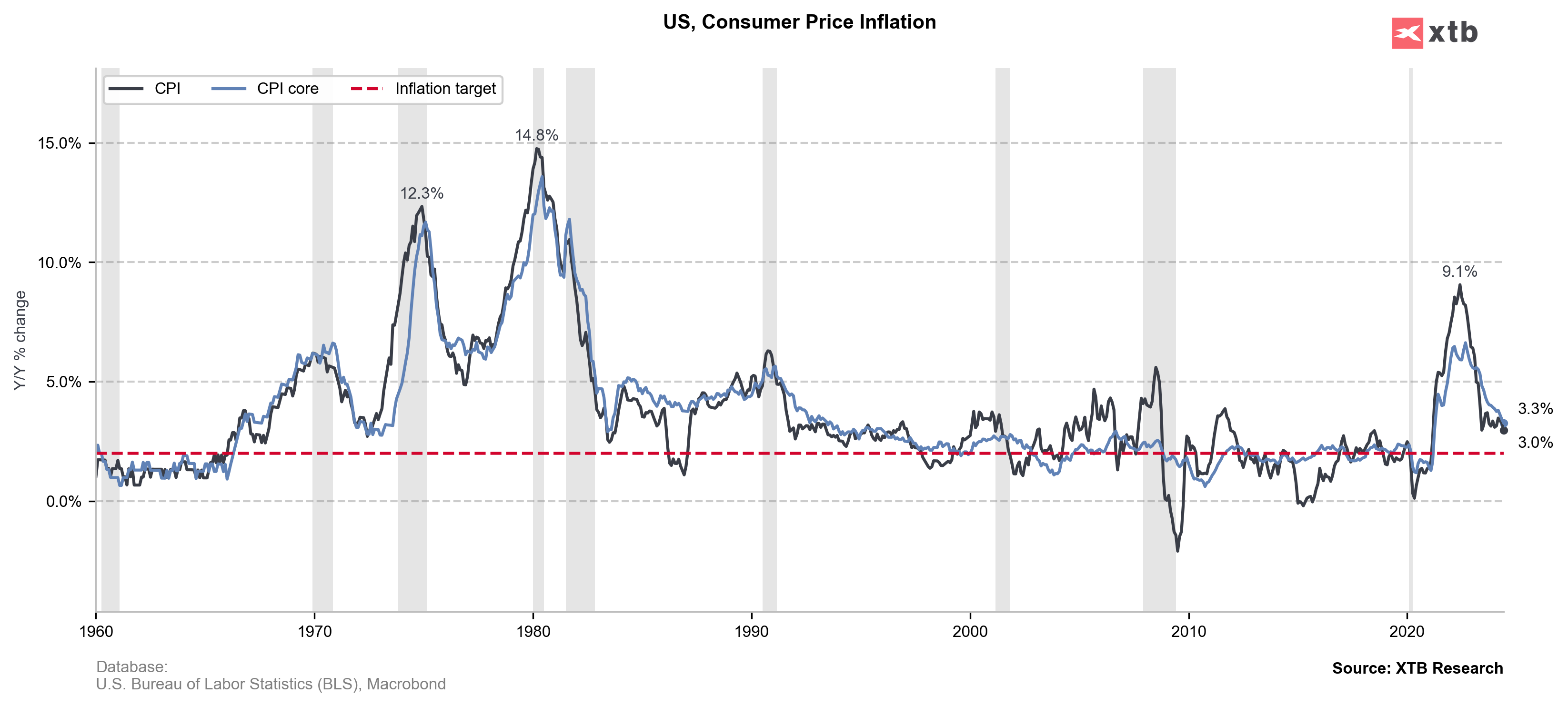

US CPI for June came in 3% YoY vs 3.1% exp. and 3.3% previously (-0.1% MoM vs 0.1% exp. and 0% previously)

US Core CPI for June came in 3.3% YoY vs 3.4% exp. and 3.4% previously (0.1% MoM vs 0.2% exp. and 0.2% previously)

- US June CPI food inflation came in 0.2%, also housing inflation was 0.2% higher, while rent was up 0.3% MoM

US jobless claims came in 222k vs 235k exp. and 238k previously (1.852M continued jobless claims vs 1,86M exp. and 1.858M previously)

After the data released, Fed fund futures traders bet more on September rate cuts in US economy. Wall Street indices are higher. Markets price in 85% chance of a September Fed rate cut after CPI (vs about 70% before).

Source: xStation5

Source: xStation5

Source: BLS, Macrobond, XTB Research

Source: BLS, Macrobond, XTB Research

مطار دبي الدولي يستأنف عمله جزئيا... 1140 رحلة خلال 84 ساعة لإعادة المسافرين

أرامكو تعدّل أسعار النفط لشهر أبريل وترفع علاوة الخام العربي الخفيف

إغلاق وحدتين لإنتاج الخام في مصفاة سترة البحرينية بسبب التوترات الإقليمية

سيولة الأسواق تبلغ 3.3 مليار درهم.. ومؤشر «دبي» يقلص خسائره