The core PCE price index, which excludes volatile items such as food and energy and is the Federal Reserve's favorite inflation indicator, rose to 3.5 % over year-on-year in June, after a 3.4% advance in May and below market expectations of 3.7%. On a monthly basis, core PCE prices decreased to 0.4% in June from 0.5% in May, below market consensus of 0.6%.

Personal income in the United States edged 0.1 percent higher in June , trying to recover from a revised 2.2 percent drop in May and beating market expectations of a 0.3 percent fall.

Personal consumption in the US surged 1% mom in June, rebounding from a 0.1% drop in May and beating market forecasts of a 0.7% increase.

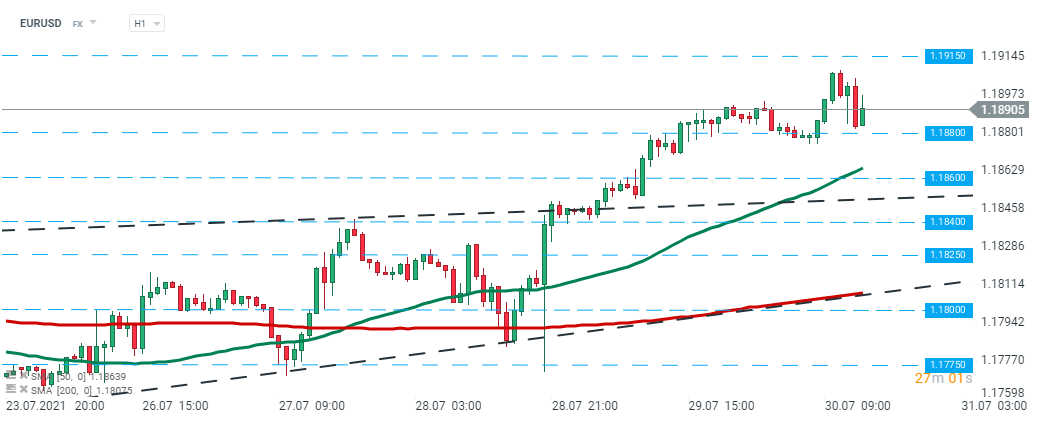

EURUSD saw a relatively small reaction to today’s data releases. The most popular currency pair continued to trade around 1.1890 level. Source: xStation5

EURUSD saw a relatively small reaction to today’s data releases. The most popular currency pair continued to trade around 1.1890 level. Source: xStation5

محضر اجتماع البنك المركزي الأوروبي: لم يبلغ تأثير قوة اليورو على التضخم ذروته بعد

بنك «كانتور» يتوقع متوسط ارتفاع 30% لأسهم شركات «أدنوك»

أسهم إماراتية تمحو خسائرها الصباحية وتحقق مكاسب

توقعات ببلوغ 1.1 تريليون درهم لحجم سوق الشحن البحري الإماراتي في 2033