The Chinese stock market is experiencing a notable rebound in recent weeks. After a period of struggle, key benchmarks like the Hang Seng Tech Index and the ChiNext gauge have surged almost 20% from their lows, signaling a potential shift from a prolonged selling pressure. This recovery is underpinned by improved sentiments, increased foreign inflow of capital, and stronger earnings, suggesting a possible end to the market's downtrend. The market's turnaround has been particularly noticeable in tech and renewable sectors, reflecting a positive change from the previous underperformance of Chinese shares. Investors, including institutional ones like abrdn plc and M&G Investment Management, are growing optimistic, seeing this as an indication of the market bottoming out.

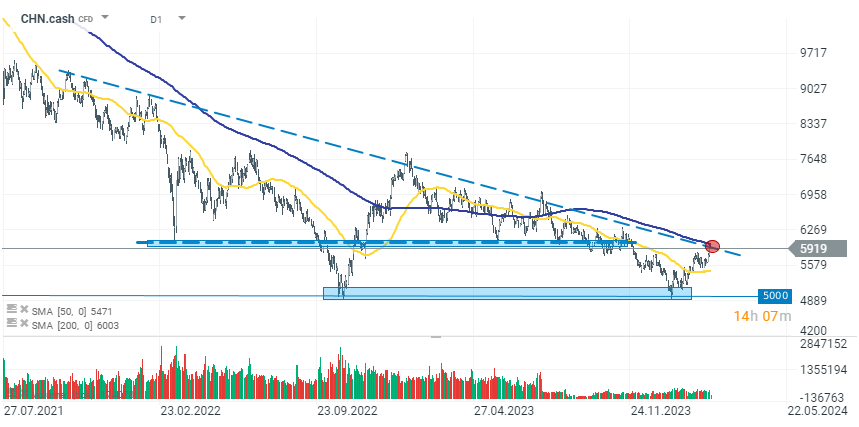

CHN.cash (D1 interval)

On the CHN.cash (HSCEI Index) chart, we can observe another day of gains, which have now recovered nearly +20% from the year's start low around 5000 points. Currently, the bulls are in a key zone that marks the upper limit of a long-term downtrend. If this is broken and the index returns above 6000 points, the HSCEI will enter a consolidation area, and the continuation of growth could even lead to the start of an uptrend. However, there are still many challenges ahead for China, so in the short term, it will be crucial to overcome the resistance at the 6000-point level.

Source: xStation 5

حصاد الأسواق - أسعار النفط لا تزال مرتفعة (06.03.2026)

ملخص السوق: المؤشرات تحاول الحفاظ على انتعاشها رغم ارتفاع أسعار النفط 🗽 أسهم برودكوم ترتفع

عاجل: US500 يرتفع وسط تصريحات مسؤولين عسكريين بشأن مضيق هرمز

حصاد الأسواق (05.03.2026)