The FOMC meeting yesterday did not bring any surprises in terms of policy decisions. Interest rates were left unchanged as well as size and pace of QE programmes. Moreover, there was no mention of taper talk and Powell said that no such discussions are expected in the near future. Fed chair noted that inflation runs high but has once again claimed that it is transitory and there is no need to act. This hints at a continued period of record low real interest rates, which has hurt USD and benefitted precious metals.

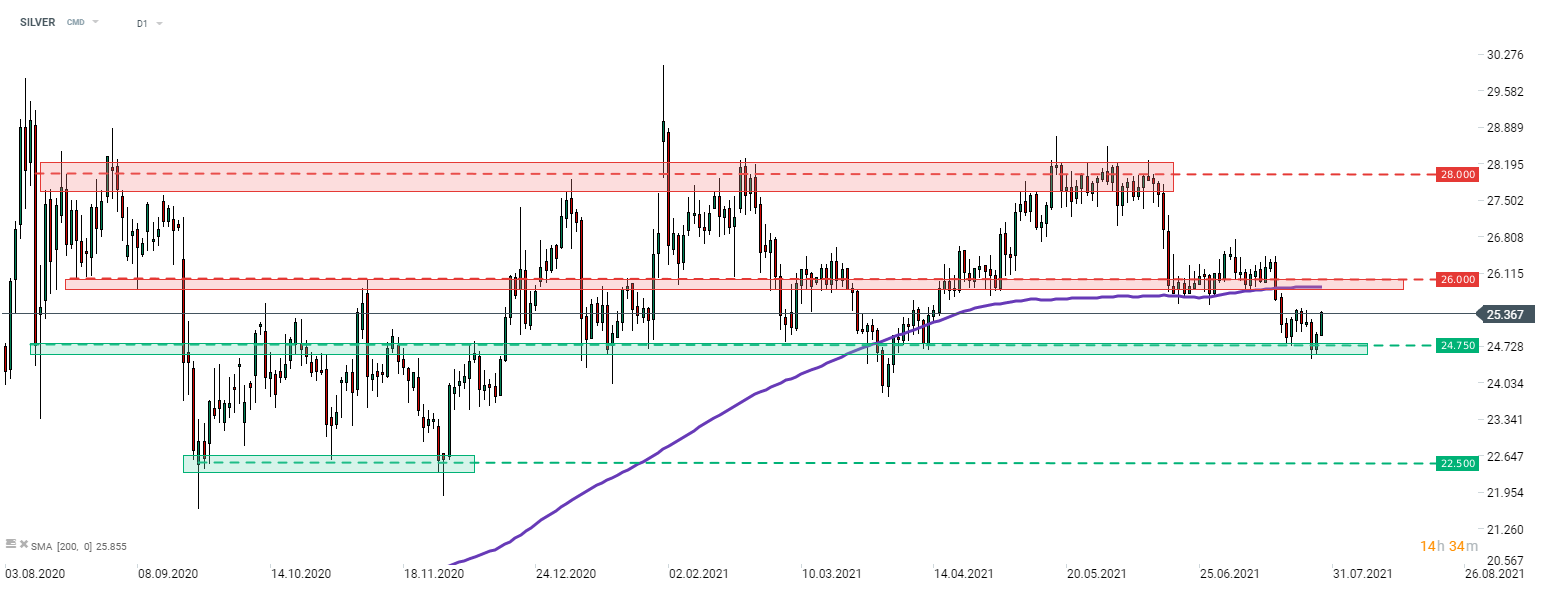

SILVER managed to bounce off the mid-term support at $24.75 yesterday and the upper move is continued today. The nearest resistance zone can be found in the $26.00 area, where 200-session moving average (purple line) can also be found. Today's GDP report release at 1:30 pm BST is likely to have an impact on US dollar and therefore may also impact precious metals.

Source: xStation5

Source: xStation5

حصاد الأسواق (05.03.2026)

ملخص اليوم – انتعاش المؤشرات مع ترقب أسواق النفط لمزيد من التطورات

إيران: نظرة عامة على الوضع والتوقعات

عاجل: ارتفاع قوي آخر في مخزونات النفط. سعر خام غرب تكساس الوسيط يقترب من 74 دولارًا.