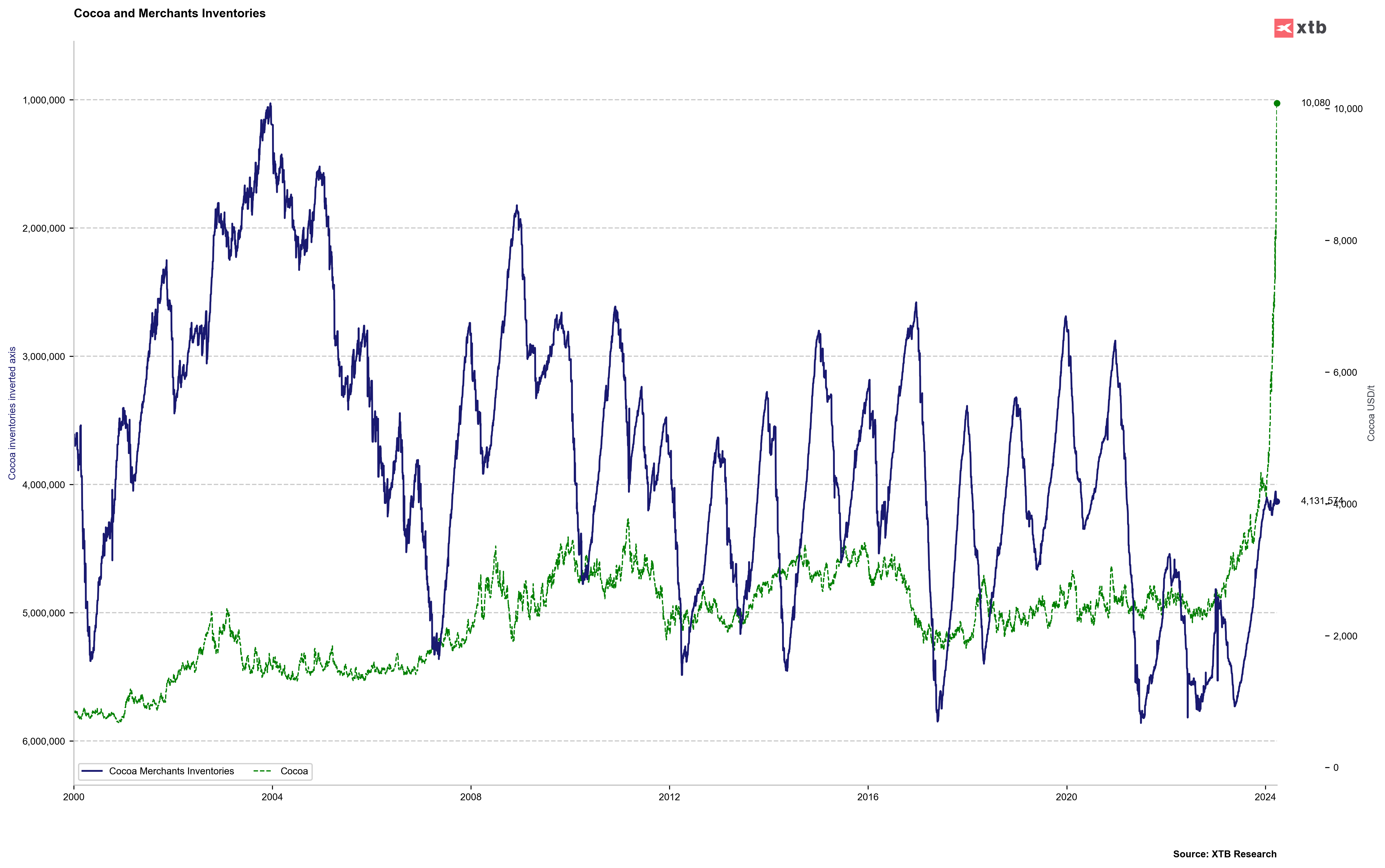

Rally on the cocoa market shows no signs of easing. Front-month cocoa futures (COCOA) jumped above $10,000 per ton for the first time in history today. Reasons behind the move higher remain unchanged, and are of fundamental nature. Poor crops in West Africa, a key cocoa producing region, are expected to lead to a third annual deficit in a row. While other growers like Brazil or Ecuador want to increase their production, it will take a couple of years before newly-planted cocoa trees bear fruit. Moreover, new environmental rules, that are about to be passed in the European Union, a key cocoa importer, are expected to further limit supplies. Cocoa stockpiles have been declining since the second half of 2023, but it is nowhere near the scale of the move on futures prices.

Source: Bloomberg Finance LP, XTB Research

Pace of the ongoing rally on cocoa market is truly astonishing. Cocoa futures trade 12% higher week-to-date, over 60% higher month-to-date and around 140% higher year-to-date. Over the past 12 months, prices climbed almost 270%! Having said that, it should not come as a surprise that cocoa looks overbought in the short- and long-term. Price is trading over 4 standard deviations above 1-year mean, one of the biggest deviations on the record. Commodity looks even more overbought on a long-term basis, with price trading 8 standard deviations above 5-year average.

Source: Bloomberg Finance LP, XTB Research

COCOA prices jump another 3.5% today and test $10,000 per ton area today for the first time in history. Seasonality patterns suggest that a period of relative calmness should begin, starting from April. Source: xStation5

COCOA prices jump another 3.5% today and test $10,000 per ton area today for the first time in history. Seasonality patterns suggest that a period of relative calmness should begin, starting from April. Source: xStation5

ملخص اليوم: بيانات أمريكية ضعيفة تُؤدي إلى انخفاض الأسواق، والمعادن الثمينة تتعرض لضغوط مجدداً!

انخفاض ناتجاس بنسبة 6% بسبب تغيرات توقعات الطقس

ثلاثة أسواق تستحق المتابعة الأسبوع المقبل (09.02.2026)

موجز جيوسياسي (06.02.2026): هل لا تزال إيران تشكل عامل خطر؟