- European equities finished 1% lower

- US jobless claims fall to new pandemic low

- US 10-year Treasury yield at 5-month low

- US100 under pressure

European indices finished today's session lower, as a clutch of mixed quarterly earnings and rising number of new COVID-19 infections. Siemens Energy (ENR.DE) stock fell more than 11.0% after scrapping its margin target as Siemens Gamesa (SGRE.ES)— its wind power division — was hit by higher-than-expected raw material and product ramp-up costs. Siemens Gamesa was the worst performer among European stocks, sliding 14.2% and suffering its worst session in two years. British index FTSE100 finished 1.22% lower after Bank of England policymaker Michael Saunders said the central bank might need to withdraw some of the current monetary stimulus sooner-than-anticipated due to a spike in inflation and a strong economic recovery. Meanwhile, investors digested China's economic data showing stronger-than-expected industrial production and retail sales numbers, while the second-quarter annual growth rate came in slightly below forecasts. The World Health Organization (WHO) COVID-19 dashboard reported the first weekly rise in global deaths from the virus in 10 weeks and a 5.6% jump in daily case numbers on Wednesday.

US indices are also trading under pressure as growth stocks rally lost its momentum. Fall in weekly jobless claims last week strengthened views about a recovery in the labor market. According to today’s data, 360K citizens claimed for unemployment benefits, less compared to last week's upwardly revised 386k. It is a new pandemic low figure, however claims are still far from the 200 thousand level reported back in February 2020. Elsewhere, Fed Chair Powell signaled there is no rush to change the central bank's easy monetary policy. Meanwhile, the earnings season continues with Morgan Stanley (MS.US), US Bancorp (USB.US) and UnitedHealth (UNH.US) all posted better than expected quarterly figures.

WTI crude fell more than 1.0% and is trading slightly above $72.30 a barrel, while Brent is trading nearly 0.9% lower around $74.10 a barrel following news that Saudi Arabia and the UAE had reached a compromise on oil policy, meaning the OPEC+ deal would be extended until the end of 2022. UAE will have a higher oil production baseline at 3.65 million bpd. Elsewhere gold rose slightly to $ 1,828.00 / oz, while silver is trading 0.25 % higher, around $ 26.30 / oz amid a stronger dollar. The yield on the benchmark 10-year Treasury note fell to 1.30%, which is the lowest level since mid-February.

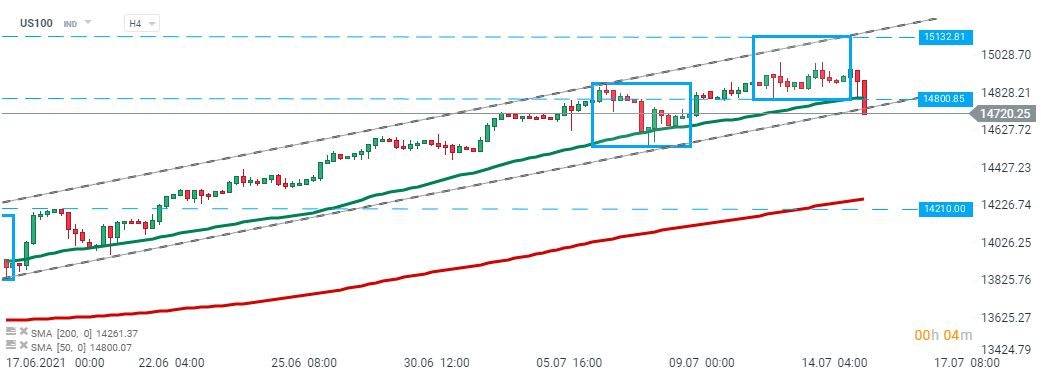

US100 pulled back from all-time during today's session. Index broke below major support at 14,800 pts which coincides with both lower limits of 1:1 structure and the ascending channel. This level is additionally strengthened by the 50 SMA (green line). This could potentially trigger a bigger downward move towards support at 14210 pts. Meanwhile, the nearest resistance lies at 15132 pts and is marked by the upper limit of the 1:1 structure and the higher limit of the ascending channel. Source:xStation5

US100 pulled back from all-time during today's session. Index broke below major support at 14,800 pts which coincides with both lower limits of 1:1 structure and the ascending channel. This level is additionally strengthened by the 50 SMA (green line). This could potentially trigger a bigger downward move towards support at 14210 pts. Meanwhile, the nearest resistance lies at 15132 pts and is marked by the upper limit of the 1:1 structure and the higher limit of the ascending channel. Source:xStation5

ملخص اليوم - تقرير قوي عن الوظائف غير الزراعية قد يؤخر خفض أسعار الفائدة من قبل الاحتياطي الفيدرالي

عاجل: زيادة هائلة في احتياطيات النفط الأمريكية!

شركة بالو ألتو تستحوذ على سايبرآرك. شركة رائدة جديدة في مجال الأمن السيبراني!

الولايات المتحدة: هل تشير الأرقام القياسية للرواتب إلى مسار أبطأ لخفض أسعار الفائدة؟