Gold prices are rising today to $2416 per ounce, although fears of a recession in the U.S. economy have eased after a lower-than-expected reading on U.S. jobless claims. Also, in line with gold, silver gains 3.3%.

- Yields on 2- and 10-year U.S. bonds currently stand at 4.04% and against 3.99% for the 10-year, respectively, indicating that the market continues to see the Fed's current monetary policy as unlikely to be sustained in the medium term. Also, market turbulence may prompt the Fed to act more decisively in the fall.

- Optimism around U.S. rate cuts and continued demand for safe-haven assets, which hedge investors against potential volatility in economic expectations, geopolitical tensions in the Middle East are the key drivers of the ongoing rally. Market expectations invariably point to more than 100 bps of rate cuts in 2024.

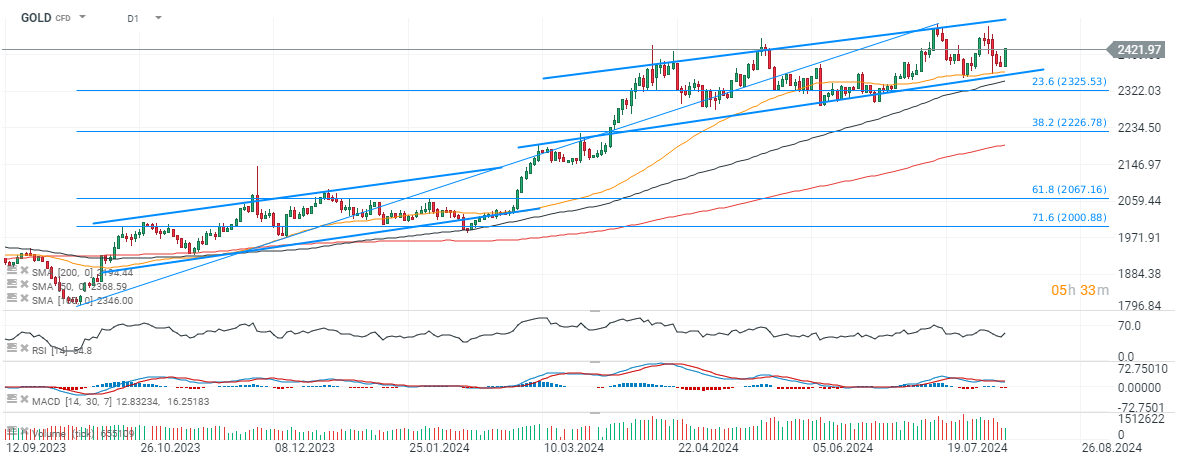

GOLD (D1 interval)

Gold quotations have maintained a key trading-range and are dynamically rising above $2,400 per ounce today. Declines were halted near the 50-session simple moving average (SMA50, orange interval). The last 5 sessions' ongoing sell-off has been nearly 50% erased by today's upward movement, The key resistance level is now around $2450 per ounce. The short-term support zone is marked by the 23.6 Fibonacci retracement of the 2023 upward wave at $2320 and the 50-session average, near $2370.

Source: xStation5

ملخص اليوم: انخفاض المؤشرات والعملات الرقمية وسط ارتفاع أسعار النفط 🚩 ارتفاع الذهب والدولار الأمريكي

ارتفاع أسعار النفط بنسبة 11% وسط تصاعد الصراع في الشرق الأوسط 📈 وارتفع مؤشر VIX مدفوعاً بالخوف في وول ستريت

ثلاثة أسواق تستحق المتابعة الأسبوع المقبل (06.03.2026)

ملخص السوق: رأس مال يغادر أوروبا📉