The stock market fared poorly on Tuesday, the Nasdaq Composite (US100) saw significant losses and dropped 0.93%. Investors remain concerned about the spread of coronavirus, as well as the ongoing geopolitical tensions, and retail sales worsen the main sentiment. Since the NASDAQ (US100) remains the weakest, we will focus on it from a technical perspective.

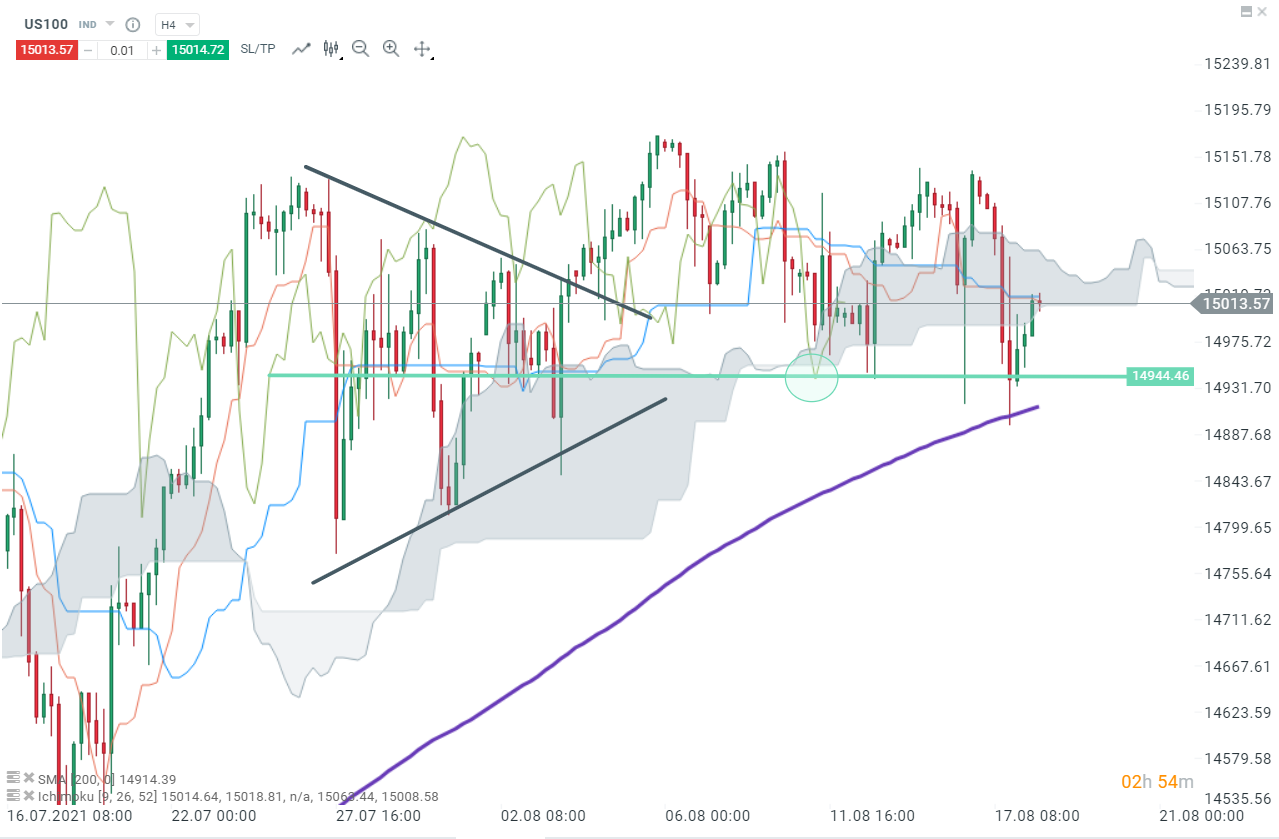

H4 interval :

The ichimoku signal generated at the breakout of the cloud was not confirmed by the chikou-span (green circle) and prices rebounded on an important support coinciding with the apex of the previous symmetric triangle (green line at 14 944). Another important support can be found lower : the SMA 200 (blue line). Breaking this SMA 200 could lead to a deeper downward. On the other hand, if bulls manage to push prices above the Ichimoku cloud, the next local resistance at 15 135 could be reached.

NASDAQ (US100), H4 interval, Source : xStation5

H1 interval :

On an hourly interval, one can notice that prices fluctuate around the Ichimoku cloud, making higher highs and lower lows following two widening trendlines and forming a broadening top pattern. This technical formation is characterized by increasing price volatility and is a reversal pattern. If prices break under the lower limit, the next support can be found at 14 755 pts (red line). Breaking under the aforementioned support could lead to the second target of the pattern around 14 610 pts (blue line). On the other hand, if bulls manage to take control of the market and push prices above the cloud, the upper limit of the broadening top pattern will act as a strong resistance.

NASDAQ (US100), H1 interval, Source : xStation5

Réda Aboutika, XTB France

هل يدخل السوق الأمريكي مرحلة تصحيح؟

وول ستريت تواصل مكاسبها؛ و US100 ينتعش بأكثر من 1% 📈

ملخص السوق: نوفو نورديسك تقفز بأكثر من 7% 🚀

فوز حزب تاكايتشي في الانتخابات اليابانية – هل يعود القلق بشأن الديون؟ 💰✂️