- Natural gas prices are down over 4% this week and are hovering around a critical support level of $2.50 per million British thermal units (mmBtu). While the fundamentals haven't changed much, the price is dipping.

- It's currently warmer than usual, but not scorching hot.

- Demand for gas is expected to rise in the coming weeks, peaking in late July or early August. This increase is due to higher electricity needs for cooling. Don't forget, hurricane season starts mid-August, which could disrupt gas production.

A breakdown of the key factors for NATGAS:

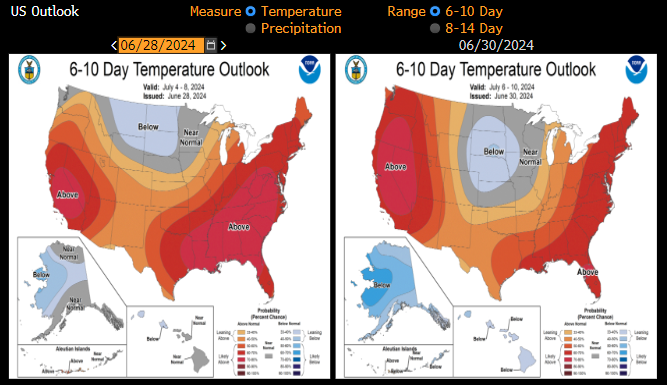

Weather Forecast:

Compared to last Friday, the temperature outlook hasn't changed dramatically. It might be slightly cooler in the central US. Source: Bloomberg, NOAA

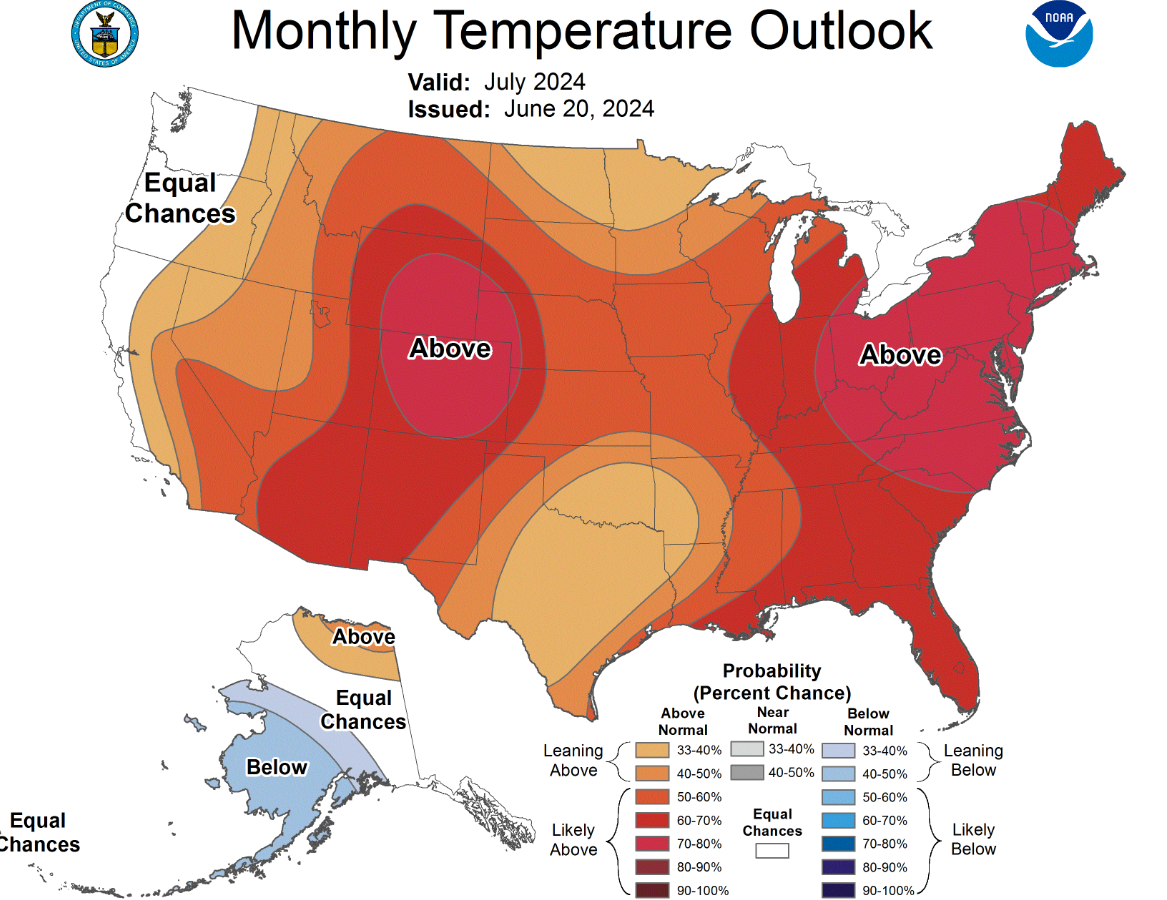

July Outlook:

A report from June 20th by NOAA indicates a high chance (60-80%) of above-average temperatures across most of the US. Source: NOAA

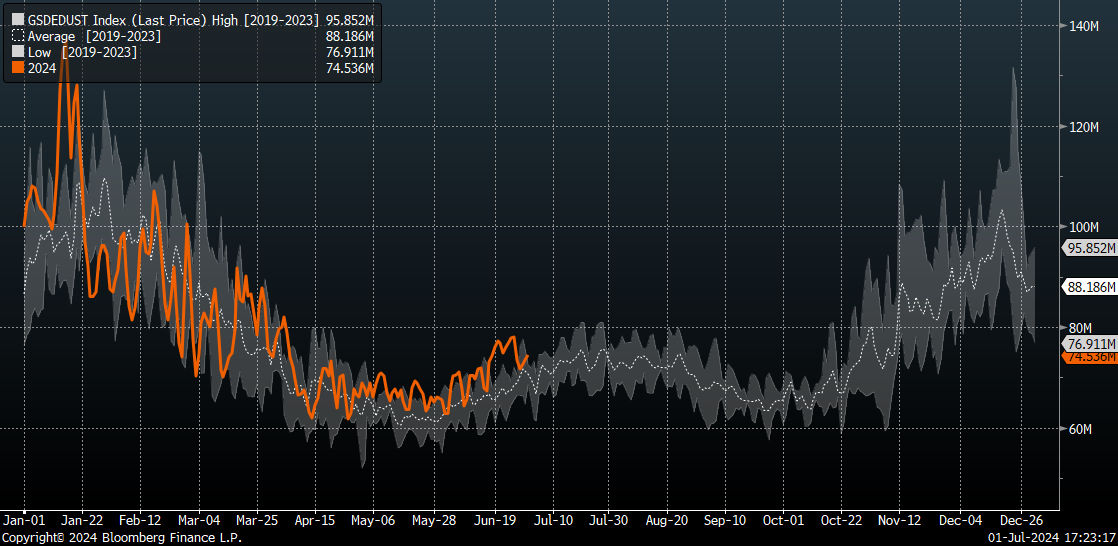

Gas Demand and Cooling:

The number of cooling degree days (a measure of cooling needs) is rising, but the forecast for this week isn't significantly higher than the previous two weeks. This could be contributing to the price pullback. However, the peak demand season is still to come in late July and early August. Source: Bloomberg Finance LP, XTB

The number of cooling degree days (a measure of cooling needs) is rising, but the forecast for this week isn't significantly higher than the previous two weeks. This could be contributing to the price pullback. However, the peak demand season is still to come in late July and early August. Source: Bloomberg Finance LP, XTB

Demand vs. Seasonal Average:

Gas demand has recently returned to around the 5-year average, and it's expected to climb further in the coming weeks based on seasonality. However, daily fluctuations shouldn't exceed 4-6 billion cubic feet per day (bcfd). Source: Bloomberg Finance LP, XTB

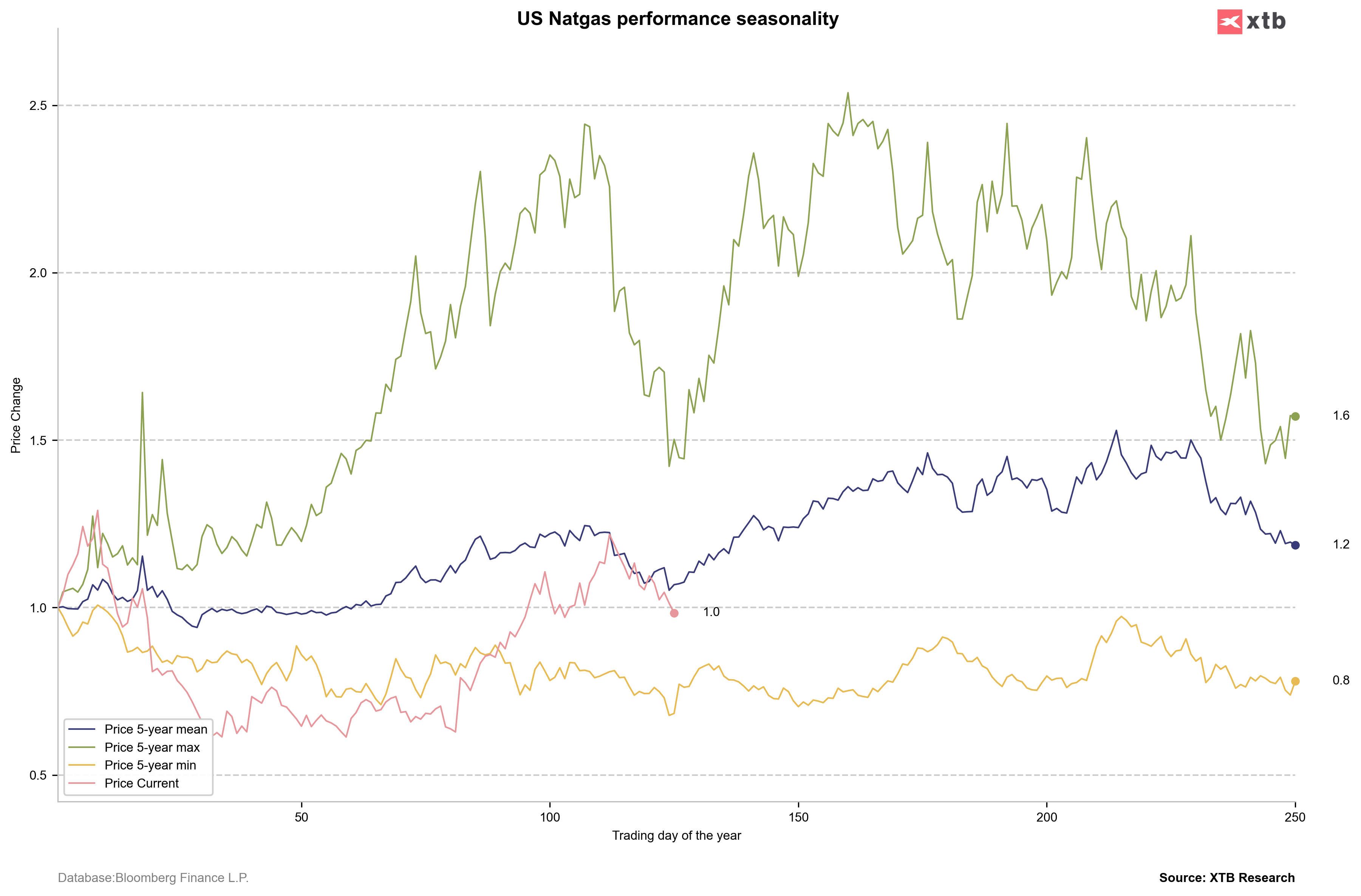

Seasonal Low:

Based on historical prices over the past five years (average, minimum, and maximum), we might be past the seasonal low point. But it's important to consider that some of the average price increases are due to the upward sloping price curve for future contracts (contango). Source: Bloomberg Finance LP, XTB

Production Rebound:

Natural gas production is bouncing back, currently about 4 bcfd below its record highs. This is happening even though the number of drilling rigs has significantly declined. (Source: Bloomberg Finance LP, XTB)

Technical outlook:

The price has decreased more than 4% in the beginning of July and is testing crucial support of 2.5 USD/MMBTU, slightly above 200-SMA average (purple line). If the price does not recover from the current area, it will be possible to go down even to the zone at the level of USD 2.2-2.3/MMBTU. On the other hand, the seasonality shows that the local low should be already behing us. Source: xStation5

The price has decreased more than 4% in the beginning of July and is testing crucial support of 2.5 USD/MMBTU, slightly above 200-SMA average (purple line). If the price does not recover from the current area, it will be possible to go down even to the zone at the level of USD 2.2-2.3/MMBTU. On the other hand, the seasonality shows that the local low should be already behing us. Source: xStation5

ارتفاع الفضة بنسبة 3% 📈 هل يعود الزخم الصعودي في المعادن الثمينة؟

ملخص اليوم: بيانات أمريكية ضعيفة تُؤدي إلى انخفاض الأسواق، والمعادن الثمينة تتعرض لضغوط مجدداً!

انخفاض ناتجاس بنسبة 6% بسبب تغيرات توقعات الطقس

ثلاثة أسواق تستحق المتابعة الأسبوع المقبل (09.02.2026)