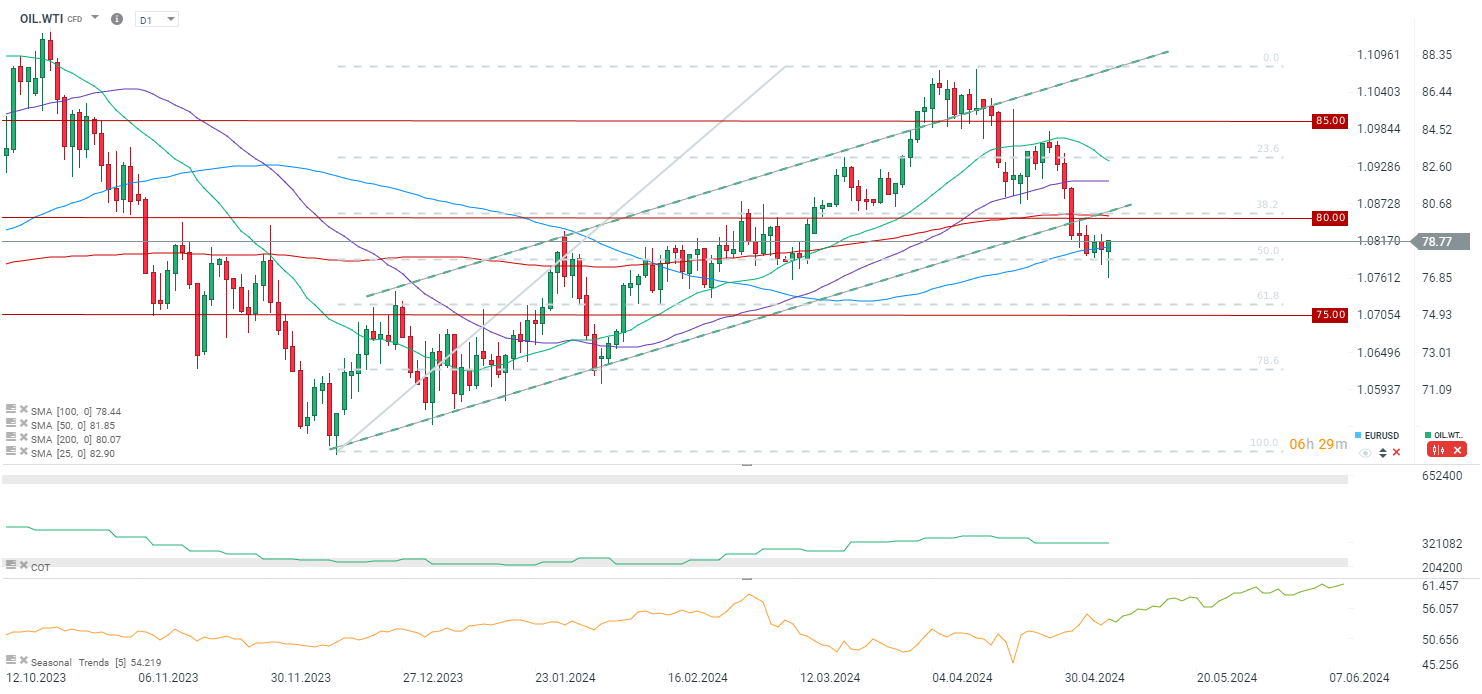

Oil is bouncing off 2-month lows, which were reached earlier today. Crude prices was down as much as 2% earlier today, but has fully recovered from and erased the drop. When it comes to WTI, price bounced off the $78 area, where one can find the 100-session moving average (blue line) and 50% retracement of the upward move launched in late-2023.

It should be noted that oil market seasonality hints at potential price recovery in the coming months, which coincides with the beginning of the so-called 'driving season'. While stockpiles usually begin to shrink in June, one cannot rule out that increased demand from refineries will begin soon. While the latest price drops in April were driven by concerns over demand in US and Europe, there seems to be no such issue in Asia. Saudi Aramco boosted export prices to Asia amid expectations of high demand. When it comes to OPEC+ policy, it should be noted that cartel is expected to maintain voluntary production cuts through the second half of the year. Russian oil minister also said that there are no discussions on lifting production levels right now.

It should also be noted that Biden administration is already suggesting that any issues related to excessive demand or insufficient supply may be solved via strategic reserve drawdowns. While strategic reserves still have not been rebuilt significantly, one cannot rule out a scenario of US government using the reserves later this year in order to bring down prices.

Source: xStation5

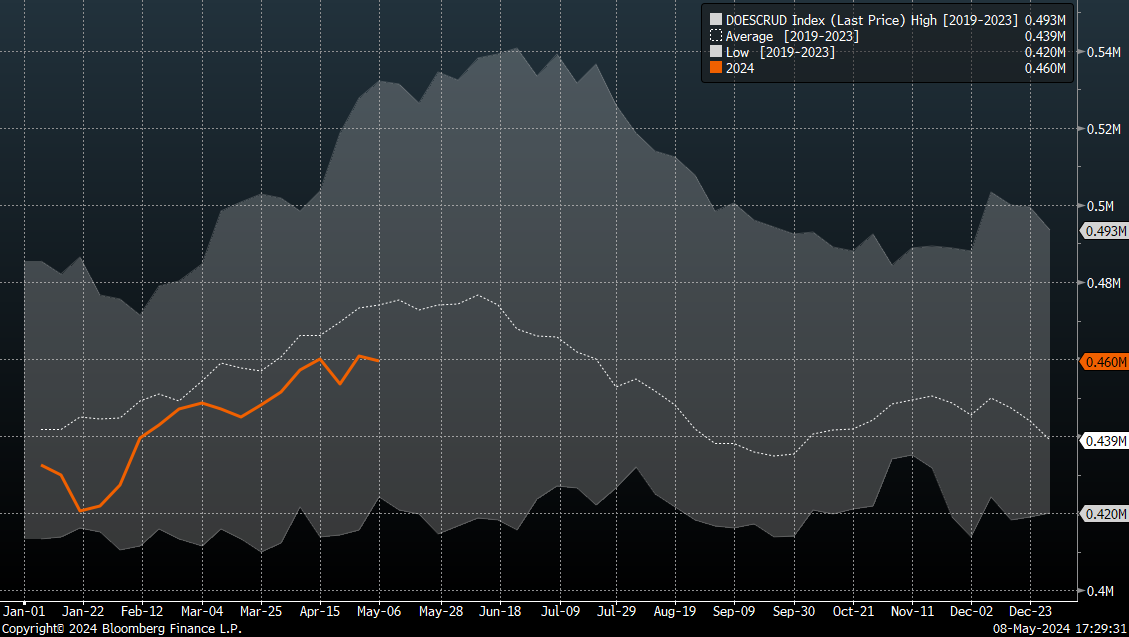

US oil inventories have been climbing recently, but seasonal pattern suggest that demand should increase in the near term and it should lead to declines in commercial stockpiles. Source: Bloomberg Finance LP

US oil inventories have been climbing recently, but seasonal pattern suggest that demand should increase in the near term and it should lead to declines in commercial stockpiles. Source: Bloomberg Finance LP

عاجل: زيادة هائلة في احتياطيات النفط الأمريكية!

ملخص السوق: ارتفاع أسعار النفط وسط التوترات الأمريكية الإيرانية 📈 مؤشرات أوروبية هادئة قبل صدور تقرير الوظائف غير الزراعية الأمريكية

📈 ارتفع سعر الذهب بنسبة 1.5% قبل صدور تقرير الوظائف، مسجلاً أعلى مستوى له منذ 30 يناير

ارتفاع الفضة بنسبة 3% 📈 هل يعود الزخم الصعودي في المعادن الثمينة؟