Precious metals are trading higher today. Prices are supported by safe haven flows triggered by escalation in the Middle East as well as the post-PPI US dollar weakening. Silver is the best performing within the asset class with an over 3% gain at press time.

US and UK airstrikes on military targets linked to Iran-back Houthi in Yemen have greatly increased risk of further escalation in the Middle East. US and UK authorities said that strikes were in retaliation for recent attacks on commercial shipping as well as aimed at deterring Houthi from carrying out further attacks. However, Houthi do not seem to be backing down and have vowed retaliation against US and UK interest in the region. Oil gained following the attacks, as did precious metals.

Precious metals are also supported by weakening of the US dollar. US PPI inflation data for December released today at 1:30 pm GMT showed a smaller-than-expected acceleration in headline producers' price growth and a bigger-than-expected slowdown in core PPI. As a result, US dollar is one of the worst performing G10 currencies today, with USD index (USDIDX) dropping 0.1%.

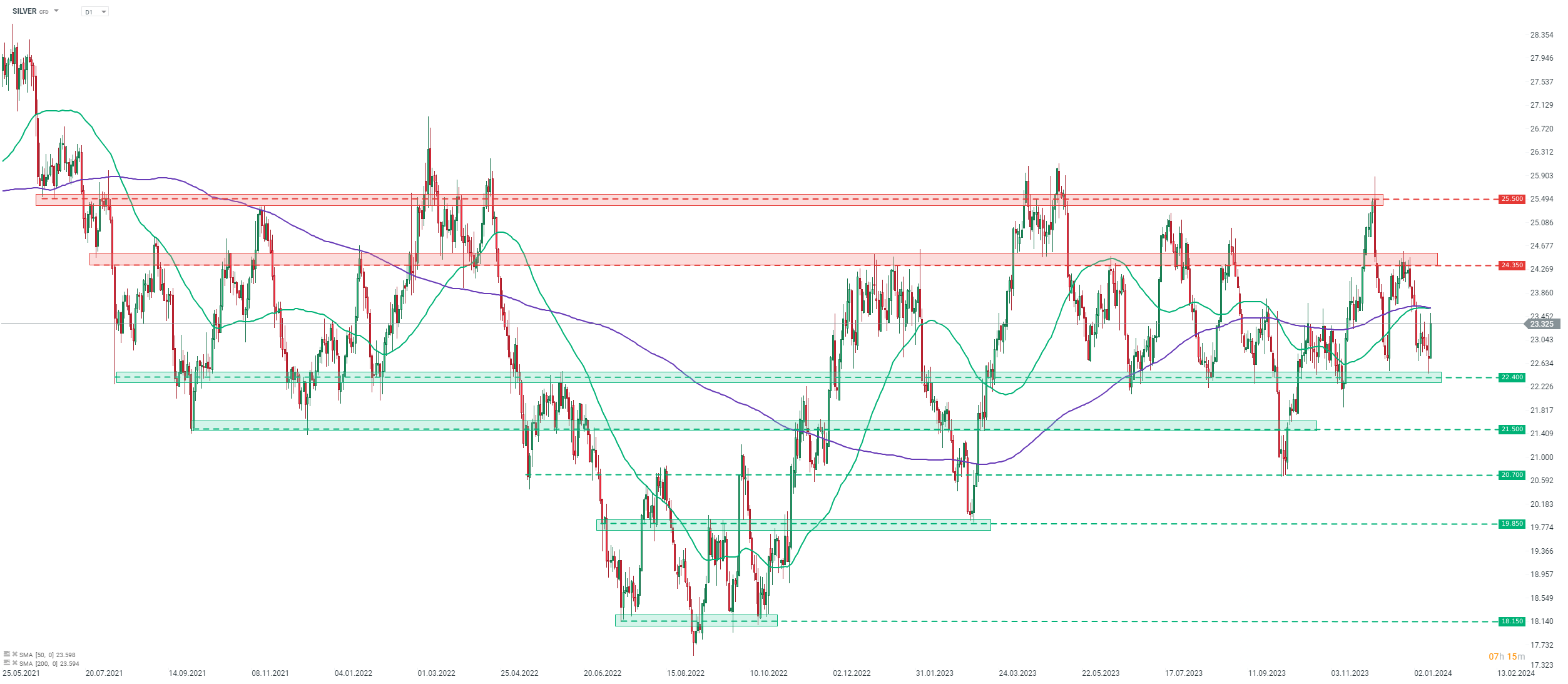

Taking a look at SILVER chart at D1 interval, we can see that the recent pullback was halted at the $22.40 support zone, which acts as the lower limit of a trading range. Bullish price reaction to this support suggests that the sideways move is still in play and a climb towards the upper limit in the $24.35 area may now follow. However, 50- and 200-session moving averages near the mid-point of the range ($23.60 per ounce area) may offer some short-term resistance on the way there.

Source: xStation5

Source: xStation5

ملخص اليوم: بيانات أمريكية ضعيفة تُؤدي إلى انخفاض الأسواق، والمعادن الثمينة تتعرض لضغوط مجدداً!

انخفاض ناتجاس بنسبة 6% بسبب تغيرات توقعات الطقس

ثلاثة أسواق تستحق المتابعة الأسبوع المقبل (09.02.2026)

موجز جيوسياسي (06.02.2026): هل لا تزال إيران تشكل عامل خطر؟