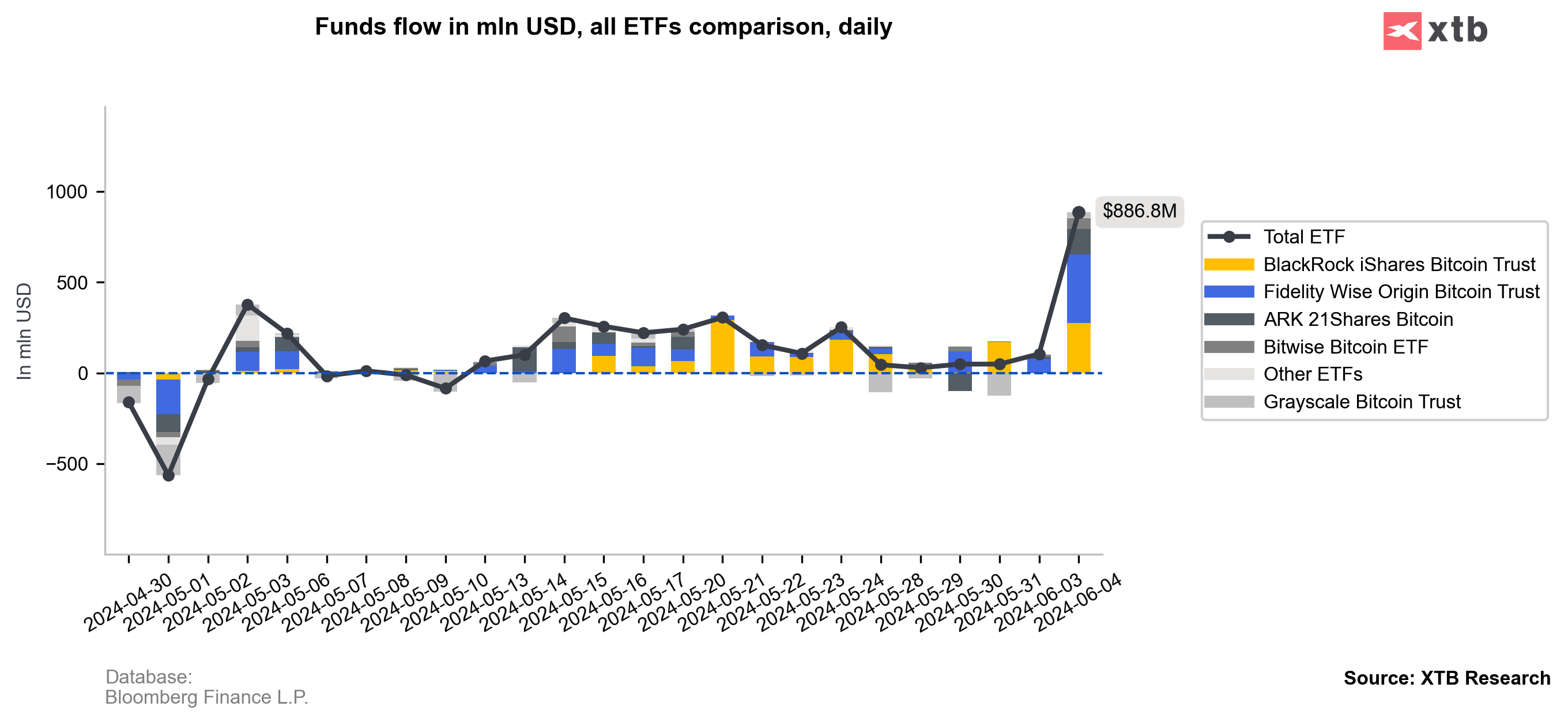

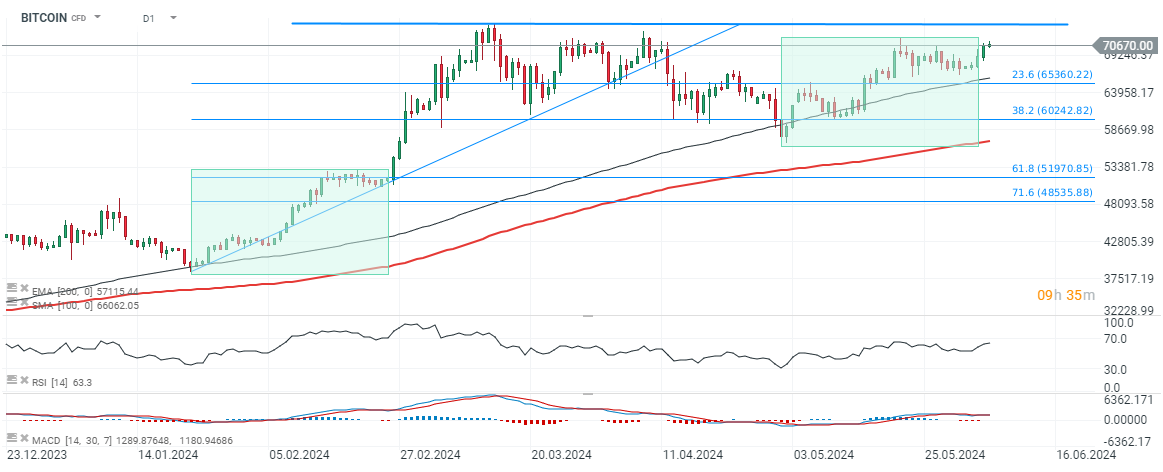

Yesterday, 10 US spot Bitcoin ETFs noted record $886.8 million net inflows, which helped the biggest cryptocurrency bounce back above $70.000. More than $800 million in short positions were liquidated yesterday, but it's still unclear why inflows were so large inside both BlackRock's IBIT and Fidelity FBTC funds. Some speculations signal that perspective of creating Texas-based stock exchange (Texas Stock Exchange) by Citadel Securities and BlackRock, which will 'specialize' in Exchange Traded Products, may fuel the market, but the fact is that yesterday inflows were probably affected by some large buyers - despite weakness on Wall Street and precious metals. Also, weaker macro data from US (and US dollar) may be a trigger to awaited Fed pivot and falling treasury yields, which can increase demand for so-called risky assets.

Source: Bloomberg Finance L.P. , XTB Reserach

Source: Bloomberg Finance L.P. , XTB Reserach

Source: xStation5

Source: xStation5

ملخص اليوم: بيانات أمريكية ضعيفة تُؤدي إلى انخفاض الأسواق، والمعادن الثمينة تتعرض لضغوط مجدداً!

🚨 انخفاض سعر البيتكوين إلى 69,000 دولار 📉 هل هذا سيناريو تصحيح بنسبة 1:1؟

ملخص السوق: نوفو نورديسك تقفز بأكثر من 7% 🚀

أخبار العملات الرقمية: انخفاض سعر البيتكوين إلى ما دون 70 ألف دولار 📉 هل ستنخفض العملات الرقمية مرة أخرى؟