Some European banks are making up for yesterday's losses thanks to reports of a liquidity injection for Credit Suisse (CSGHN.CH) by the SNB. However, the rebound is relatively small, and the bank's problems still appear to be far from over.

European banking index rebounds less than 0.5%.A significant recovery is seen in the shares of Germany's Commerzbank (CBK.DE). Spain's Bankinter (BKT.ES) continues its declines from historic highs in early March. Its shares are losing 2.77% today. Source: Bloomberg

European banking index rebounds less than 0.5%.A significant recovery is seen in the shares of Germany's Commerzbank (CBK.DE). Spain's Bankinter (BKT.ES) continues its declines from historic highs in early March. Its shares are losing 2.77% today. Source: Bloomberg

News from the banking sector

- According to Saudi National Bank, which owns a significant stake in Credit Suisse, yesterday's panic was 'unjustified'. Credit Suisse is losing more analysts and equity executives in Asia, as employee departures have accelerated;

- 5-year credit default swaps for Swiss bank UBS have risen 26 bps to 171 bps this year, according to ICE data. Although overall credit risk in Europe has fallen as Credit Suisse shares have rallied;

- Japan Bank lobby chief Hanzawa indicated that Credit Suisse does not have a material impact on the financial system. but the collapse of SVB showed that a run on banks can happen quickly, even as they strengthen risk controls.

- According to Japan's banking lobby, systemic risk from the SVB collapse has diminished as the Fed has backed bank customers;

- According to FT sources, European regulators have criticized U.S. "incompetence" in the case of the collapsed Silicon Valley Bank;

- S&P: Several Japanese banks with large holdings of U.S. bonds may be vulnerable to market sentiment due to the SVB, but not enough to downgrade their ratings;

- S&P: The Asia-Pacific region is well positioned to absorb any spillover effects from the SVB collapse;

- JPMorgan estimates that slower loan growth by medium-sized banks will subtract 0.5 to 1% from U.S. GDP growth

- US Treasury Secretary Janet Yellen indicated that the U.S. banking system remains healthy, and this week's decisive action shows the government's determination to keep depositors safe;

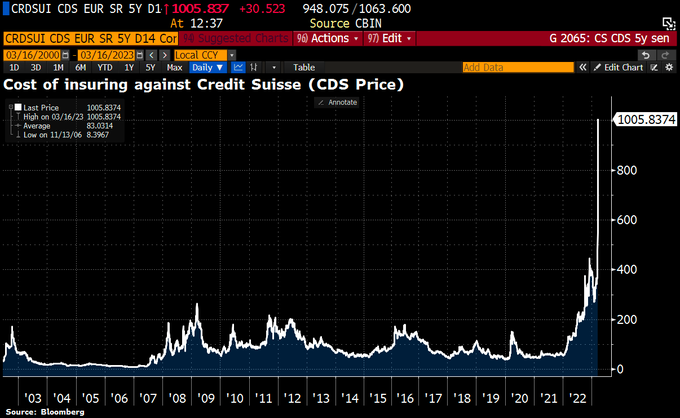

- The cost of insuring against Credit Suisse's insolvency remains very high even despite help from the SNB. The bank will borrow about CHF 50 billion from the SNB;

- The current valuation of the 5-year credit default swap (CDS) for Credit Suisse is already over 10% and continues to rise.

Insurance costs against Credit Suisse. Source: Bloomberg

Deutsche Bank (DBK.DE) shares, H4 interval. The share price has fallen below the 38.2 Fibonacci retracement and is heading towards the 61.8 retracement of the upward wave started in October 2022 at €9.2 per share. The SMA200 and SMA100 averages are approaching a bearish intersection in AT called the 'cross of death.' If the bulls manage to reverse the trend, the nearest support seems to be the psychological resistance at $10 per share. Source: xStation5

Deutsche Bank (DBK.DE) shares, H4 interval. The share price has fallen below the 38.2 Fibonacci retracement and is heading towards the 61.8 retracement of the upward wave started in October 2022 at €9.2 per share. The SMA200 and SMA100 averages are approaching a bearish intersection in AT called the 'cross of death.' If the bulls manage to reverse the trend, the nearest support seems to be the psychological resistance at $10 per share. Source: xStation5

หุ้น Ryanair กดดันจากความตึงเครียดในตะวันออกกลาง 📉

Stock of the Week: Broadcom ขับเคลื่อนโดย AI ทำสถิติใหม่ 🚀

Market Wrap: ดัชนีหุ้นพยายามยืนรีบาวด์ แม้ราคาน้ำมันปรับตัวสูงขึ้น 🗽 หุ้น Broadcom พุ่งแรง หลังผลประกอบการและแนวโน้มธุรกิจ AI เกินคาด

📀 Coinbase และ MicroStrategy พุ่งแรง หลังทรัมป์ท้าทายธนาคารบนวอลล์สตรีท