-

Baidu's Ernie Bot has surpassed 100 million users, indicating a strong market presence and user adoption despite initial mixed reviews.

-

Ernie Bot is a leader among Chinese generative AI chatbots but still lags behind ChatGPT in performance rankings, showing room for improvement.

-

The rapid development and adoption of generative AI chatbots like Ernie Bot reflect the growing global competition and innovation in AI technology.

Baidu's Ernie Bot, a ChatGPT-like chatbot, has achieved a significant milestone by amassing over 100 million users since its public release in August, following a partial unveiling and trial period. Despite its underwhelming initial release, Baidu gained a first-mover advantage in the crowded Chinese market of generative AI chatbots. While Ernie Bot leads among Chinese chatbots, its performance, as per SuperCLUE's ranking, is still over 10 points lower than the latest version of ChatGPT. The launch of Ernie Bot and other generative AI services reflects the global trend of companies developing large language models for various applications, with Baidu positioning itself as a key player in this rapidly evolving market.

Third Quarter 2023 Financial Results recap:

- Total Revenues: $4.72 billion, a 6% increase year over year.

- Baidu Core Revenue: $3.64 billion, up 5% year over year.

- Operating Income: $860 million.

- Adjusted EBITDA: $1.30 billion

- Cash and Equivalents: $27.78 billion

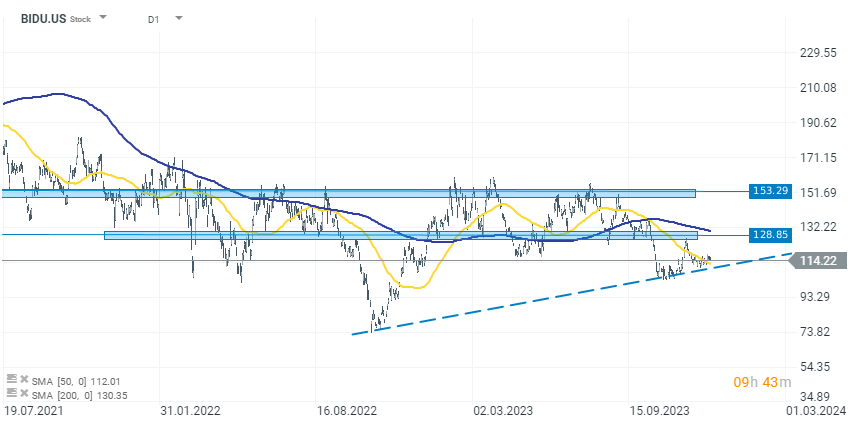

Source: xStation 5

ยุโรปจะเผชิญภาวะเชื้อเพลิงหมดหรือไม่?

ความเชื่อมั่นบนวอลล์สตรีทลดลง 📉 ไฮไลต์ฤดูกาลประกาศผลกำไร S&P 500

ข่าวเด่นวันนี้ 2 ม.ค.

Block Inc. ปรับลดพนักงาน 40% แต่หุ้นปรับตัวขึ้น 16% – นี่คือพาราไดม์ใหม่ของตลาด?