Danish pharmaceutical company, Bavarian Nordic (BAVA.DK) is trading up more than 3% today and climbing near the highs of early August. It's hard to find justification for this other than yesterday's announcement by the World Health Organization (WHO), which approved an initial $135 million package to accelerate and coordinate the fight against a potential increase in global monkeypox (mpox) virus infections. The WHO program aims to prevent and fund prevention, both on the part of scientists and collaborating institutions.

- News of the virus is creating elevated, speculative volatility in the stocks of companies that stand to profit from the sale of vaccines such as Bavarian, Emergent BioSolutions (EBS.US) and Moderna (MRNA.US) and Biontech (BNTX.US), which are only in the approval stage for their mRNA products.

- African regulators and health ministry officials estimate that about 200,000 doses are currently available, of the vaccine against the 10 million needed. So far, Bavarian has donated about 15,000 doses to Africa, while Emergent has donated 50000.

- The most difficult situation is in Africa, in the Congo region, although in relation to the population the number of cases is still relatively small. So far, the virus has also been detected in Sweden and the Philippines.

Bavarian has told the African Center for Disease Control and Prevention (CDC) that it is capable of delivering 10 million doses of the vaccine by the end of 2025 and about 2 million doses, later this year. By some experts, the Bavarian vaccine is touted as safer, against Emergent. The National Institute of Allergy and Infectious Diseases, will hold a conference on August 29-30 on mpox research and control of virus expansion.

Bavarian Nordic (D1 interval)

The stock has traded almost twice as high since the 2023 minima. Driving valuations are, among other things, expectations for increased demand and production of mpox vaccines.

Source: xStation5

Historically, Bavarian Nordic's shares have been characterized by high volatility, and the last five years can hardly be described as exceptionally successful for the company. However, there have been isolated price spikes in which Bavarian's shares have gained 2 and more than 3 times.

Source: xStation5

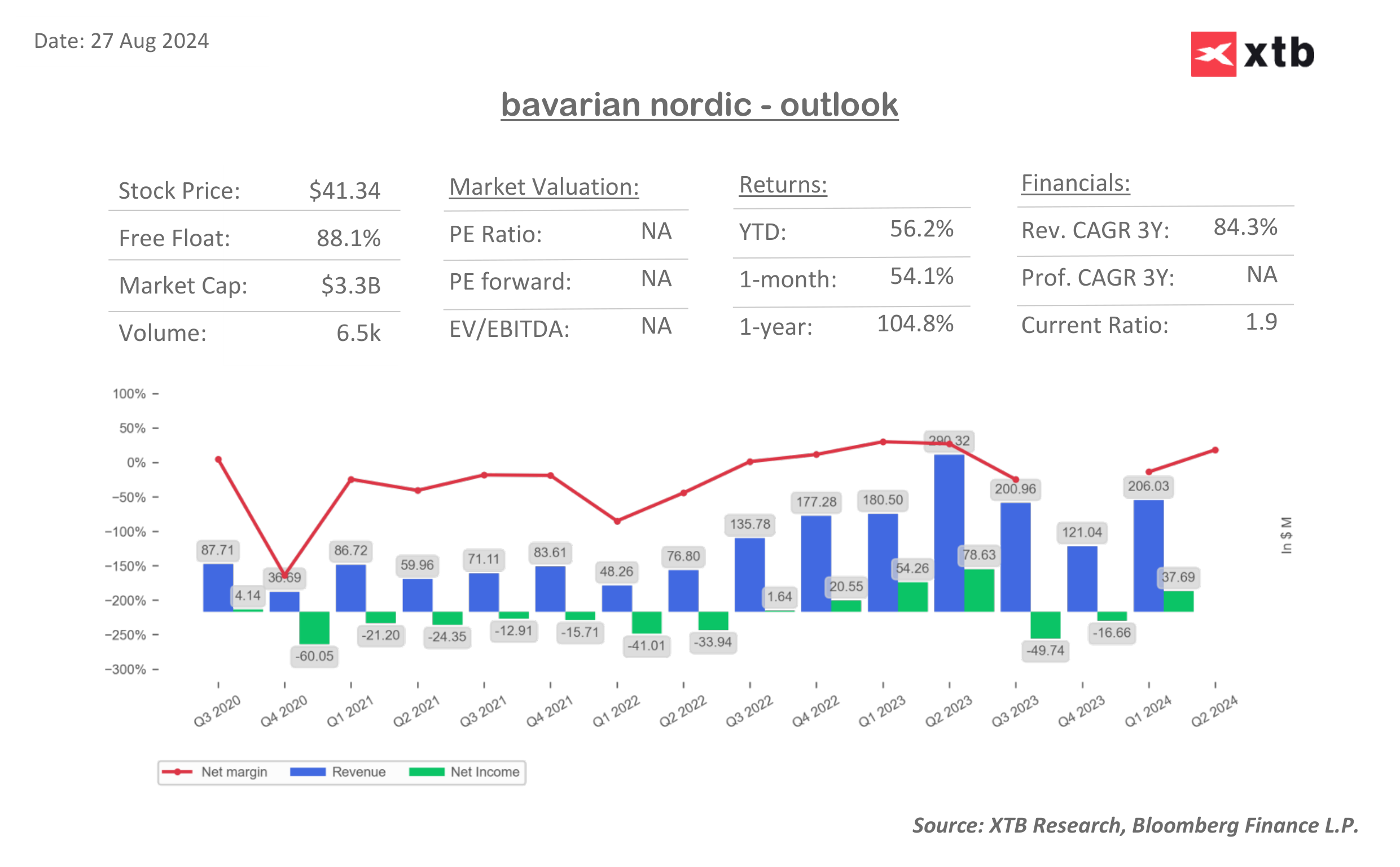

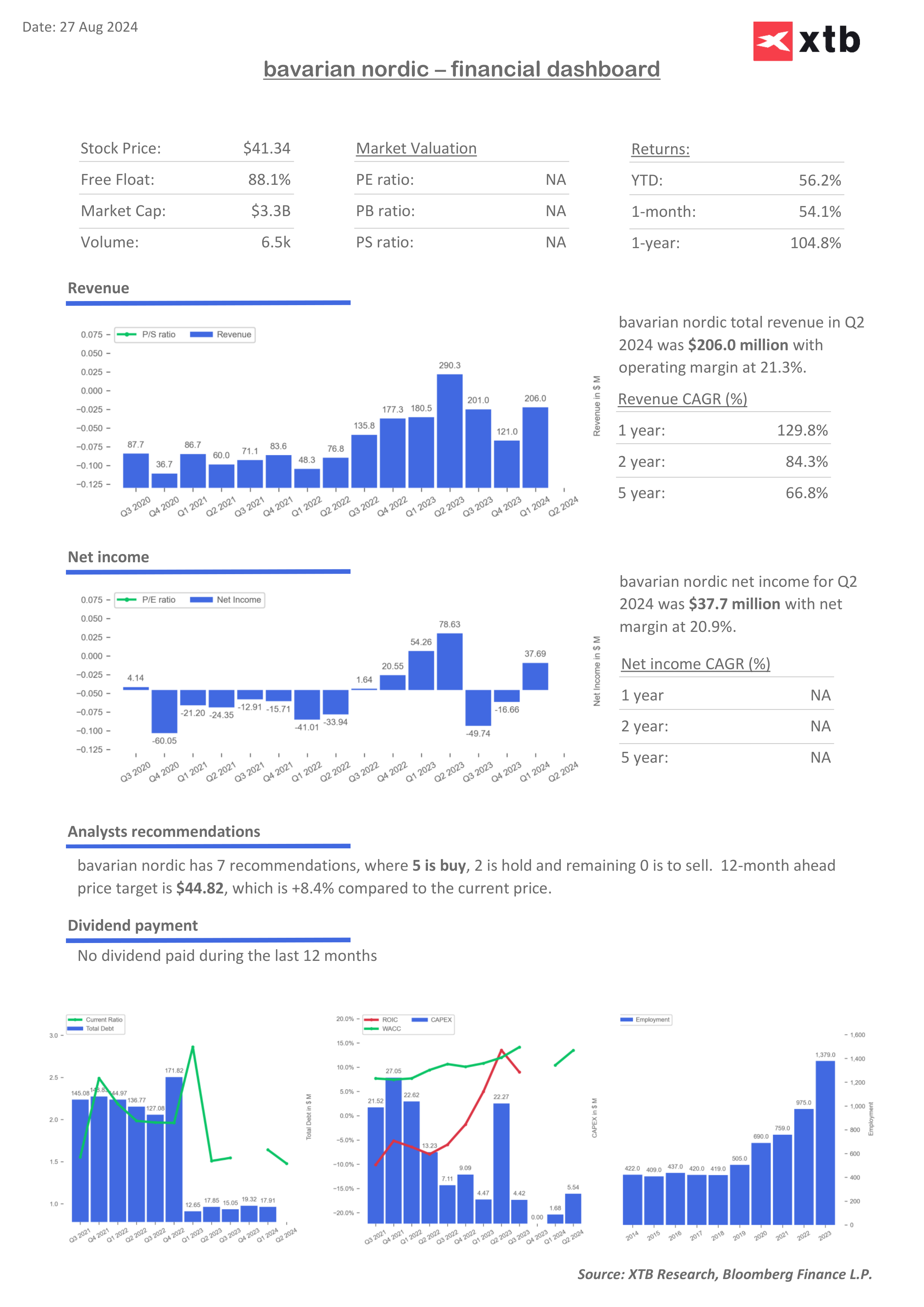

Revenues, earnings and financial multiples dashboards of Bavarian Nordic

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

📈 Boeing ปรับตัวขึ้น ท่ามกลางข่าว คำสั่งซื้อ 737 MAX ขนาดใหญ่จากจีนที่อาจเกิดขึ้น

หุ้น Ryanair กดดันจากความตึงเครียดในตะวันออกกลาง 📉

Stock of the Week: Broadcom ขับเคลื่อนโดย AI ทำสถิติใหม่ 🚀

Market Wrap: ดัชนีหุ้นพยายามยืนรีบาวด์ แม้ราคาน้ำมันปรับตัวสูงขึ้น 🗽 หุ้น Broadcom พุ่งแรง หลังผลประกอบการและแนวโน้มธุรกิจ AI เกินคาด