The token of the world's largest cryptocurrency exchange, Binance, Binancecoin (BNB) has been showing incredible resilience recently and is doing better than Ethereum and Bitcoin in a correction. The cryptocurrency has had 7 upward sessions in a row. Meanwhile, the founder of the world's largest cryptocurrency exchange, Chanpeng Zhao known by his nickname 'CZ', could spend up to 3 years in a US prison, according to reports from the US Department of Justice, cited by Bloomberg and Reuters. However, this information has not affected sentiment around BNB at all.

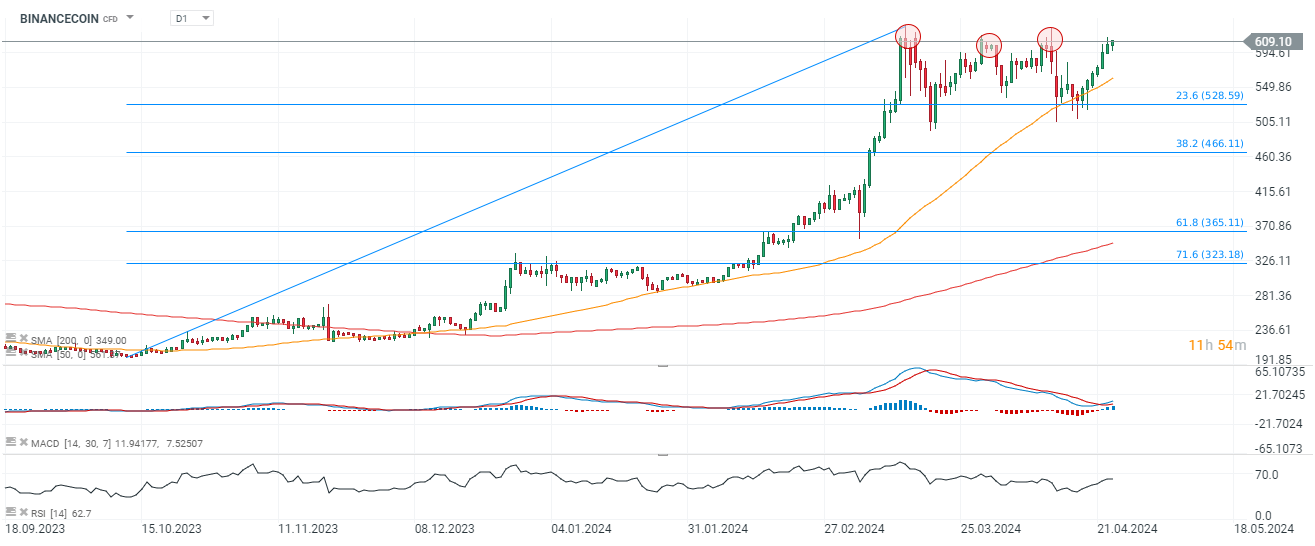

Binancecoin (D1 interval)

Binancecoin has held support in the form of the 23.6 Fibonacci retracement of the December 2022 upward wave and is trading at $610 per BNB i.e. at a level where we have historically seen significant price reactions. As a result, if the price of Bitcoin were to plunge, a spike in volatility and a sizable downward reaction would not be out of the question. On the other hand, however, BTC has been clearly stabilizing in recent days, and a return above $70,000 could push Binancecoin to new historic highs, although sentiment around most altcoins remains mixed. BNB has shown tremendous resilience recently, and has quickly returned to levels close to ATH despite BTC's 20% correction and the still nearly 10% lower price of the major cryptocurrency from its March highs.

Source: xStation5

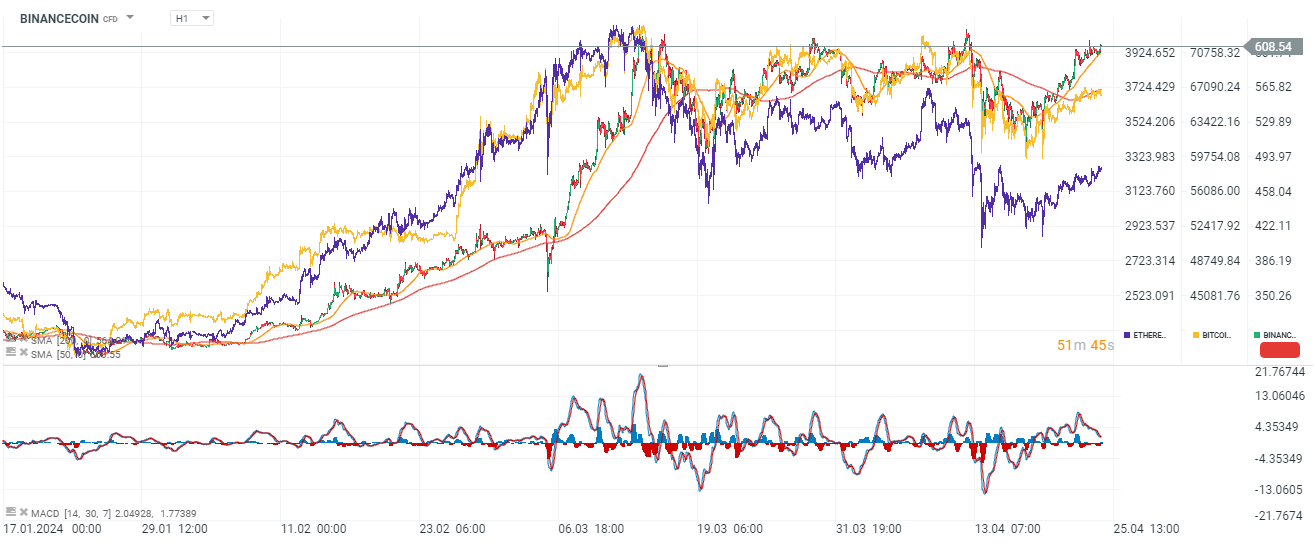

Binanecoin has recently fared better than both Bitcoin and Ethereum; demand for BNB is boosted by more project launchpads on the Binance exchange.

Source: xStation5

ข่าวเด่นวันนี้ 5 มี.ค.

📀 Coinbase และ MicroStrategy พุ่งแรง หลังทรัมป์ท้าทายธนาคารบนวอลล์สตรีท

บิทคอยน์พุ่งเหนือ 70,000 ดอลลาร์ แม้ดอลลาร์แข็งค่า📈

ข่าวเด่นวันนี้ 4 มี.ค.