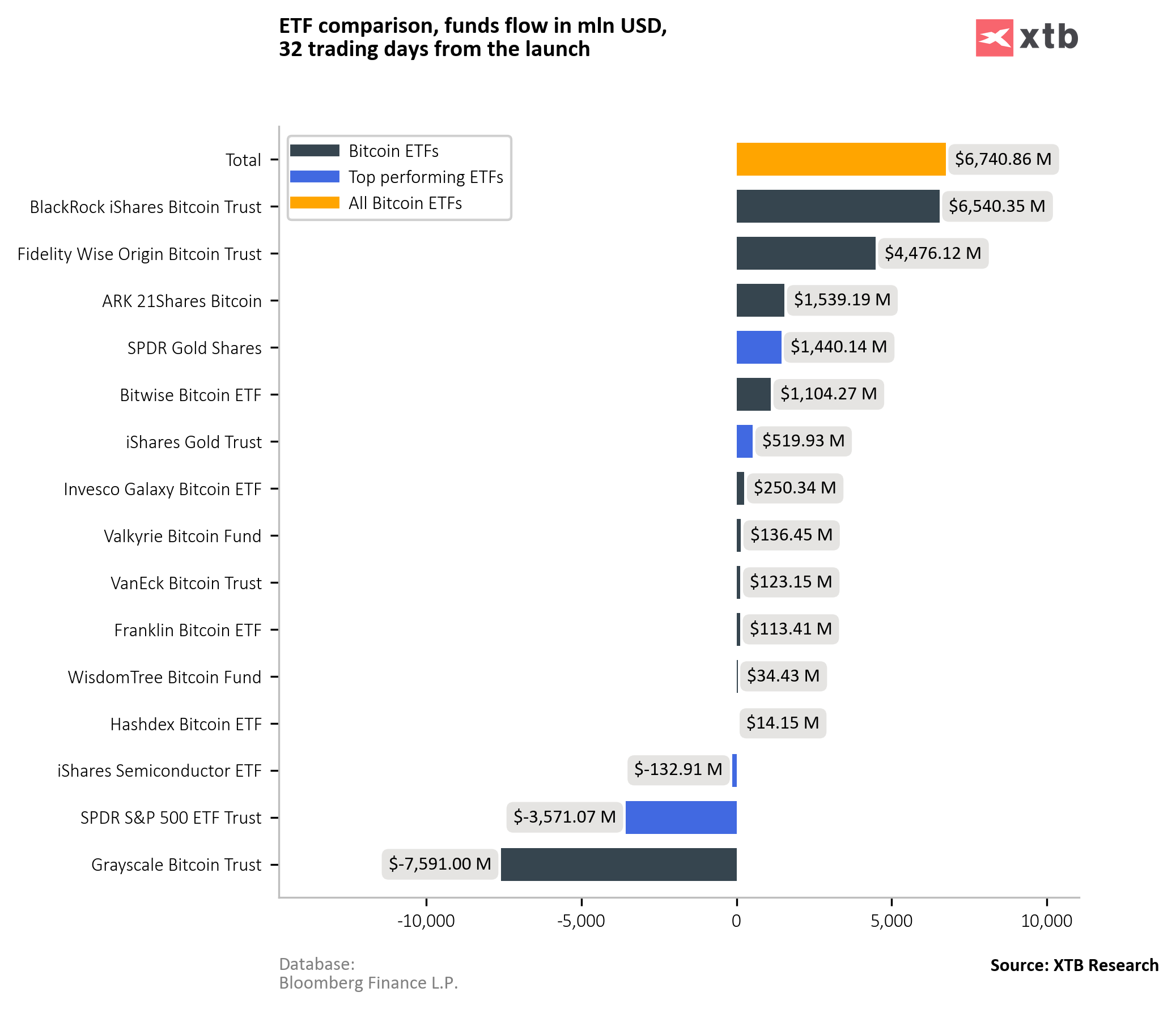

Bitcoin has gained over 6.0% and has breached the 60,000 USD level, approaching very close to its historic highs from the 2021 bull run. The dynamic growth in the largest cryptocurrency is driven by positive inflows into ETFs, which to date have amounted to over 6.7 billion USD, including outflows from Grayscale.

In the 32 trading days since the launch of ETFs, BlackRock has accumulated Bitcoins valued at over 6.5 billion USD, followed by Fidelity with more than 4.4 billion USD.

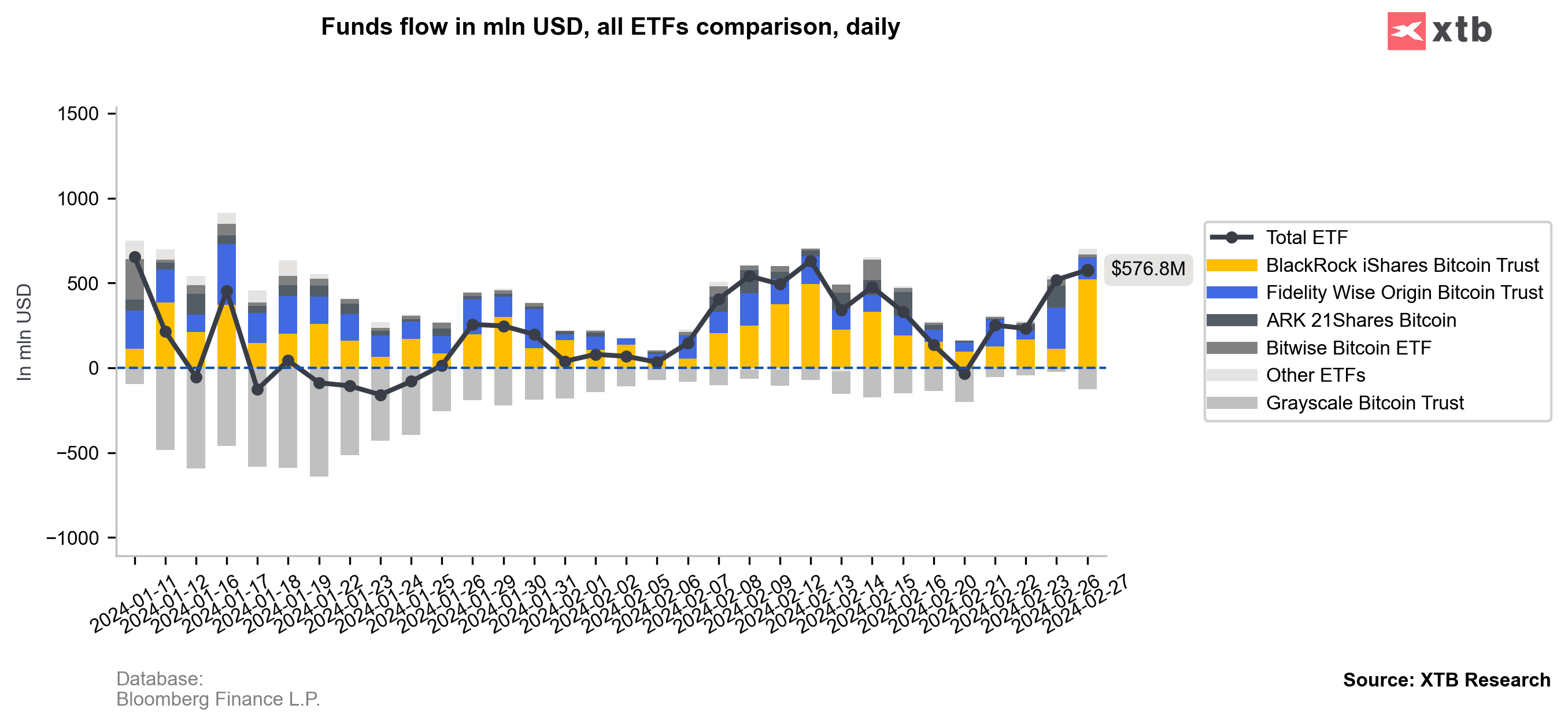

Inflows into ETF funds once again demonstrate a higher dynamic of investor's interest in the digital currency. Inflows to BlackRock iShares broke their previous records yesterday. Source: XTB Research

Today, Bitcoin has gained over 6% and is testing the psychological barrier of 60,000 USD for the first time since November 2021. Source: xStation

ข่าวเด่นวันนี้

🚨 Bitcoin หลุด $69K 📉 อาจเข้าสู่การแก้ไข 1:1

Market Wrap: หุ้น Novo Nordisk ทะยานมากกว่า 7% 🚀

ข่าวคริปโต: บิทคอยน์หลุด 70,000 ดอลลาร์ 📉 คริปโตจะร่วงอีกหรือไม่?