The mood of the cryptocurrency market is weak today, with Bitcoin starting to fall after yesterday's Fed decision and slipping from the $26,000 level to $24,800. Unlike the Nasdaq, crypto was unable to make up for the sell-off during Jerome Powell's conference.

- Industry portals also point out that Binance's exchange-traded security fund-the so-called SAFU-has suffered significant losses because Binancecoin (BNB) and Bitcoin were the main components of its reserves-that have recently fallen sharply (especially BNB). Since the beginning of June, the value of SAFU was said to have fallen from $950 million to $861 million. The fund is to be used only in extreme situations for the exchange according to WSJ sources the exchange makes sure that its value is at an all-time high. Binancecoin is also losing today and has not been able to stay above $240.

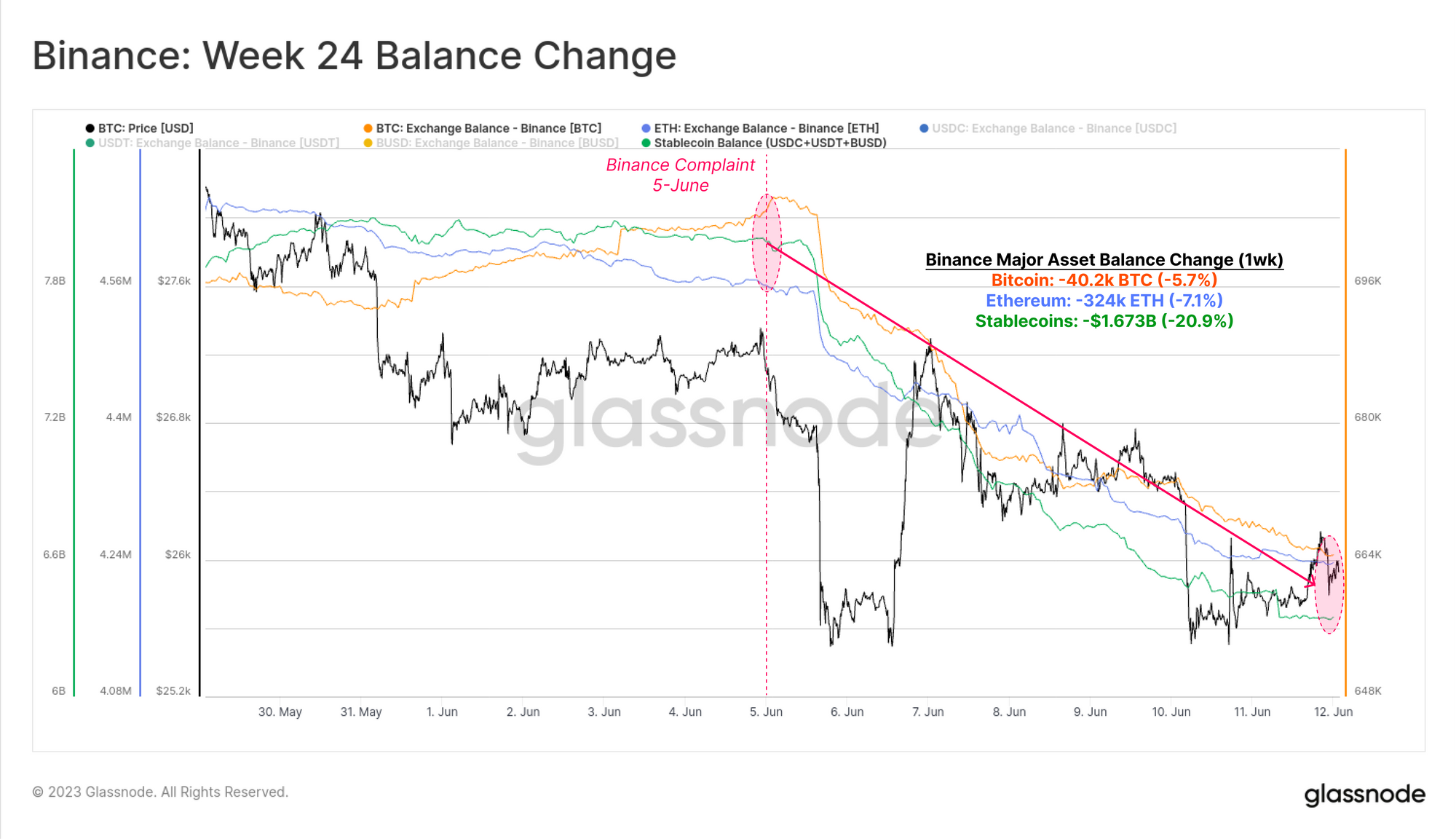

Investors continue to withdraw their funds from the Binance exchange due to regulatory uncertainty and concerns about systemic risk. Since the Fed announcement, nearly one-fifth of the reserves in stablecoins (cryptocurrencies tracking mainly USD, used for purchases) have disappeared from the exchange. Source: Glassnode

Investors continue to withdraw their funds from the Binance exchange due to regulatory uncertainty and concerns about systemic risk. Since the Fed announcement, nearly one-fifth of the reserves in stablecoins (cryptocurrencies tracking mainly USD, used for purchases) have disappeared from the exchange. Source: Glassnode

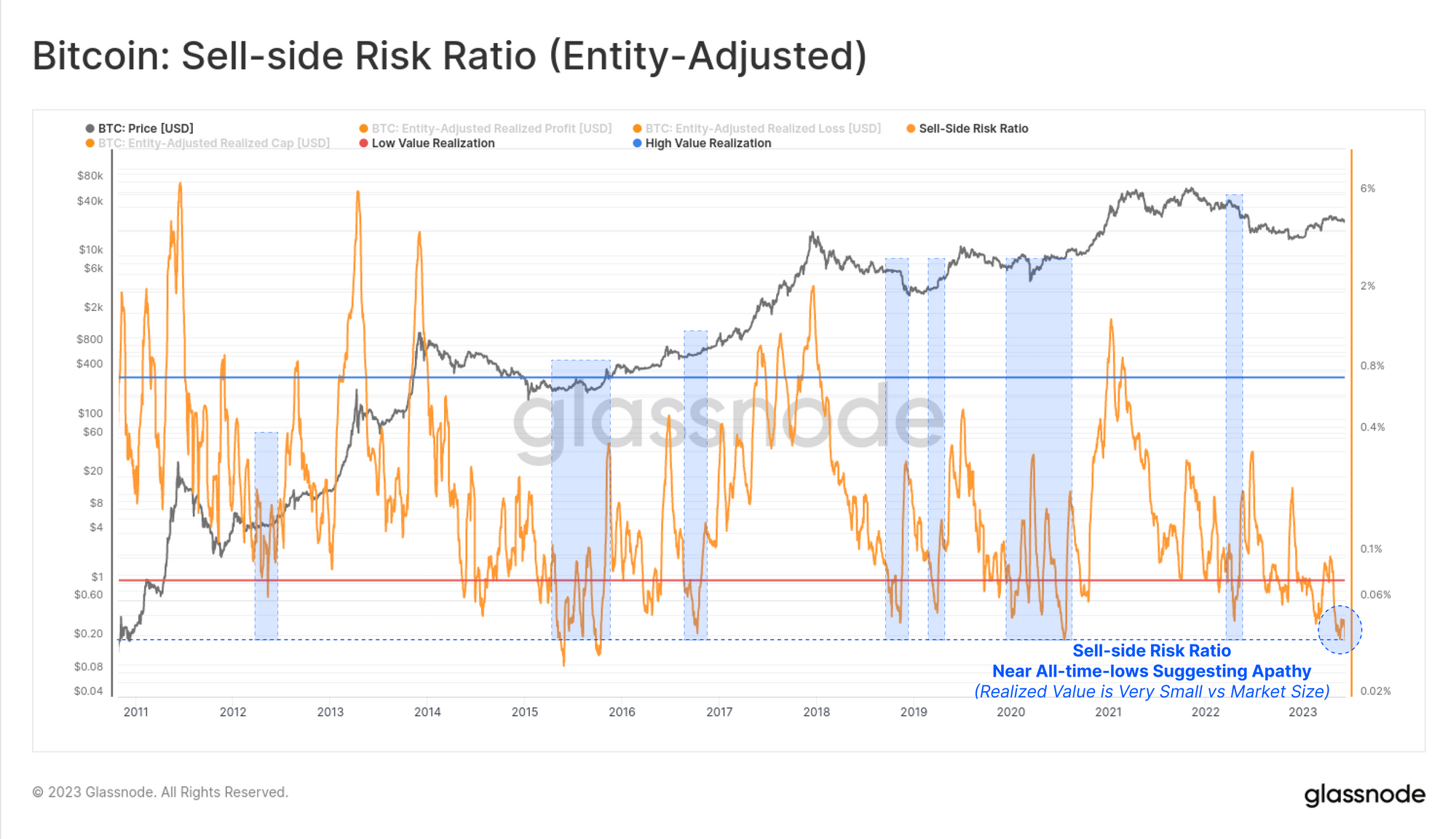

The Bitcoin sell-side risk index is near all-time lows now. The indicator calculates the market's unrealized gains and losses to the so-called realized asset size, i.e. the prices investors paid for the BTC they bought. Relative to the total realized value, the total value of gains and losses is $391 billion, which is historically very low. The low level of the ratio has historically occurred during periods of depleting supply pressure and total market abandonment. In addition, Glassnode reported that the indicator was supported by a low reading of the volume index - RVT. Source: Glassnode

BITCOIN, D1 interval. The price has fallen below $25,000 and if the level is not recovered relatively quickly a test of the 61.8 Fibonacci retracement, around $21,300, will not be ruled out - in the vicinity of these runs also the so-called Realized Price average, i.e. the average of purchases of all BTC since the beginning of the trading history - this average has served as an important trend indicator in many previous cycles. Source: xStation5

คริปโตปรับตัวขึ้น 4 % ท่ามกลางความตึงเครียด 📈

ข่าวเด่นวันนี้ 10 มี.ค.

3 ตลาดที่น่าจับตาสัปดาห์นี้

Bitcoin ฟื้นตัว แม้หุ้นโลกเทขาย น้ำมันพุ่งแรง