Bitcoin breaks above the important $ 40,000 resistance today and gains almost 4%. This is a continuation of the weekend rebound when Tesla CEO Elon Musk indicated that his company would consider buying Bitcoin again if more renewable energy is used to "mine" the cryptocurrency. Musk said about 50% of energy would have to come from renewable sources if Tesla were to buy bitcoin again and accept it as a payment option.

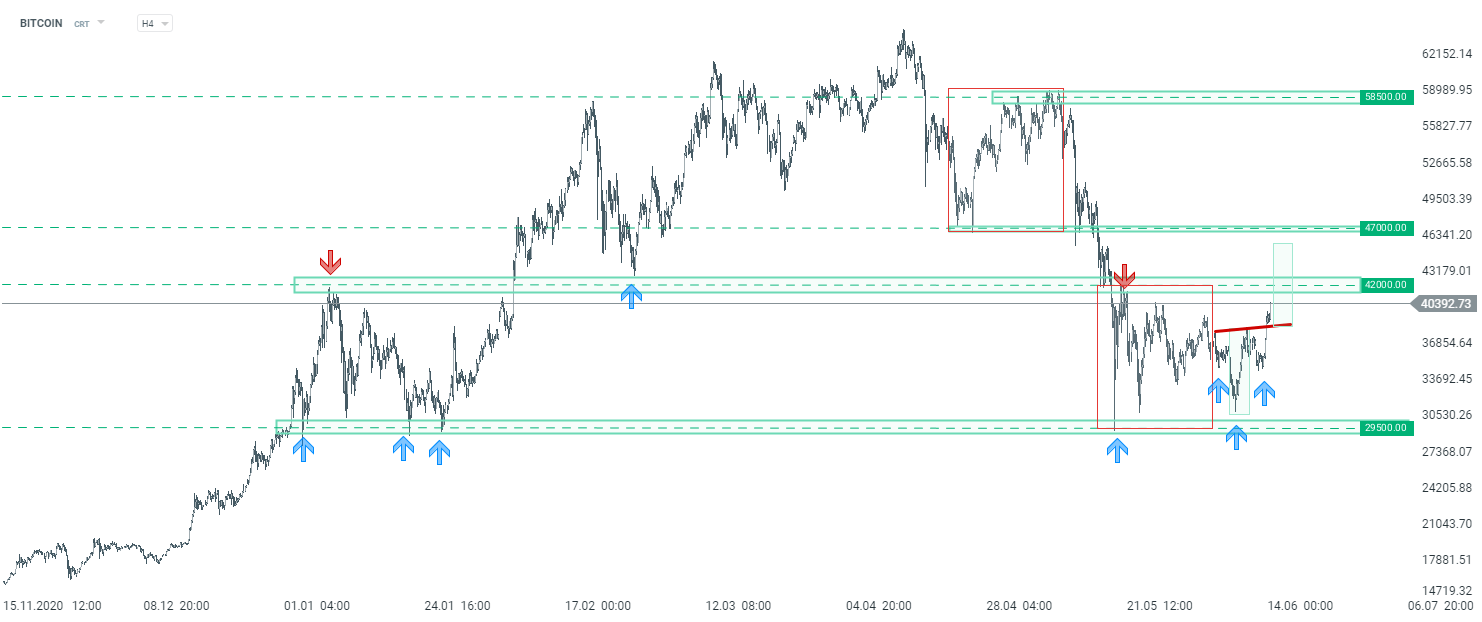

From a technical point of view, Bitcoin remains in the consolidation zone, with the upper limit located around $ 42,000. Theoretically, there was also a breakout of the neckline of a potential inverted head to shoulder formation with a target around $ 45,500. Should a new wave of supply appear, the key short-term support is located at $ 35,000 and $ 30,000.

Source: xStation5

Source: xStation5

ข่าวเด่นวันนี้

🚨 Bitcoin หลุด $69K 📉 อาจเข้าสู่การแก้ไข 1:1

Market Wrap: หุ้น Novo Nordisk ทะยานมากกว่า 7% 🚀

ข่าวคริปโต: บิทคอยน์หลุด 70,000 ดอลลาร์ 📉 คริปโตจะร่วงอีกหรือไม่?