Bitcoin price rose sharply during today's session and hit a new record high at $ 66,900 after the successful debut of the first US bitcoin futures exchange-traded fund - ProShares Bitcoin Strategy ETF. The fund tracks CME bitcoin futures, or contracts speculating on the future price of bitcoin, not the digital currency itself. On its first day of trading, the fund certificate rose 4.9% to USD 41.94. With more than 24 million BITO shares changing hands on Tuesday alone, the ETF has already broken into the top 30% of ETFs in terms of AUM, though settlements mean net flows in and out will not be known until overnight on Wednesday, Bloomberg said.

New ETF garnered a first-day trading volume of more than $1 billion, ranking it among the most successful launches of all time. Yesterday ProShares Bitcoin Strategy ETF was the second most heavily traded fund certificate after the BlackRock fund. Additionally bullish comments from a legendary trader also lifted sentiment. Billionaire investor Paul Tudor Jones on CNBC’s “Squawk Box” called crypto his preferred inflation hedge over gold. Meanwhile Head of Research at Fundstrat Thomas Lee, said Bitcoin’s price rally is a signal of a strong risk-on environment and said the market could still rally more than 6% by the end of the year despite the “jagged year of progress” it’s had.

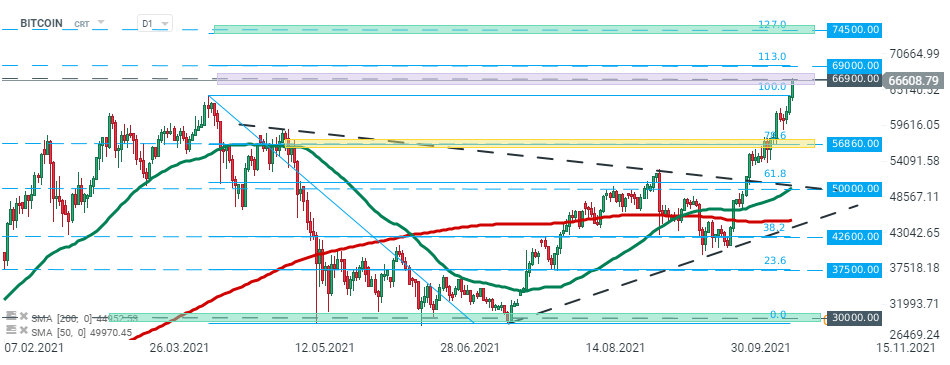

Bitcoin price hit new all-time high at $66,900 and if current sentiment prevails next targets for bulls are located at $69,000 and $74,500 level which are marked with 113% and 127% external Fibonacci retracements. On the other hand, if sellers will manage to halt advances here, then downward impulse towards support at $56,860 may be at risk. Source: xStation5

ข่าวเด่นวันนี้ 5 มี.ค.

📀 Coinbase และ MicroStrategy พุ่งแรง หลังทรัมป์ท้าทายธนาคารบนวอลล์สตรีท

บิทคอยน์พุ่งเหนือ 70,000 ดอลลาร์ แม้ดอลลาร์แข็งค่า📈

ข่าวเด่นวันนี้ 4 มี.ค.