Bitcoin breaks out of a short consolidation to the upside and gains 4.00% today. Even before the opening of the cash session in the U.S., Bitcoin's price remained subdued, hovering around the $58,000 level. However, a bullish opening on Wall Street increased investors' appetite for risk. At the time of publication, the US100 is up 2.40%, also breaking through key support at the 19,000-point level. This improved sentiment has finally spread to crypto market investors as well. The price is also supported by the strongly negative sentiment that has persisted since last week. Extreme sell-offs and negative investor sentiment create little potential for further declines.

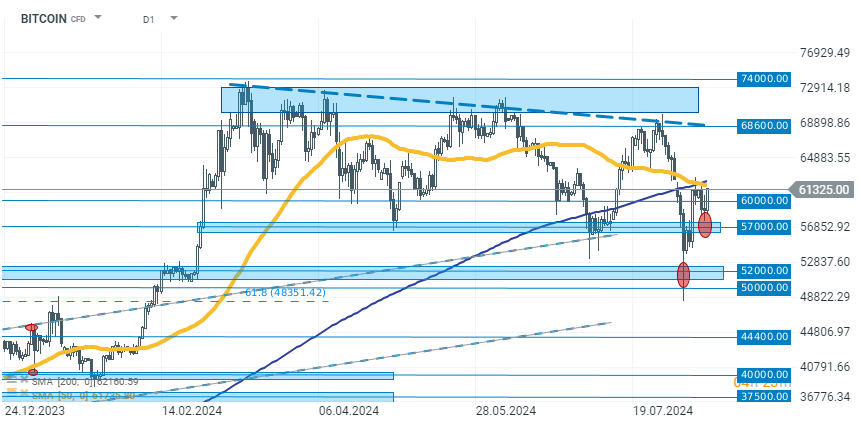

Bitcoin (D1)

The price of Bitcoin has broken out of a key area after the recent pullback. On the chart, we can see that the recent drop below $50,000 was quickly bought up, and in just three sessions, Bitcoin managed to climb back above $60,000. Subsequently, the pullback and lower liquidity over the weekend pushed BTC's price back down to the $57,000 level. For the uptrend to continue, another breakout from support, which we are currently observing, was crucial.

Source: xStation 5

Source: xStation 5

คริปโตปรับตัวขึ้น 4 % ท่ามกลางความตึงเครียด 📈

ข่าวเด่นวันนี้ 10 มี.ค.

3 ตลาดที่น่าจับตาสัปดาห์นี้

Bitcoin ฟื้นตัว แม้หุ้นโลกเทขาย น้ำมันพุ่งแรง