The major cryptocurrency is trying to hold the $28,000 level amid weaker stock market sentiment and general risk aversion. On-chain data indicates that in the medium term the upward momentum may be maintained although a correction after impressive gains in Q1 2023 seems likely.

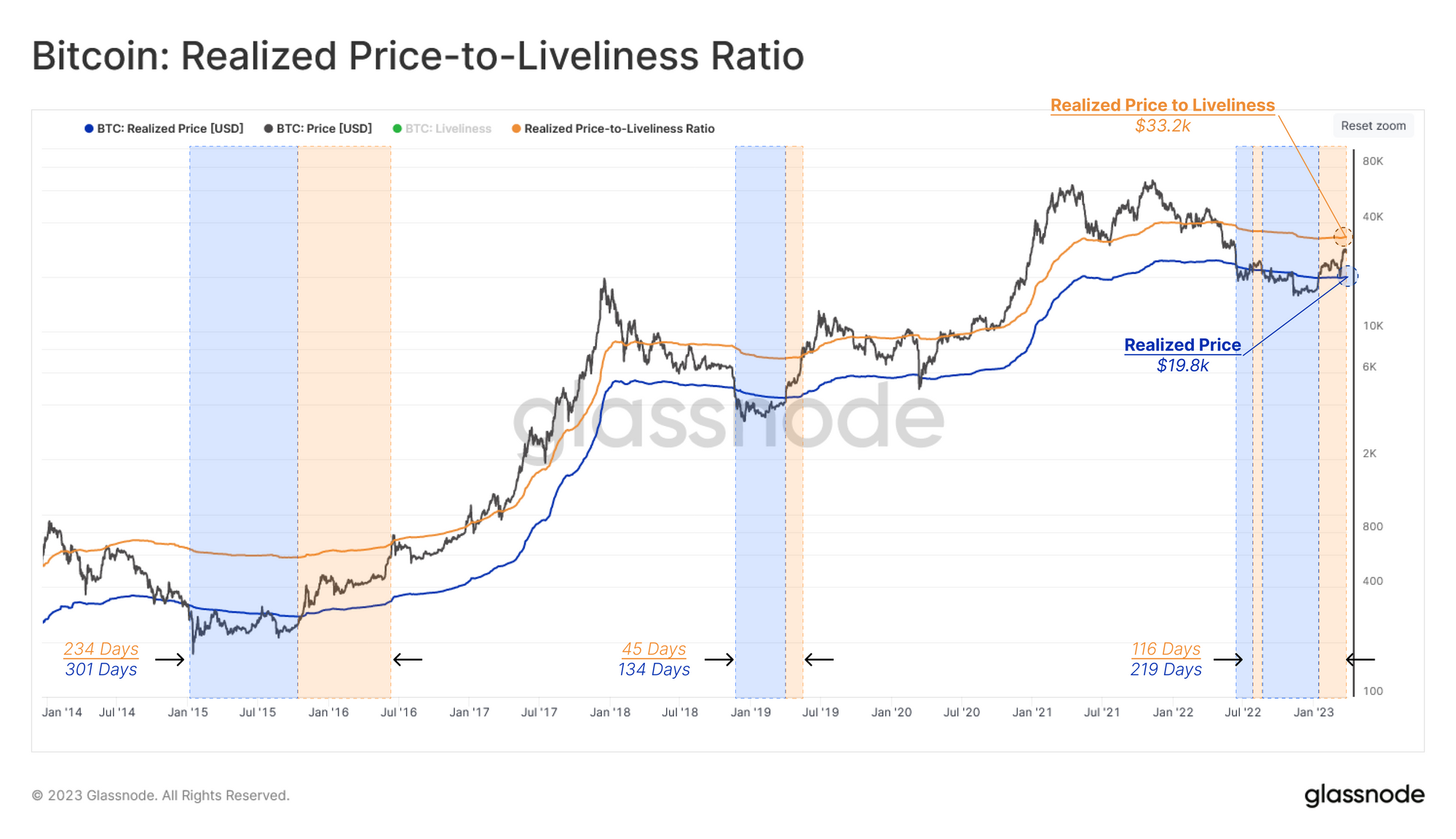

Bitcoin's spot price is currently well above the average blockchain BTC purchase price i.e. Realized Price (around $19,800). According to Glassnode, the cryptocurrency market is currently in a key transition phase between a bull market and a bull market. The upper limit of this phase is marked by the Realized Price to Liveliness Ratio in the vicinity of $33,000, which could be an important resistance level. Source: Glassnode

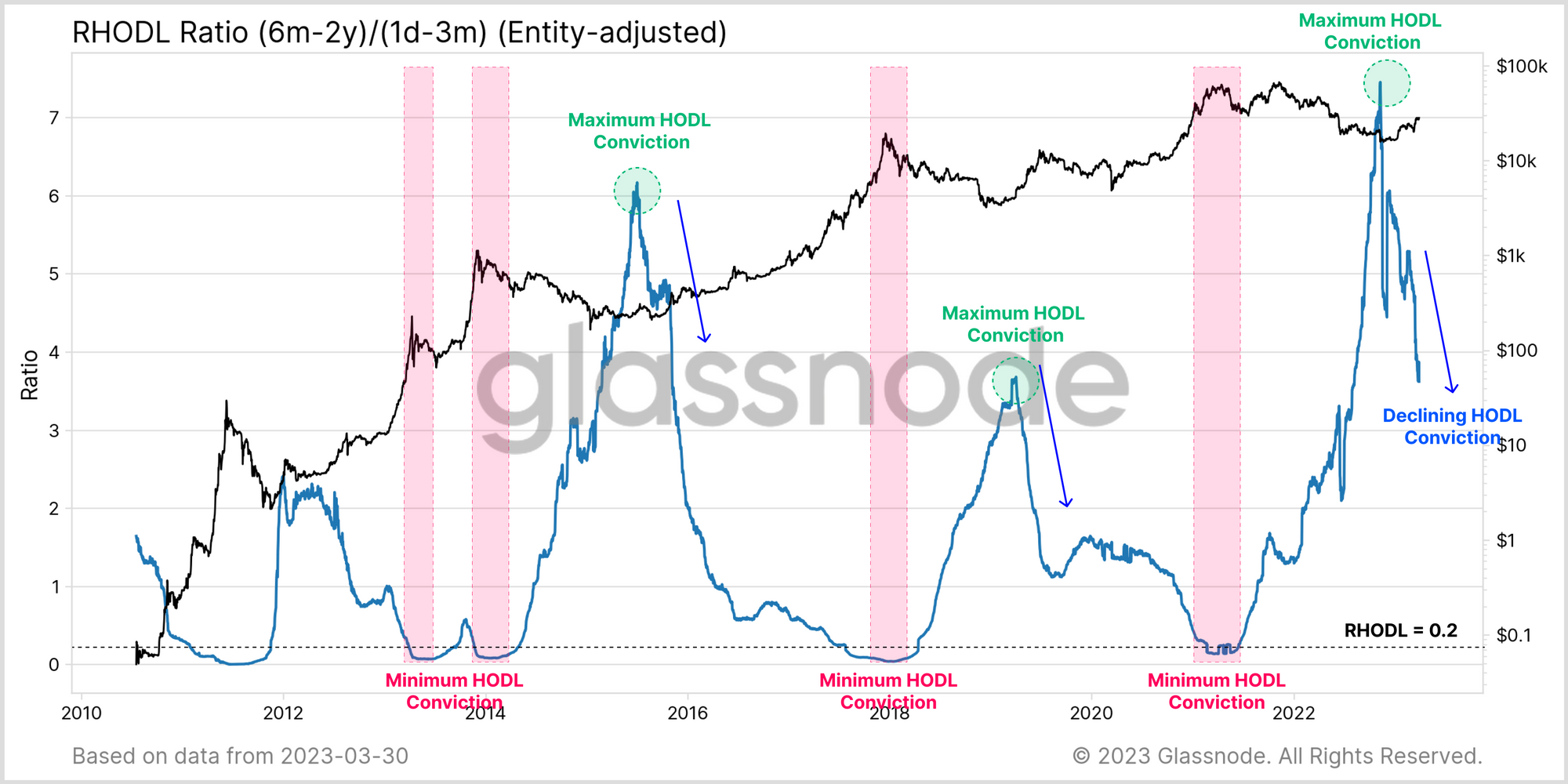

The ratio compares the value of BTC held by long-term investors in one cycle (6m-2y) to short-term holders (1d-3m). The structure of the RHODL indicator indicates a sharp change in trend that began with the collapse of FTX, with BTC sold by long-term investors to a new group of buyers. The sudden drop in the index in earlier cycles was seen as a turning point. Source: Glassnode The indicator measures the change in supply based on the length of time BTC is held in portfolios. It is positive (green) when BTC 'ages' at a faster rate (low propensity to sell) and negative (red) when the rate of sales exceeds the accumulation and conviction rate of HODLers. The period of spending was relatively short-lived (the collapse of FTX) and we again see a green color advantage with more than 60,000 BTC added to HODLers' balances per month. Source: Glassnode

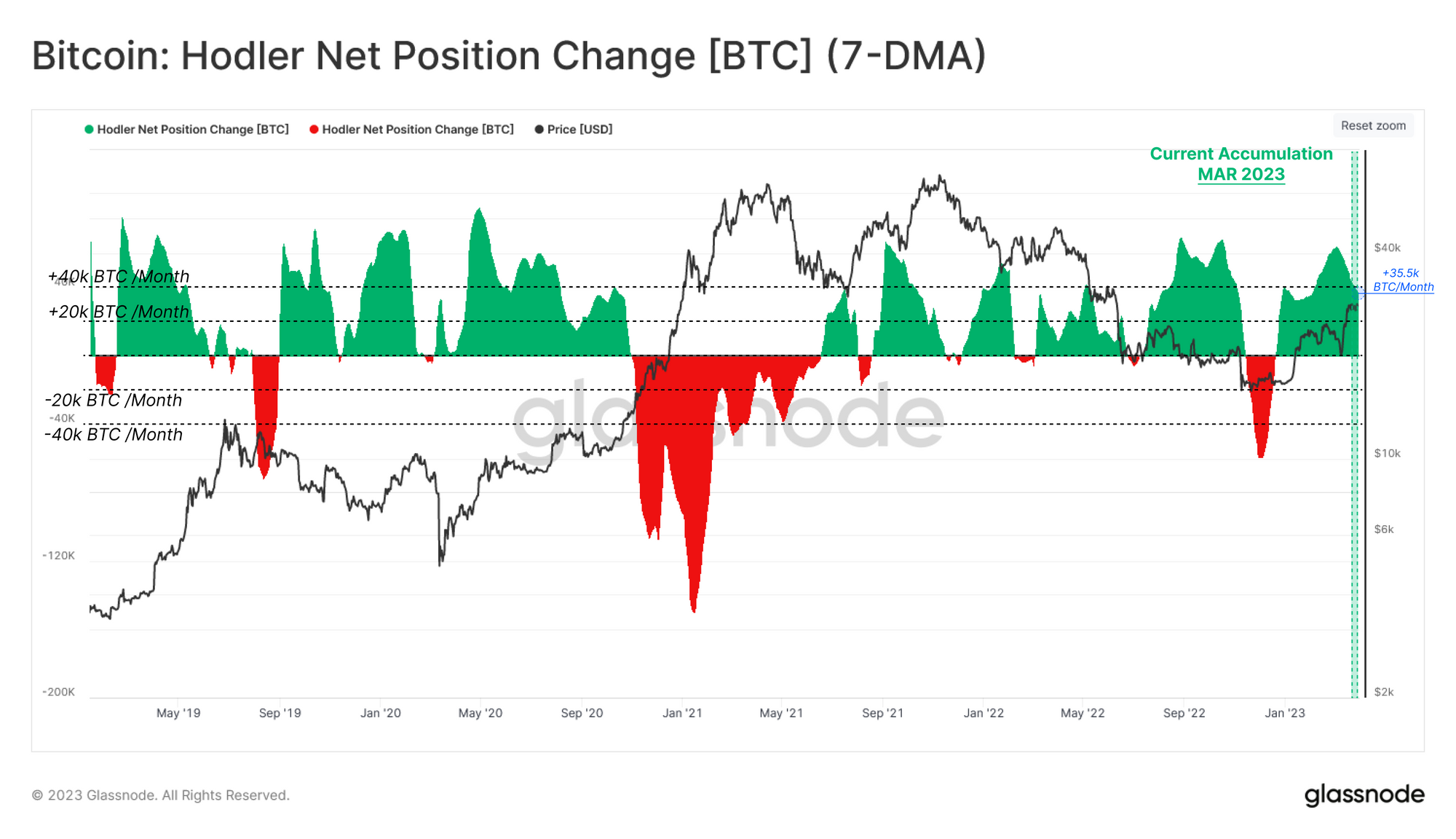

The indicator measures the change in supply based on the length of time BTC is held in portfolios. It is positive (green) when BTC 'ages' at a faster rate (low propensity to sell) and negative (red) when the rate of sales exceeds the accumulation and conviction rate of HODLers. The period of spending was relatively short-lived (the collapse of FTX) and we again see a green color advantage with more than 60,000 BTC added to HODLers' balances per month. Source: Glassnode

Bitcoin chart, H1 interval. The price measures the main short-term support level, which is set by the SMA200 (red line), near $28,000. Source: xStation5

Bitcoin chart, H1 interval. The price measures the main short-term support level, which is set by the SMA200 (red line), near $28,000. Source: xStation5

🚨 Bitcoin หลุด $69K 📉 อาจเข้าสู่การแก้ไข 1:1

Market Wrap: หุ้น Novo Nordisk ทะยานมากกว่า 7% 🚀

ข่าวคริปโต: บิทคอยน์หลุด 70,000 ดอลลาร์ 📉 คริปโตจะร่วงอีกหรือไม่?

สรุปข่าวเช้า