The beginning of the new week in global markets brings a continuation of the downward momentum in the cryptocurrency market. Bitcoin is currently losing close to 3% in intraday trading and is approaching the key medium-term barrier of 40,000 USD. Significant downward dynamics are also observed in Altcoins. Ethereum is currently down 4.6% and is trading in the 2355 USD zone.

The declines are supported by further information about Bitcoin transfers from Grayscale to Coinbase Prime, a platform aimed at institutions. In today's transfer at the start of the session, Grayscale sent another 19,260 Bitcoins.

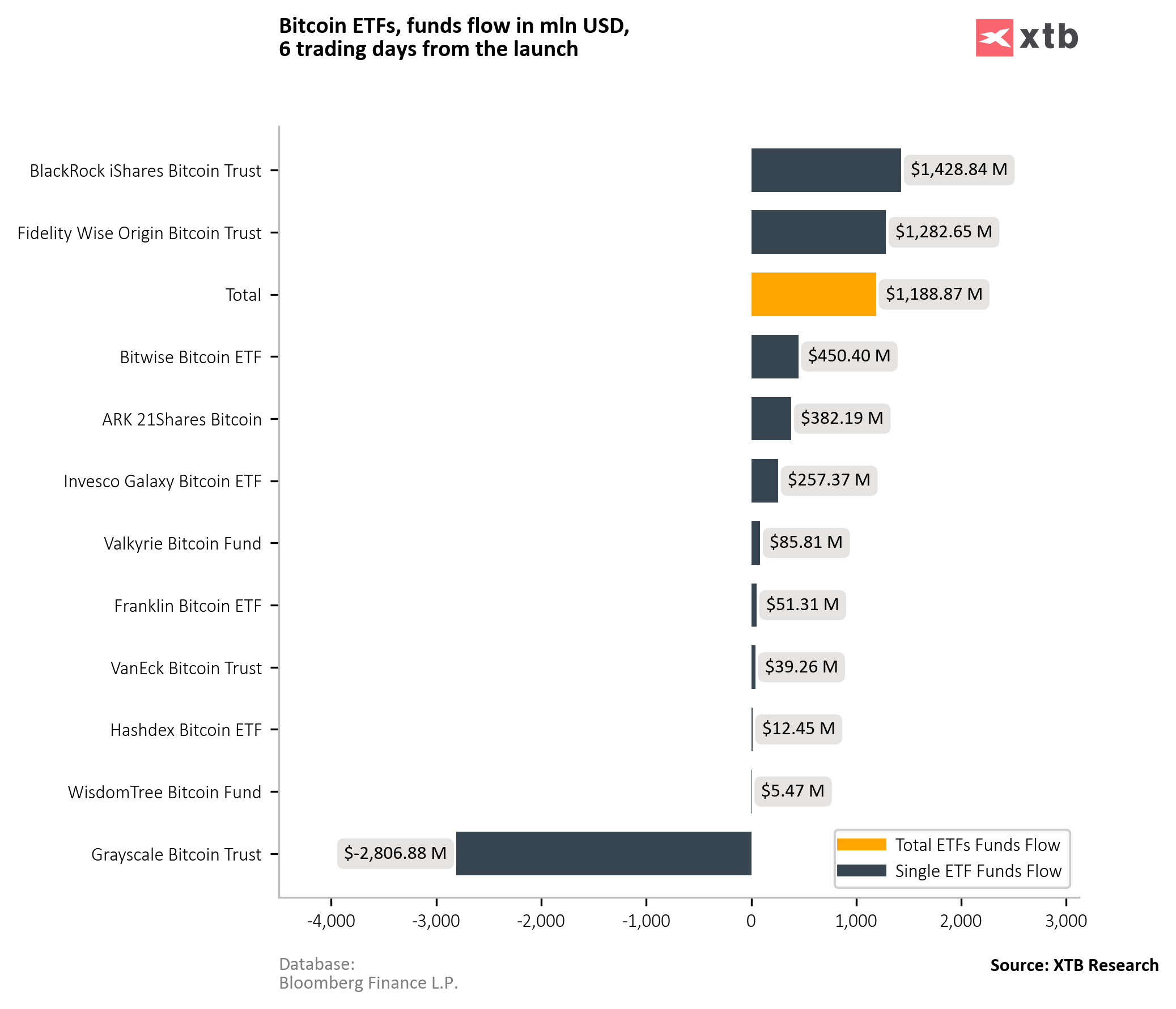

The above chart shows the accumulated capital flows for spot ETFs on Bitcoin. Over 6 days since the start of trading on exchanges, the total outflows of capital from Grayscale amounted to 2.8 billion dollars, exerting supply pressure on the market. Investors fear that the selling pressure may continue for many weeks. However, considering the capital flow from all ETFs, we still record a positive flow of +1.188 billion dollars.

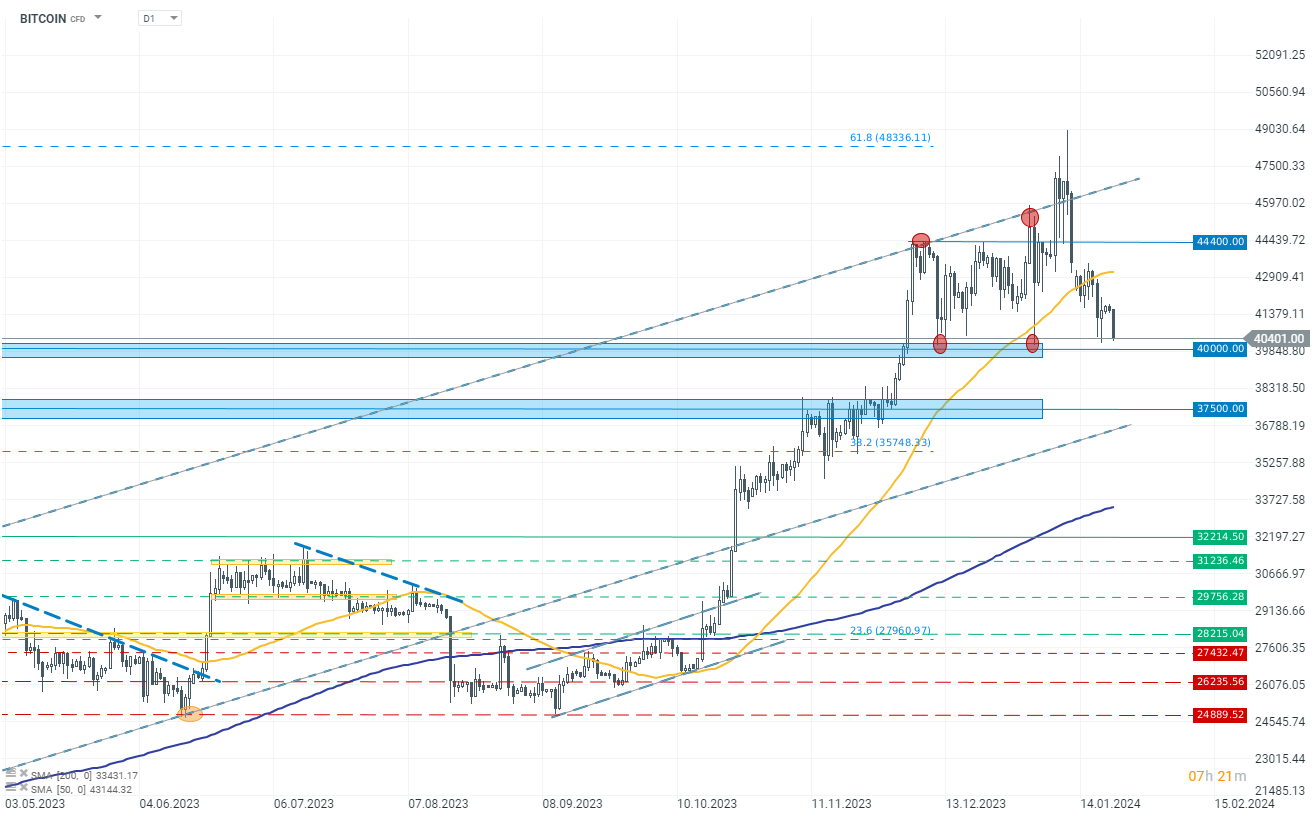

Bitcoin is currently losing close to 3% and is approaching the key support level of 40,000 USD. A potential breach of this zone could bring the quotations of the most popular cryptocurrency to the lowest levels observed since the first half of December 2023. In the case of demand reactions, the key resistance area could be the 42,000 USD zone, where currently the 50-day exponential EMA (blue curve) and the 50% retracement of the downward wave that began in November 2021 are located.

Source: xStation

🚨 Bitcoin หลุด $69K 📉 อาจเข้าสู่การแก้ไข 1:1

Market Wrap: หุ้น Novo Nordisk ทะยานมากกว่า 7% 🚀

ข่าวคริปโต: บิทคอยน์หลุด 70,000 ดอลลาร์ 📉 คริปโตจะร่วงอีกหรือไม่?

สรุปข่าวเช้า