Bitcoin price '' in the range of $29,000 - $29,300 after yesterday's dynamic declines. At the same time, the latest analysis of Glassnode's on-chain data indicates that the largest addresses (above 1,000 BTC) are likely to sell (distribute) BTC. Interestingly, the structure of Bitcoin's recent price chart somewhat resembles Wyckoff's distribution pattern.

- According to Glassnode, the bulk of the whales are now short-term addresses

- Whales are responsible for more than 40% of all BTC inflows to exchanges

- As of 2021, the total amount of BTC held by whale addresses has dropped from 63% to 46%

- Whales holding between 10,000 and 100,000 BTC sold nearly 50,000 BTC in the last month with a slight increase in the balance of smaller addresses and the largest, over 100,000 BTC

- Glassnode does not rule out that much of the whale activity has to do with internal BTC movements between the wallets of the largest addresses.

BITCOIN chart, H4 interval. The SMA100 average crossed the SMA200 from above, which, looking at the February-July 2023 period, heralded a preceding decline in the BTC price. Also, the MACD changed direction from neutral to downward. Source: xStation5

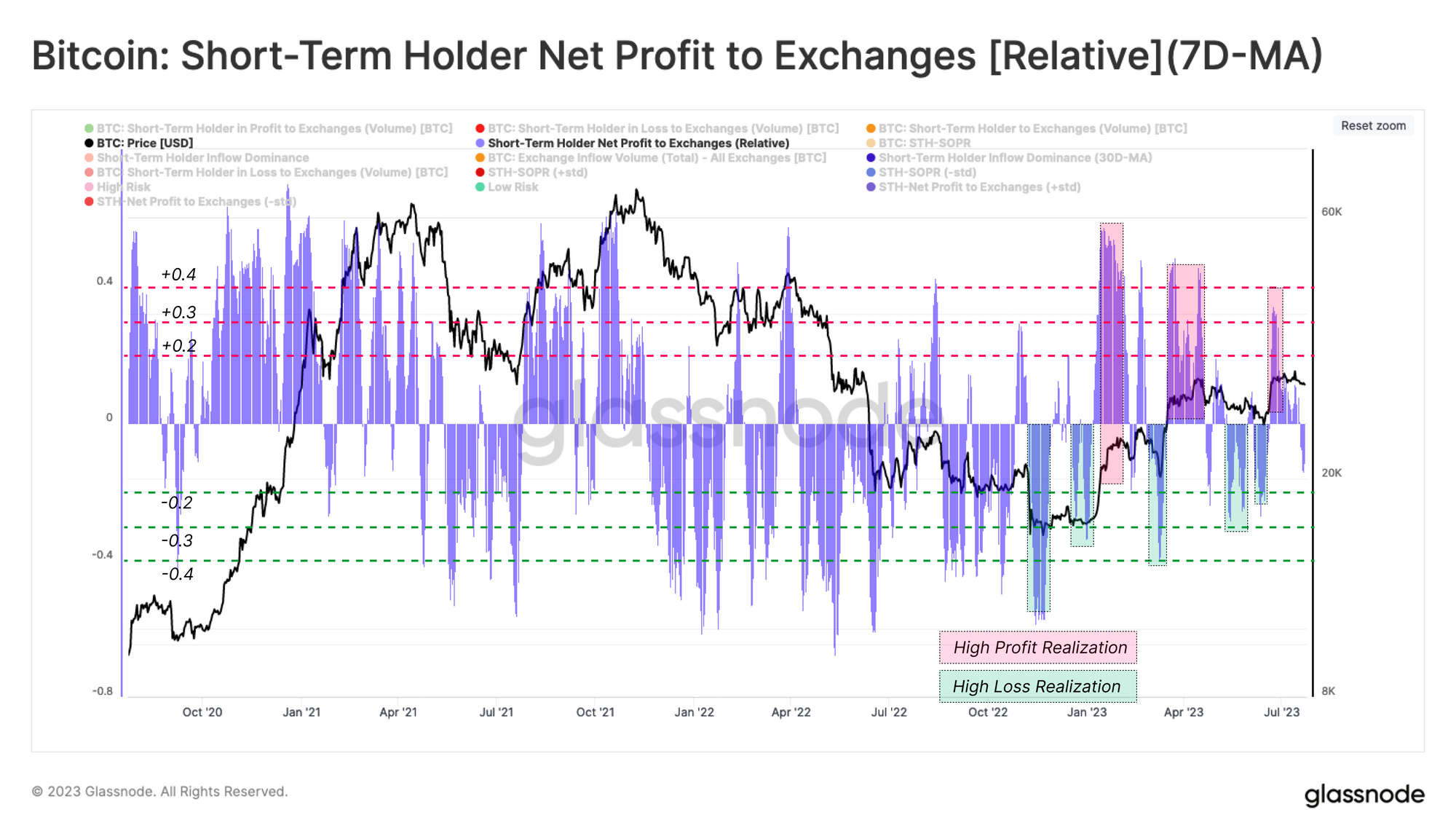

BITCOIN chart, H4 interval. The SMA100 average crossed the SMA200 from above, which, looking at the February-July 2023 period, heralded a preceding decline in the BTC price. Also, the MACD changed direction from neutral to downward. Source: xStation5 The chart above confirms the pressure to realize sizable profits of short-term investors (a large part of whom are whales) as a potentially main reason for the distribution and price decline Source: Glassnode

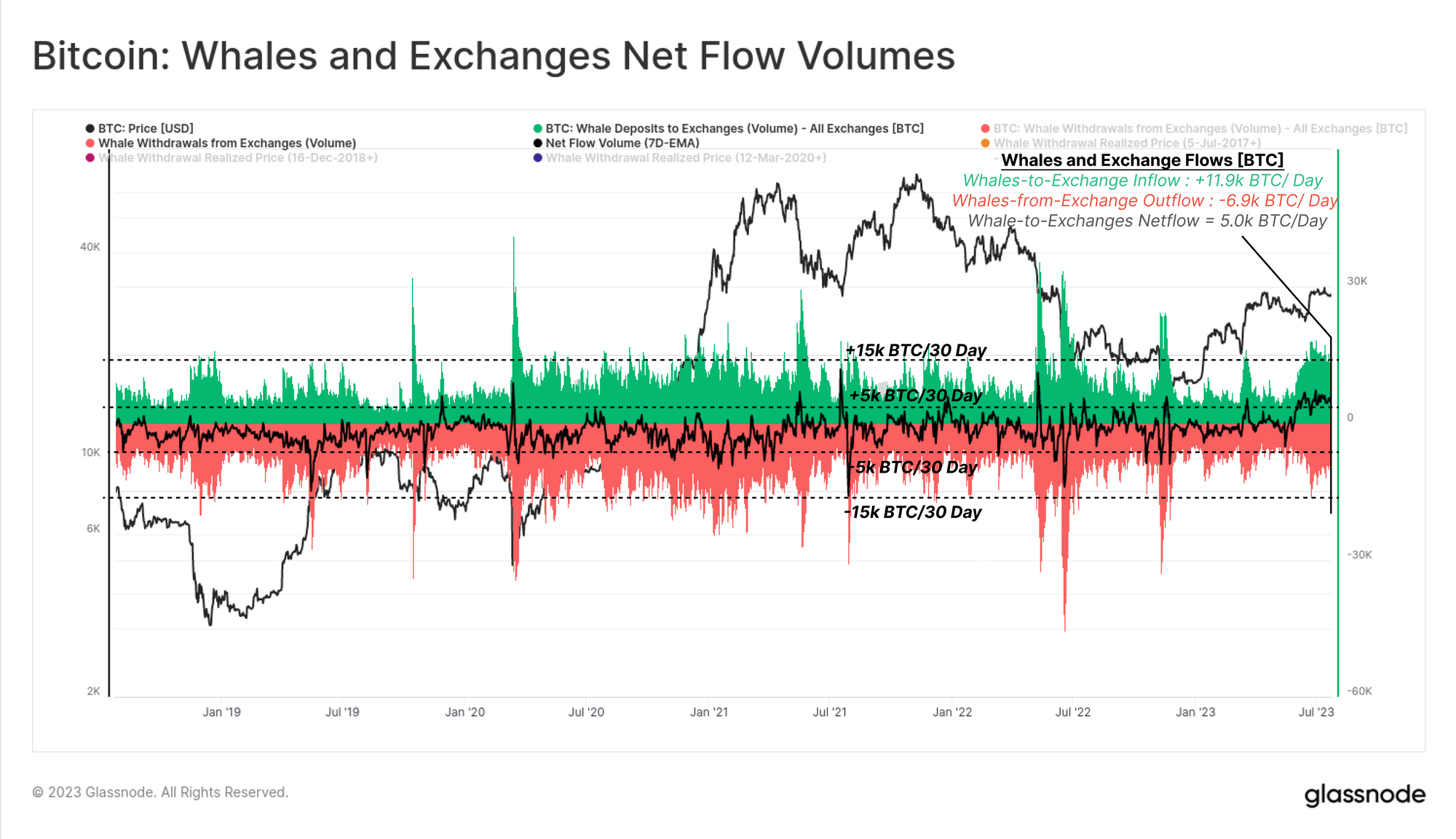

The chart above confirms the pressure to realize sizable profits of short-term investors (a large part of whom are whales) as a potentially main reason for the distribution and price decline Source: Glassnode The chart confirms that BTC inflows belonging to whales have recently increased to around 11.9 thousand BTC per day (over 100% higher than the average). Source: Glassnode

The chart confirms that BTC inflows belonging to whales have recently increased to around 11.9 thousand BTC per day (over 100% higher than the average). Source: Glassnode

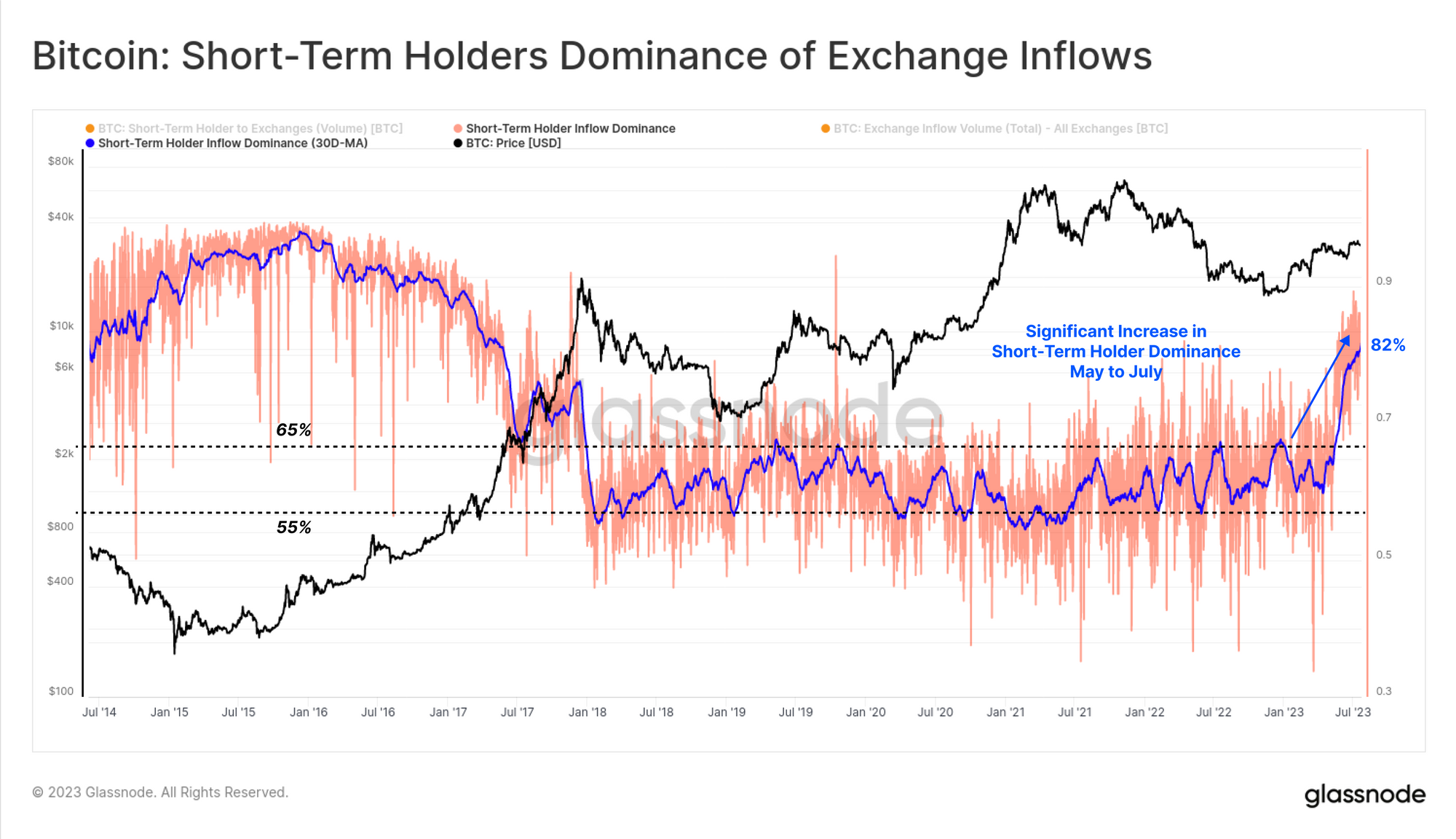

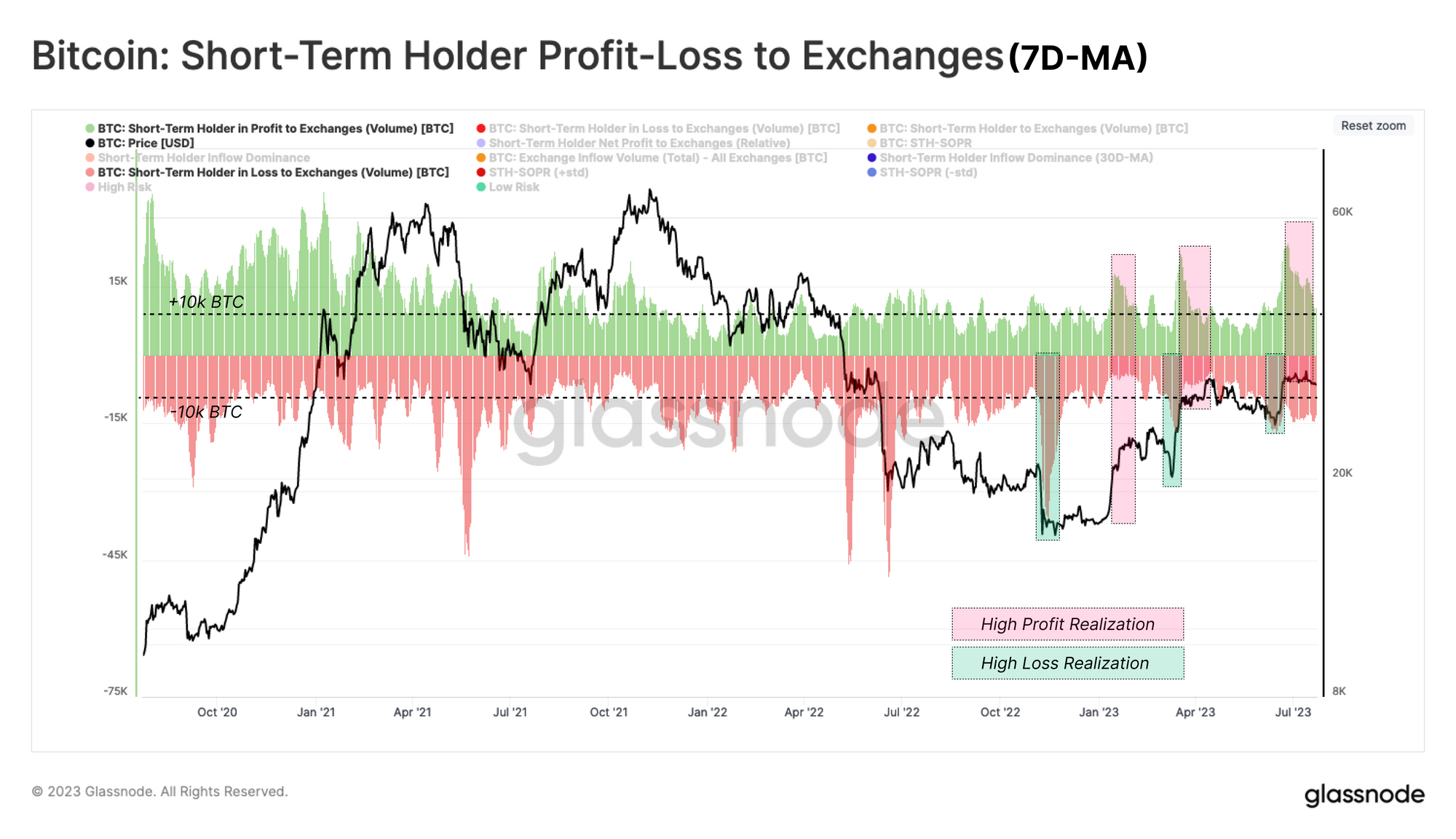

Between May and July 2023, the number of inflows into exchanges by short-term investors increased significantly, which ultimately contributed to the ongoing aggregate selling pressure. Source: Glassnode This kind of changes in the profit/loss structure in the context of BTC supply are cyclical. Every rally and correction since the bankruptcy of the FTX exchange has resulted in a gain or loss of 10,000 BTC in the profit or loss of a group of short-term investors, respectively. Source: Glassnode

This kind of changes in the profit/loss structure in the context of BTC supply are cyclical. Every rally and correction since the bankruptcy of the FTX exchange has resulted in a gain or loss of 10,000 BTC in the profit or loss of a group of short-term investors, respectively. Source: Glassnode

ข่าวเด่นวันนี้ 5 มี.ค.

📀 Coinbase และ MicroStrategy พุ่งแรง หลังทรัมป์ท้าทายธนาคารบนวอลล์สตรีท

บิทคอยน์พุ่งเหนือ 70,000 ดอลลาร์ แม้ดอลลาร์แข็งค่า📈

ข่าวเด่นวันนี้ 4 มี.ค.