Bitcoin managed to recover in a flash and after yesterday's plunge to $48,000 caused by a slightly higher-than-forecast CPI reading from the US, it is trading at new local highs at $51,500. The strong U.S. dollar has not prevented Bitcoin from rising from $48,000, to over $51,000, in a matter of hours. Ethereum is similarly in great spirits, approaching $2,700, a level not seen since May 2022. More than 94% of Bitcoin's wallets are in profit, historically in line with bull market momentum.

- A higher inflation reading signaling likely Fed cuts only in the second half of the year (probably June or July, expectations for May fell to nearly 30% from 52% previously) and a stronger dollar (USDIDX index at levels seen in the fall of 2023) did not dampen cryptocurrency market sentiment for long.

- It seems that crypto market sentiment could be dampened by further higher-than-forecast inflation readings, while this is not the baseline scenario and the market expects price pressures to continue to weaken (although the decline will not necessarily be as large as Wall Street expects).

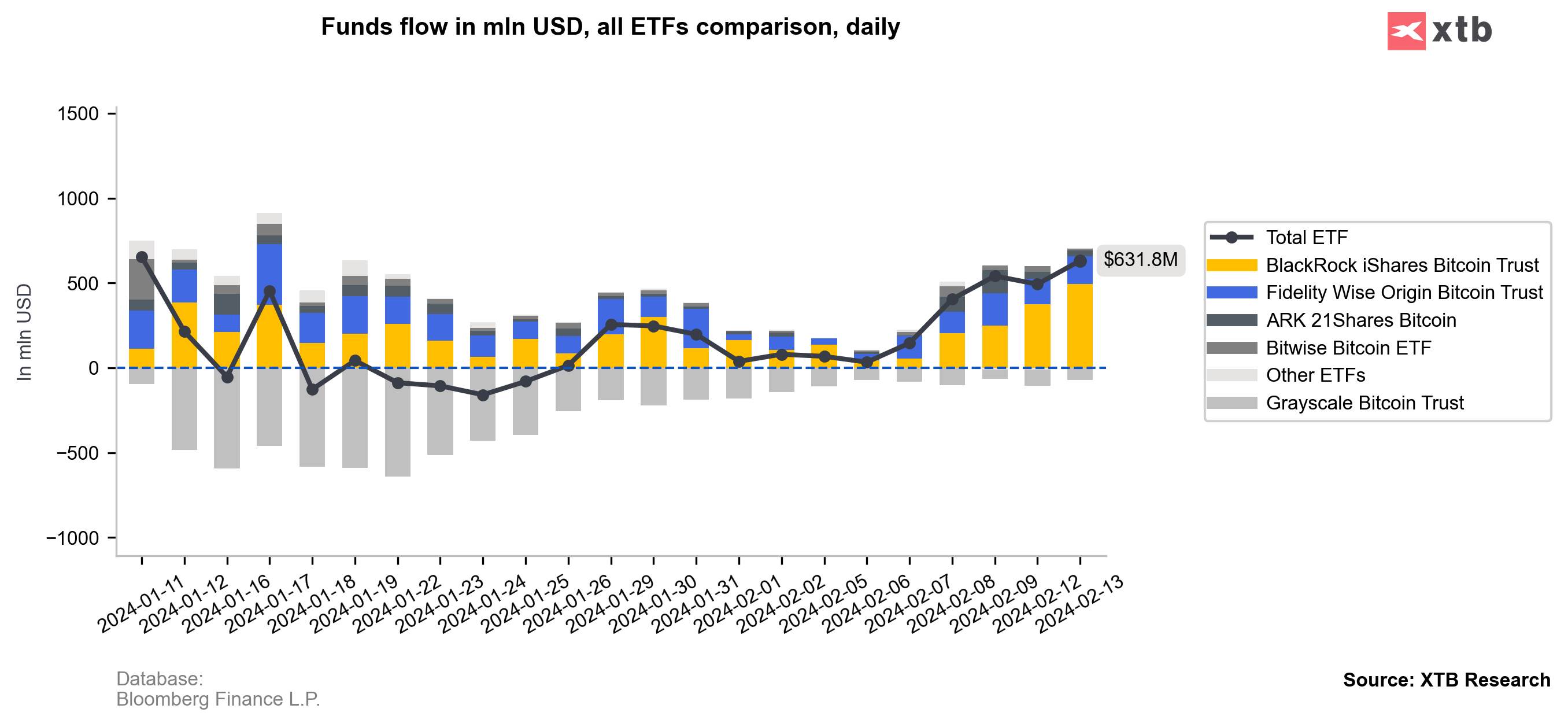

- Total positive net inflows into Bitcoin ETFs, since January 11, are already over $3 billion. In terms of year-to-date inflows, the BlackRock Bitcoin Trust (IBIT) ETF ranked 4th among all ETFs tracked by Bloomberg

- Data from Coinbase Advanced, known for its institutional activity, signals that a massive amount of Bitcoin outflows from the exchange into external portfolios, signaling a reluctance to sell despite record price levels and Bitcoin's spectacular rally

- Franklin Templeton has joined the ranks of institutions requesting the creation of a spot Ethereum ETF. Expectations are growing for SEC approval of ETF (ETC) applications for Ethereum, this summer.

Recent days have brought higher investor activity in bitcoin ETFs. The value of daily inflows is hovering around $600 million, at a time when outflows from Grayscale are consistently lower. Source: Bloomberg Finance L.P.

Gold saw a sharp decline yesterday. Bitcoin (gold chart), in contrast, managed to reverse the supply reaction very quickly. Source: xStation5

Bitcoin charts (D1, M30)

Source: xStation5

Source: xStation5

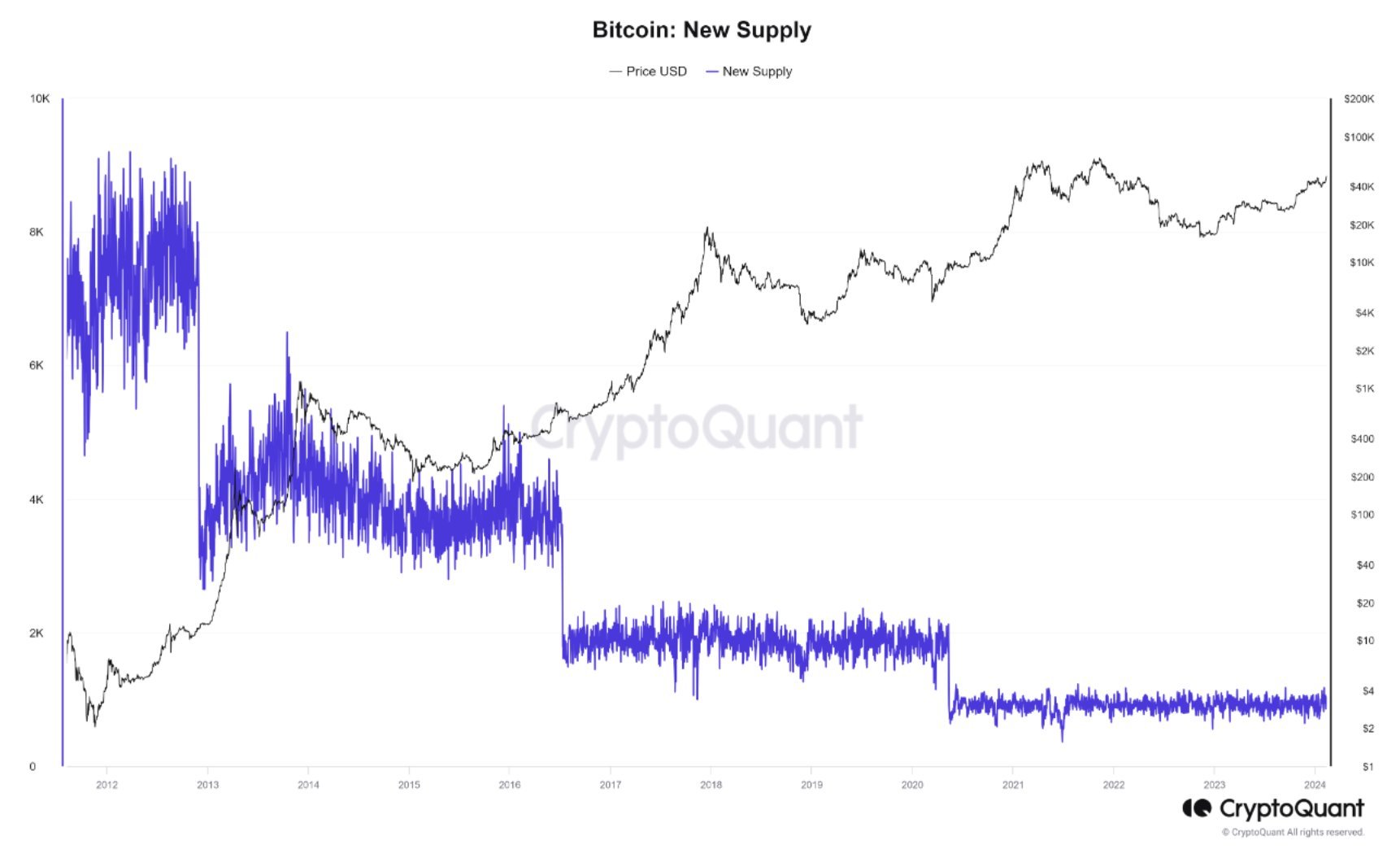

Bitcoin's supply is decreasing with each halving. In addition, the creation of ETFs has increased medium- and long-term demand for the cryptocurrency. The next halving will take place in April, this year. Source: CryptoQuant

คริปโตปรับตัวขึ้น 4 % ท่ามกลางความตึงเครียด 📈

ข่าวเด่นวันนี้ 10 มี.ค.

3 ตลาดที่น่าจับตาสัปดาห์นี้

Bitcoin ฟื้นตัว แม้หุ้นโลกเทขาย น้ำมันพุ่งแรง