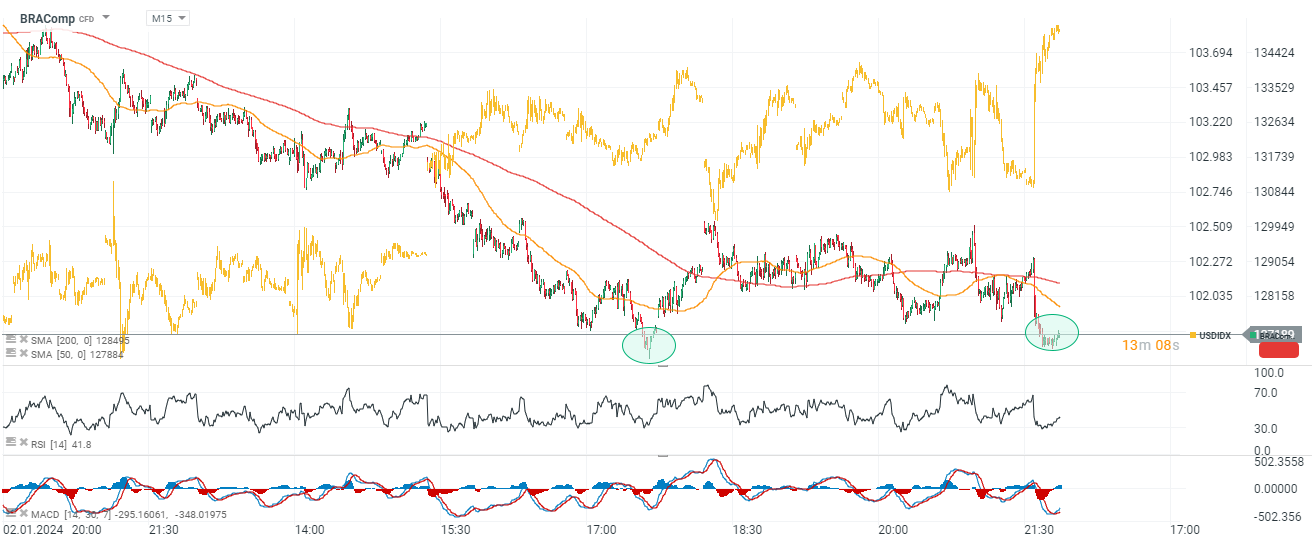

Futures on the main index of Brazilian equities (BRAComp) are one of the weakest indices today, with declines of nearly 1.1%. The index has already lost close to 7% from its post-roll-off peaks and is doing very poorly in 2024, similar to China's Hang Seng, on which the scale of the decline since 1 January is around 8%.

- The prospect of the Fed maintaining a more hawkish stance has some emerging markets particularly susceptible to commodity listings and cyclicals trading lower. Shares in Brazil's largest commodity company Vale (VALE.US) are losing almost 3% today. According to analysts' observations, Brazilian companies are being dragged down by declines in China signalling problems for exporters;

- The weak performance of Brazilian equities comes as a surprise to Bank of America analysts, who about a month ago expected a rally, due to faster Federal Reserve policy easing and a weaker dollar. The market is now pricing a cut only for May, and the dollar index has climbed to seven-week highs.

BRAComp (Interval M15)

Source: xStation5

Source: xStation5

US100 รีบาวด์หลังข้อมูล UoM 🗽 Nvidia ดีดแรง +5%

Market wrap: ดัชนียุโรปพยายามรีบาวด์ หลังวอลล์สตรีทเผชิญแรงเทขายหนักเป็นประวัติการณ์ 🔨

📈 วอลล์สตรีทฟื้นตัว ดัชนี VIX ลดลง 5% 🗽 ฤดูกาลรายงานผลกำไรของสหรัฐฯ บอกอะไรเรา?

สรุปข่าวเช้า