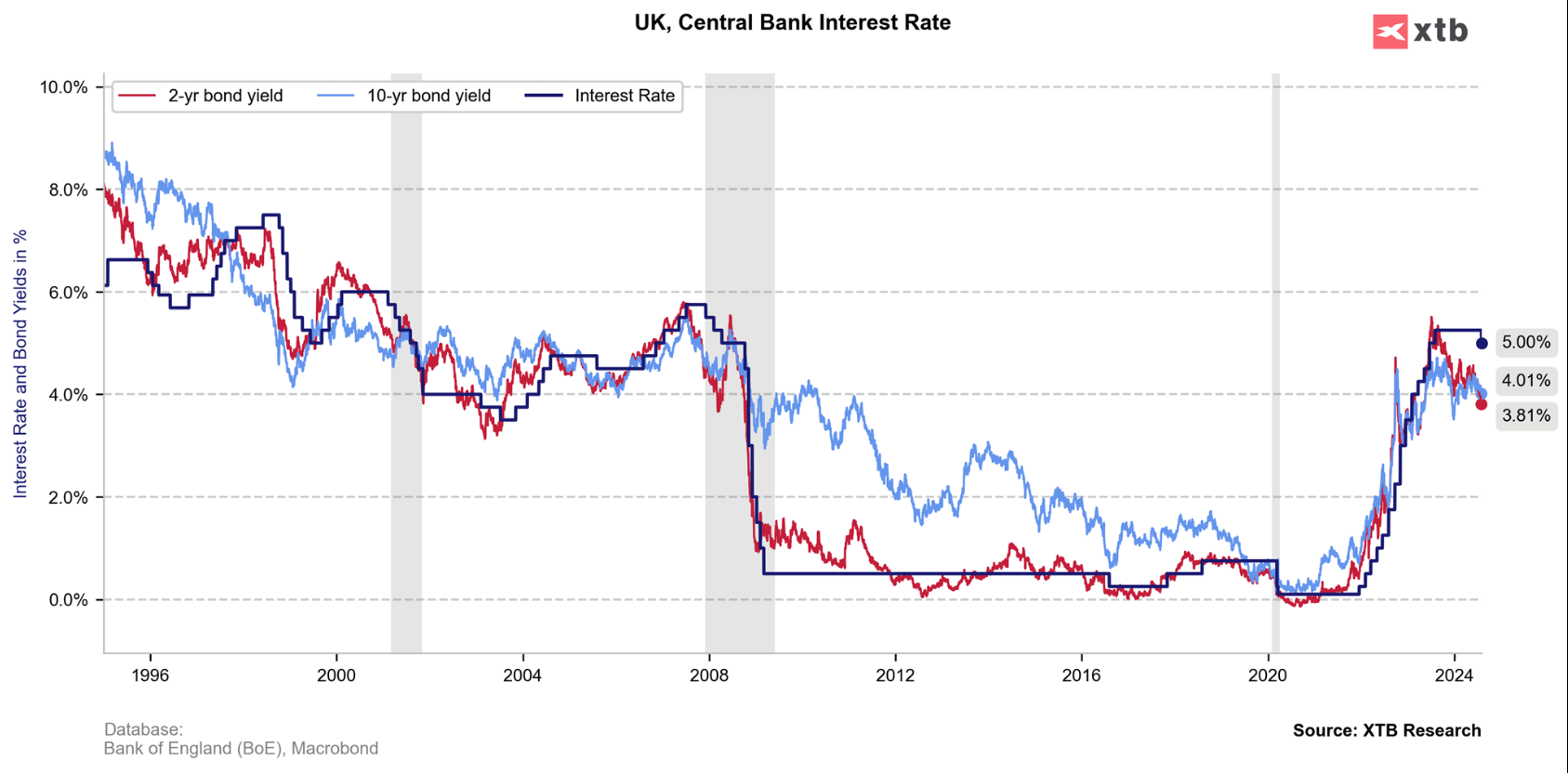

12:00 PM BST, United Kingdom - BoE Interest Rate Decision for August:

- actual 5.00%; forecast 5.00%; previous 5.25%;

The Monetary Policy Committee (MPC) has decided to reduce the Bank Rate by 0.25 percentage points to 5%, aiming to meet the 2% inflation target while supporting growth and employment. The decision was based on current and projected economic conditions, including a rise in inflation due to past energy price changes and persistent domestic inflationary pressures. The MPC emphasizes a forward-looking approach to maintain restrictive monetary policy until inflation risks are sufficiently mitigated.

Key Points:

- MPC voted 5–4 to reduce Bank Rate to 5%. Four members preferred maintaining the rate at 5.25%.

- Twelve-month CPI inflation at 2% in May and June, expected to rise to 2.75% in the second half of the year.

- Private sector earnings growth fell to 5.6%, and services CPI inflation declined to 5.7%.

- GDP has picked up but underlying momentum is weaker.

- MPC focuses on second-round effects of inflation, monitoring a broad range of indicators.

- Headline inflation expected to decrease, leading to weaker pay and price-setting dynamics.

- Margin of slack anticipated as GDP falls below potential and the labor market eases.

- Persistent inflationary pressures may persist due to higher demand and structural factors.

- Monetary policy will remain restrictive until inflation risks dissipate.

- CPI inflation projected to fall to 1.7% in two years and 1.5% in three years.

- Risks of inflation persistence remain, influenced by domestic wage and price-setting factors.

ปฏิทินเศรษฐกิจ: ธนาคารกลางปะทะความเสี่ยงเงินเฟ้อทั่วโลก

สรุปข่าวเช้า 5 มี.ค.

ดัชนีภาคบริการ ISM ออกมาแข็งแกร่ง กิจกรรมทางเศรษฐกิจขยายตัวมากที่สุดนับตั้งแต่ปี 2022

สหรัฐขึ้นภาษีนำเข้าสินค้าขึ้นเป็น 15%