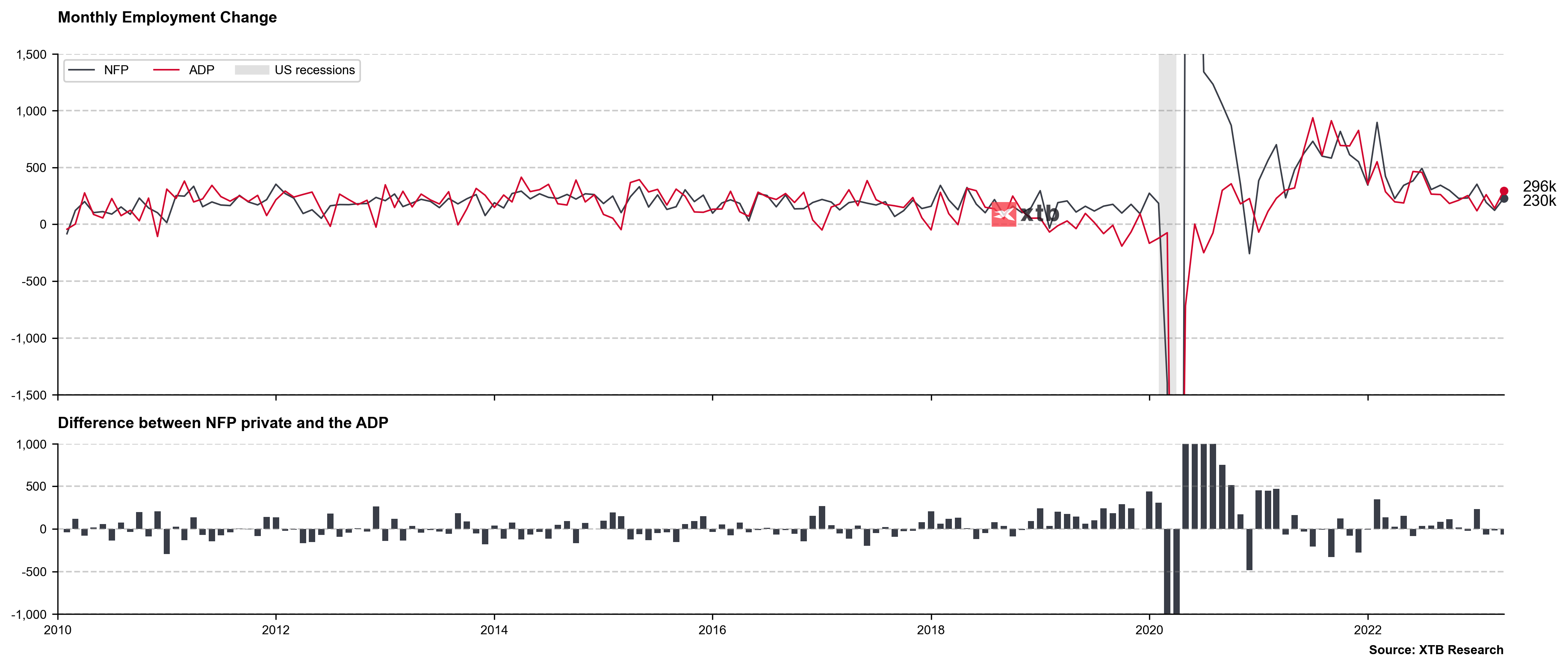

NFP report for April, a key macro release of the day, was published at 1:30 pm BST. While FOMC decision is already behind us, the report remains on watch as job openings drop and companies announce more planned layoffs. Actual data came in strong - NFP beat expectations by a huge margin, wage growth accelerated to 4.4% YoY while unemployment rate dropped from 3.5 to 3.4%. Overall, report can be seen as hawkish and would be supportive of continuing rate hike cycle in the United States.

US, NFP report for April.

- Non-farm payrolls: 253k vs 180k expected (165k previously)

- Unemployment rate: 3.4% vs 3.6% expected (3.5% previously)

- Wage growth (monthly): 0.5% MoM vs 0.3% MoM expected (0.3% MoM previously)

- Wage growth (annually): 4.4% YoY vs 4.2% YoY expected (4.2% YoY previously)

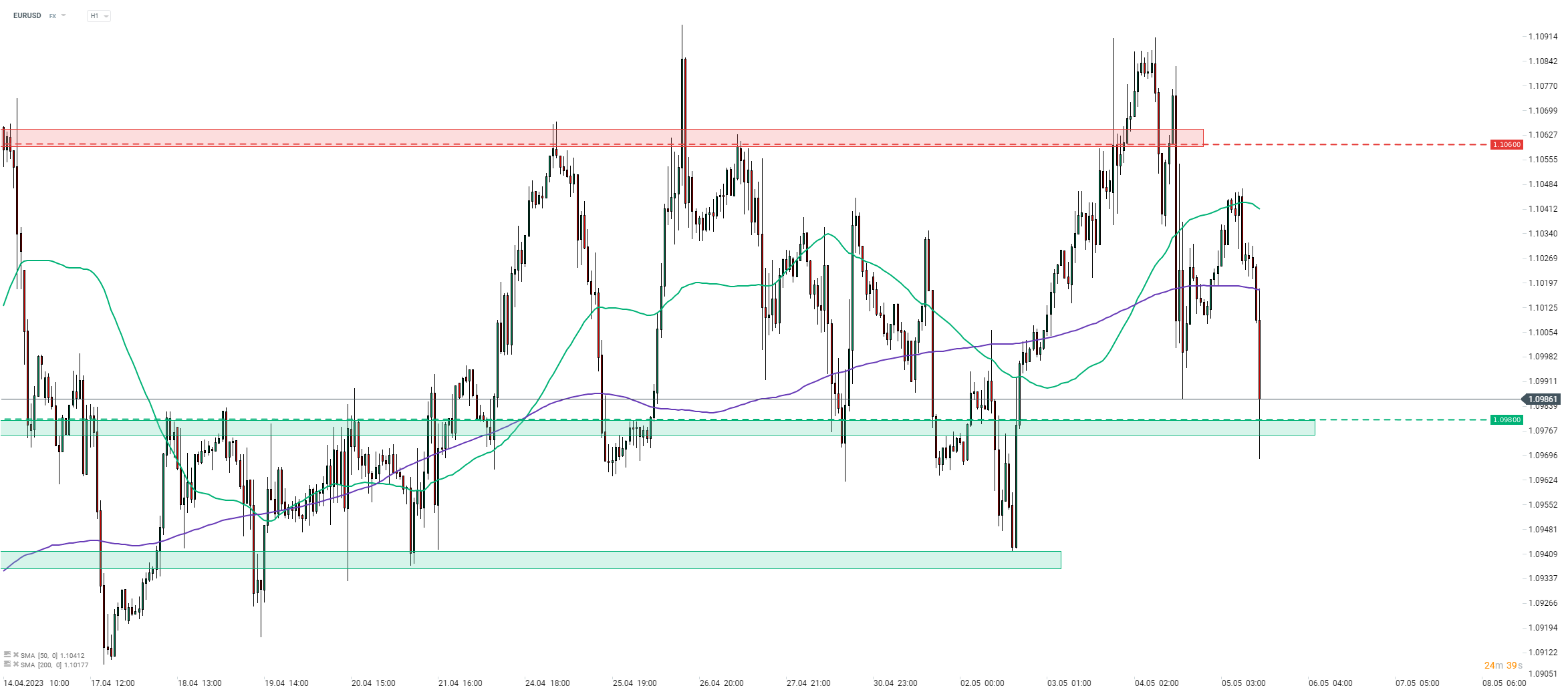

Market reaction was hawkish as well - USD strengthened with EURUSD dropping below 1.10 mark in a knee-jerk move while equity indices dropped. Nevertheless, the majority of the move on USD has been erased quite quickly while US500 holds slightly below 4,100 pts. GOLD took a hit on USD strengthening and plunged below $2,030 mark.

EURUSD plunged below 1.10 mark after hawkish NFP report and tested 1.0980 support zone. Source: xStation5

EURUSD plunged below 1.10 mark after hawkish NFP report and tested 1.0980 support zone. Source: xStation5

Source: Bloomberg, XTB

📉 BREAKING: US100 ร่วงเล็กน้อย หลังรายงาน NFP ต่ำกว่าคาด

ปฏิทินเศรษฐกิจ – ทุกสายตาจับตา NFP

ECB Minutes: ผลกระทบเต็มที่จากความแข็งค่า ยูโร ต่อเงินเฟ้อยังมาไม่ถึง 🇪🇺

ปฏิทินเศรษฐกิจ: ธนาคารกลางปะทะความเสี่ยงเงินเฟ้อทั่วโลก