-

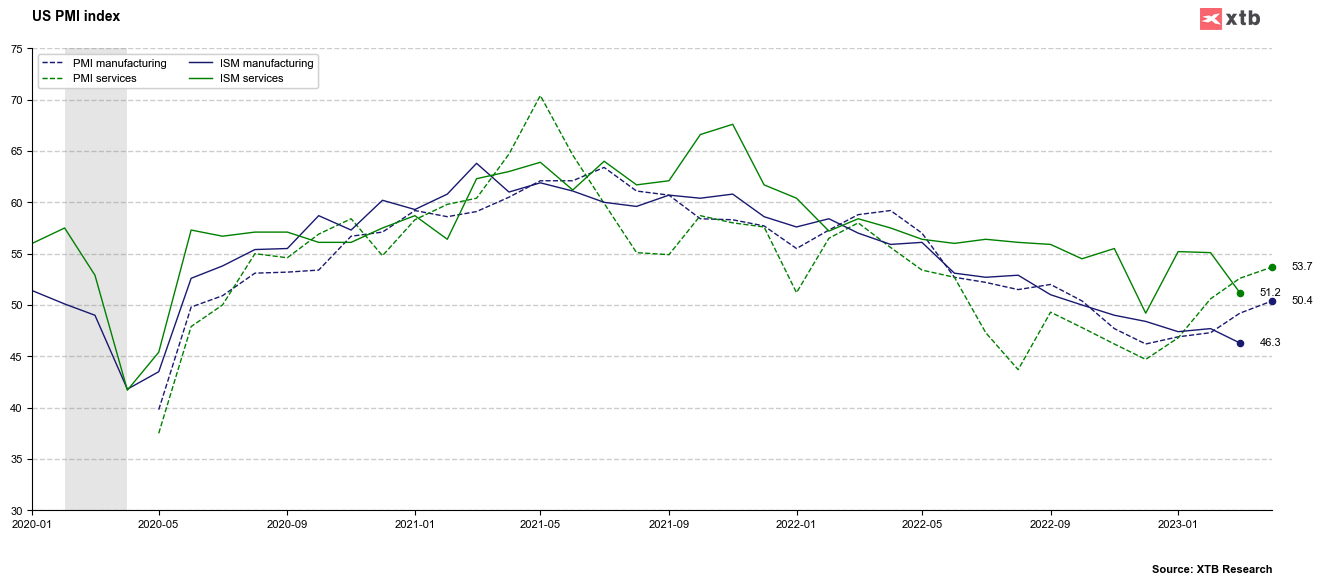

Manufacturing: 50.4 vs expected: 49 Previous: 49.2

-

Services: 53.7 vs expected: 51.5. Previous: 52.6

Data came better than expected by analysts and this means the US economy remains strong. Which gives some space for the FED to continue to tighten monetary policy. As in the EU, the PMI services came much better than manufacturing.

Currently investors estimate the probability of a 25 pb rate hike at 86.6% in favor of a 25 bp hike and 13.4% in favor of no change at the Fed meeting in early May. After the release of the PMI data, investors have some hints on what to expect from the ISM data for April, which will be released on May 3.

US500 is trading below 4160 points. Right after the publication there was no significant reaction. However, a moment later the index dipped below 4150 points moving away from the upper support line.

📉 Market Wrap: เงินทุนไหลออกจากยุโรป 🇪🇺

🚩 US500 ร่วงก่อนตลาดสหรัฐเปิด ขณะที่ดัชนี VIX พุ่งขึ้น 6%

สรุปข่าวเช้า 6 มี.ค.

Market Wrap: ดัชนีหุ้นพยายามยืนรีบาวด์ แม้ราคาน้ำมันปรับตัวสูงขึ้น 🗽 หุ้น Broadcom พุ่งแรง หลังผลประกอบการและแนวโน้มธุรกิจ AI เกินคาด